While the coronavirus crisis has sent the financial markets across the world into a tailspin, the situation has been further compounded by the OPEC War, which has led to a crash in oil prices. The situation is related to the disagreement between OPEC, which is effectively led by Saudi Arabia and Russia.

The disagreement with regards to oil production led to OPEC flooding the market with more oil, which resulted in a massive drop that threatened the state of the markets. In such a situation, many oil stocks declined and many went into penny stock territory due to the drop.

In such a situation, many fear that some oil companies may actually go bankrupt because of the implications of the OPEC War. However, it is believed that the whole situation might not escalate further and could actually be resolved.

After all, even Saudi Arabia and other Middle-Eastern countries are losing a lot due to this OPEC War. That being said, there are some companies that could benefit from low oil prices, and here is a quick look at four of those.

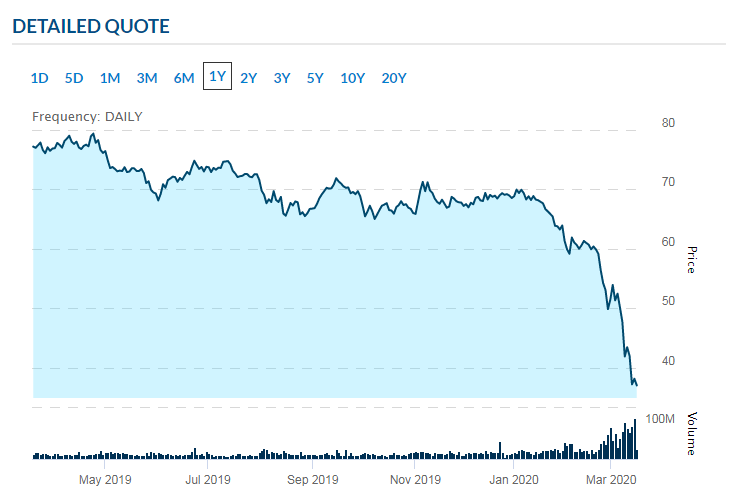

Oil Stocks to Watch: Exxon Mobil Corporation (NYSE:XOM)

When it comes to the energy sector, there is no other company that can quite match up to the American behemoth Exxon Mobil. Low oil prices have been beneficial to the company over the past months and have allowed Exxon to make relatively cheap investments. It wishes to invest $35 billion a year up until 2025, and the company believes that it can make a 10% return even if oil prices drop to $35 a barrel.

The company is involved in all aspects of the oil business, so some portion of its operations can benefit from low prices. Moreover, Exxon boasts of a very strong balance sheet and has a debt to equity ratio of only 0.15. It has the financial wherewithal to weather the storm, and its dividend yield of 8% is another attractive aspect.

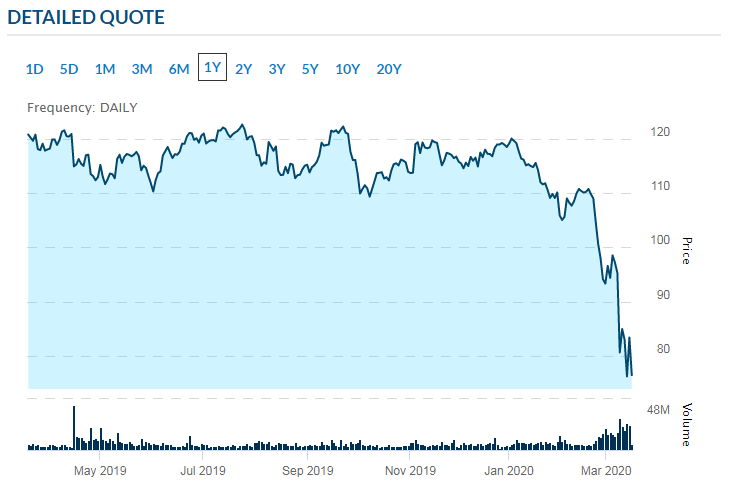

Oil Stocks to Watch: Chevron Corporation (NYSE:CVX)

If investors are looking for an even safer option in the middle of the OPEC War, they could explore the possibility of tracking Chevron. Like Exxon, Chevron is a giant in the industry and has a debt to equity ratio of only 0.12.

While the fall in oil prices could be harmful to American companies like Chevron, which have invested heavily in the onshore US energy industry, Chevron believes that even with lower oil prices, it can continue to make money.

