Shares of

Dolby Laboratories, Inc.

DLB

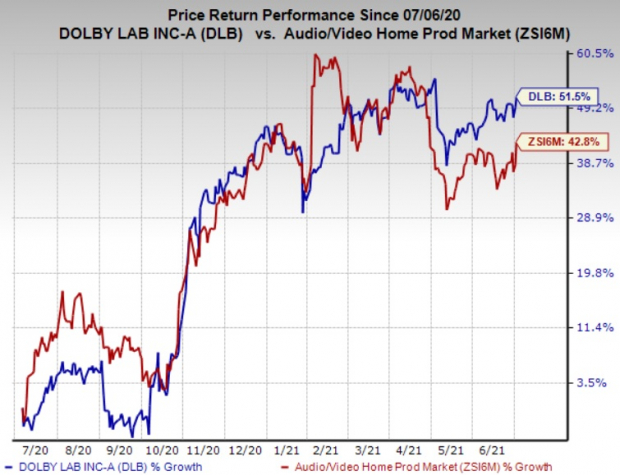

have surged 51.5% over the past year, driven by a flexible business model and solid financials. Amid post-pandemic market revival and unwinding of various lockdown restrictions, the company is gradually witnessing a healthy rebound in pent-up demand for premium entertainment experiences. Earnings estimates for the current and the next fiscal have increased 14.3% and 11.2%, respectively, over the past year, implying inherent growth potential. With healthy fundamentals, this Zacks Rank #2 (Buy) audio-visual solutions provider appears to be a promising investment option at the moment. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Image Source: Zacks Investment Research

Growth Drivers

Founded in 1965, San Francisco, CA-based Dolby specializes in audio noise reduction and audio encoding/compression. The company offers state-of-the-art audio, imaging, and voice technologies that revolutionize entertainment and communications at theaters, home, work and mobile devices. Also, the company designs and manufactures audio and imaging products including digital cinema servers and other products for film production, cinema, television, broadcast and other entertainment industries.

Dolby’s long-term growth strategy stands on three pillars, namely advancing the science of sight and sound, providing creative solutions, and delivering superior experiences. Successful execution in each of these areas has led to decent growth over the past quarters. Dolby has three impressive projects — Dolby Vision, Dolby Voice and Dolby Cinema — which will likely accelerate growth, going forward.

The Dolby Voice technology, an audio conferencing solution, is witnessing solid growth opportunities that are adding to the company’s strength. Apart from expanding its foothold in the traditional audio conferencing market, Dolby Voice is making concerted efforts to bolster its footprint in the budding video conferencing market. Dolby Voice is gearing up for some interesting product launches in collaboration with its partner, BlueJeans. It had inked a partnership with audio conferencing provider, West, to expand this business.

Dolby has maintained its long-standing partnerships with industry frontrunners like

Apple Inc.

AAPL

,

Amazon.com, Inc.

AMZN

and

Netflix, Inc.

NFLX

to offer best-in-class services and fend off competition. With robust financials, the company employs diligent capital deployment strategies for ensuring growth. The capital allocation strategies are designed to maintain a flexible capital structure, deliver value to shareholders through sustainable growth, solid margins, strong cash flows and return capital. Moreover, Dolby dedicatedly follows a balanced capital deployment strategy and continually rewards its shareholders through share repurchases and dividend increases.

Dolby Cinema technology is considered to be a major profit churner for the company. Its client list includes AMC in the United States, Wanda and Jackie Chan in China, Cineplexx in Austria, REEL in Middle East and Vue in the Netherlands. Dolby Cinemas is enjoying exponential market traction and the company brought Dolby Cinema to the U.K. for the first time with Odeon Cinemas Group. The content pipeline for Dolby Cinema continues to grow with about 190 titles in Dolby Vision and Dolby Atmos either announced or released. Combined with Dolby’s existing partners in China, Wanda and Jackie Chan, the company has more than 140 screens open or committed in the country. Impressively, China has rebounded significantly in terms of Dolby Cinema installations in the post pandemic scenario. The company stated that currently, 90% of the Dolby Cinemas are opened globally with certain capacity restrictions.

However, the current volatile environment resulting from the ongoing pandemic situation, continues to mar cinema product sales, which ultimately led to lower box office share revenues. Nevertheless, the company believes that surging demand for premium viewing experiences will fuel growth for Dolby Cinema in the long haul. Overall, it has about 250 Dolby Cinema sites across 11 countries with more than 20 exhibitor partners. The company had inked agreements with two new exhibitor partners that will bring the first Dolby Cinema to South Korea and Saudi Arabia. Market reports suggest that consumers are increasingly viewing video content on smartphones, tablets and computers, which in turn is expected to unlock opportunities for Dolby.

Dolby is housed within the Audio Video Production industry that carries a

Zacks Industry Rank

#113, which places it among the top 44% of more than 250 Zacks industries. The stock’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates encouraging prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. Consequently, the stock appears to be an enticing investment option at the moment.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out

Zacks’ Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report