Thanks to the record-breaking bull market we’ve witnessed over the last decade, boring recession-proof stocks to buy have not really been at the forefront of investors’ line of thinking. However, the last few weeks have changed that drastically as the outbreak of the coronavirus brings an end to the long, slow recovery and threatens to plunge the global economy into recession. Now, boring is very much best.

Primarily, the appeal for ho-hum recession-proof stocks is their secular demand profile. Should the coronavirus cause a domestic or global economic slowdown, you’ll want to focus on everyday necessities, like food and toiletries. Additionally, pharmaceutical stocks are enjoying some serious gains given their close links to the current situation, and are likely to withstand a recession given the fact that people are always going to need medicine.

The three companies mentioned here are all blue-chip stocks, which is the term used for nationally recognized, well-established, and financially solid companies. Blue chips generally sell high-quality, widely used products and services and are very robust in times of economic downturn, given their public standing and the necessity of many of their products. Let’s take a look at three blue-chip recession-proof stocks catching our eye today:

Recession-Proof Stocks to Watch: Procter & Gamble (NYSE:PG)

Images of empty supermarket shelves have been all over social media for the last few days. At first, consumers were busy stocking up on non-perishable food in case they have to self isolate. Then, disinfectants, cleaning products, and toilet roll started flying out the door as people realized they need more than just food to survive.

In most situations, PG stock doesn’t get too much of a buzz because it’s a boring, safe anchor to your portfolio, but these are not normal times, and that might be exactly what your portfolio needs. It’s not that shares won’t ever suffer volatility, because they do—in fact, it’s actually at its lowest point since last June. But over the long run, you can have confidence that Procter & Gamble products will remain in kitchen cupboards and on bathroom shelves for a long time to come.

Recession-Proof Stocks to Watch: Kroger (NYSE:KR)

Grocery shopping is never going to set the world alight, but with the rapid spread of the coronavirus across the US, people are panic shopping like never before. This kind of irrationality does no one any favors—except Korger’s shareholders. KR stock is generally one of the best recession-proof stocks because, well, everyone needs to eat. A recession would also see a decline in people eating out, meaning grocery stores actually tend to do better in times of hardship.

With over 3,000 locations across the US, all of which CEO Rodney McMullen is determined to keep open during the crisis, Kroger definitely has the network to withstand whatever may come its way. Again, this stock has seen a slight dip this week as the full impact of the virus remains to be seen, but it is definitely one to consider hedging your bets in to out a possible recession considering its stock price actually went up between 2007 and 2009.

Recession-Proof Stocks to Watch: Waste Management (NYSE:WM)

Not many investors think, “Gee, today is the day I invest in trash!” But maybe today should be that day. The process of waste management and disposal is something that rarely crosses anyone’s mind, but it’s one of the few industries that almost never sees a slowdown. Generally, the US tends to dump its waste on other countries, but we’re seeing an increasing trend of these nations turning down America’s trash, meaning domestic waste management stocks are likely to thrive.

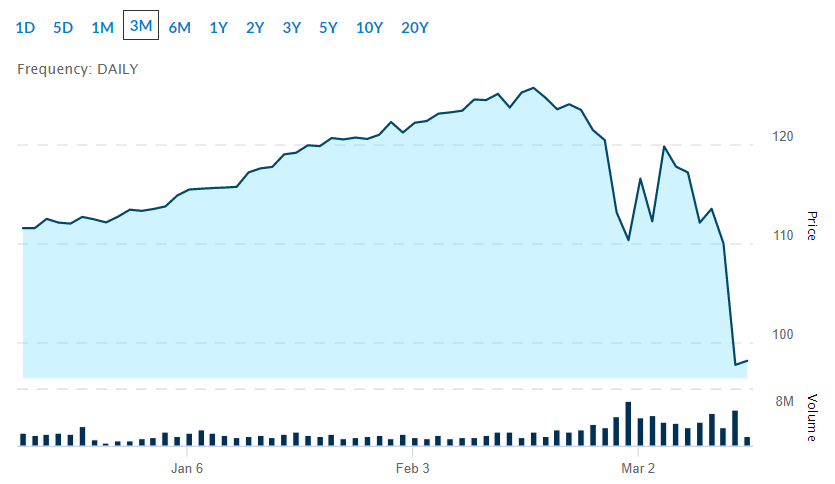

A look back at WM stock history shows that it actually thrived in 2008 at the worst of the last financial crisis. Recently, the stock has fallen from a peak of $125 in February to currently trade at $98.47, which is, of course, down to the fall in the market as a result of the coronavirus. While it may continue to fall as the outbreak worsens, timing is crucial here to pick up WM stock at its lowest point because it’s nearly certain to bounceback once stability returns to the market.

The Bottom Line

Uncertainty is everywhere these days. In fact, it’s not even certain that we are headed toward a recession, although it looks highly likely. With the worst of the virus outbreak yet to come, recession-proof blue-chip stocks are likely to experience further dips before bouncing back once the worst has subsidized. So, as an investor, you’ll need the perfect combination of insight and timing to see the full potential of these recession busting firms.

Featured Image: DepositPhotos © Jasastyle