>> Top 3 Recession-Proof Stocks to Watch

The company may have reduced its investments recently, but it is still expected to bring in as much as $20 billion a year in the form of investment in the foreseeable future. In addition to that, it has a dividend yield of 6%, making Chevron a potentially attractive bet for investors.

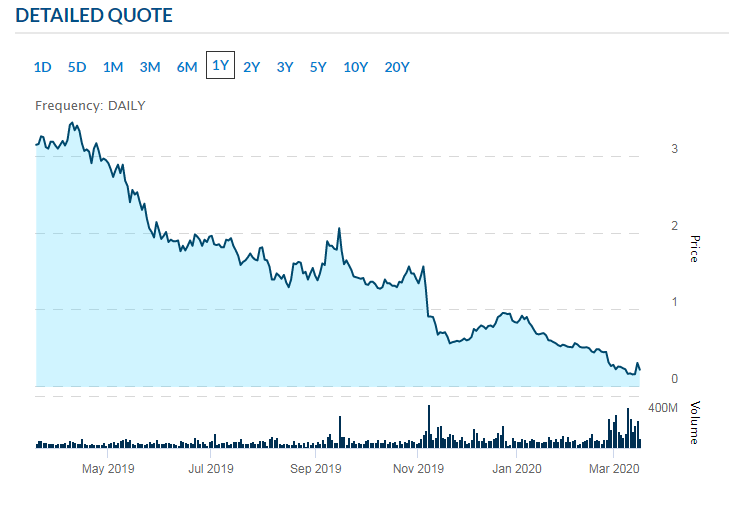

Oil Stocks to Watch: Chesapeake Energy Corporation (NYSE:CHK)

American shale oil producer Chesapeake Energy is perhaps one of the more infamous penny stocks in the sector, and in 2020 so far, the stock has declined by as much as 79.2%. There have been widespread fears that the continued drop in oil prices, in addition to the all-in demand for oil, is going to do untold damage to Chesapeake Energy.

In other words, people believe that the company might actually go bankrupt due to the current situation. The company may be in all sorts of trouble, but the theory about bankruptcy is entirely predicated on the assumption that oil prices are going to continue to be at these levels for the rest of the year. If oil prices do rebound, then the company could make a comeback, and the stock price might recover as well.

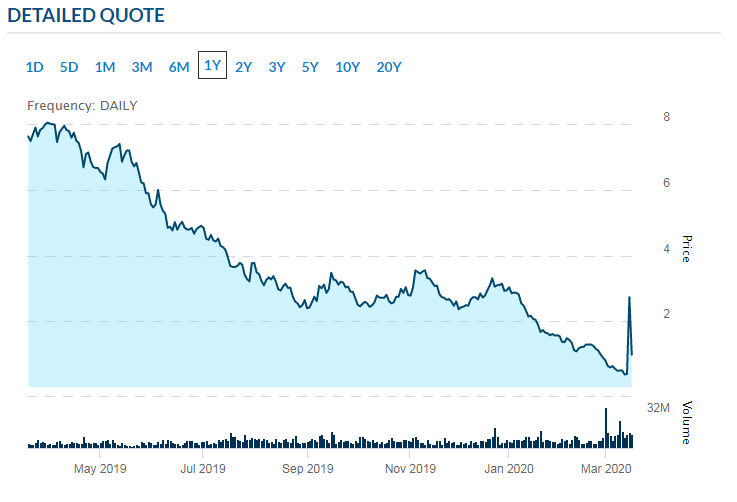

Oil Stocks to Watch: Gulfport Energy Corporation (NASDAQ:GPOR)

Investors who want to bet on a resolution of the OPEC War and an eventual rise in oil price could have a look at Gulfport Energy. The oil and gas exploration company has decent prospects in the near-term and a debt load that could be managed efficiently. Additionally, its cash flow is also at a healthy level.

As much as three-fourths of the company’s revenue last year was generated by natural gas exploration, which cushions Gulfport from the risks posed by lower oil prices considerably. It is a free cash flow positive company and generated $725 million last year. However, if the OPEC War continues, then it could certainly make life difficult for Gulfport. That being said, GPOR is a stock that could be in a position for a significant move when the oil prices eventually rebound.

Key Takeaway

Considering the higher volatility in oil prices, it would be tough for investors to trade oil stocks. So, one may be advised to wait for the markets to stabilize before considering oil stocks.

Featured image: PixaBay