On May 19th, 2017, Zinc outperformed bellwether coppers 2% gain, with LME prices set at $2,616 a ton, which is equivalent to $1.19 zinc price per pound. This caused a 3.3% jump. Building on last year’s 60% gain, the zinc price forecast is now showing that zinc is back in the running for 2017.

CEO of Teck Resources (NYSE:$TECK), Donald Lindsay, told investors that among the diversified miners’ portfolio, it is most confident, or bullish, about zinc’s short term forecast.

As the world’s number 3 producer of zinc, the Vancouver-based company showed investors a presentation at the Bank of America Merrill Lynch Global Metals & Mining Conference which described the current, close-knit market environment for zinc supply.

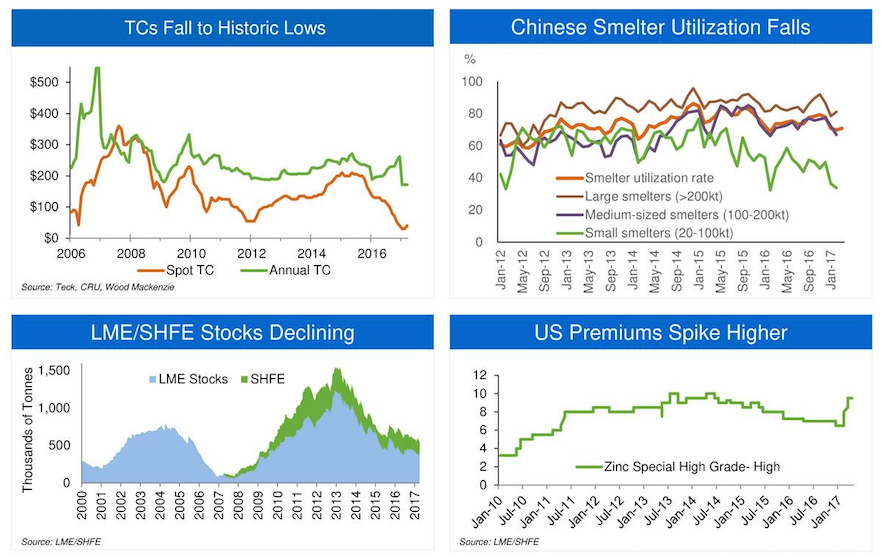

Statistically speaking, the lack of zinc supply is most noticeable in spot treatment or refining charges, which are imposed by smelters, which is a form of extractive metallurgy.

Lindsay further noted that annual contract TCs have fallen to historic lows. Additionally, refiners, including Korea Zinc (KRX:$010130), which is the world’s largest producer of zinc, are debating whether or not to cut production due to low TCs.

With a lack of zinc supply, Chinese refineries have taken to lowering capacity utilization. Additionally, China’s refined zinc output has fallen to its lowest level in more than two years. Therefore, it is likely that there will be a step up in imports of refined zinc supply.

According to LME’s most recent data, zinc stocks have fallen to 170,000 tons, which is the lowest it has been since October of 2008. Additionally, the Shanghai Futures Exchange has monitored inventories at warehouses and it was discovered that these inventories fell 9.5% to 91,700 tons.

In the United States, the zinc price forecast is increasing as premiums for zinc supply are heading higher. In China, premiums for zinc supply have jumped by $10 to $155 a ton. This is the highest it has jumped in almost three years.

Featured image: www.theinvestor.co.k