Corning Incorporated

GLW

recently unveiled innovative cellular solutions to power 5G connectivity in indoor locations that often remain impermeable to some 5G frequencies. The products are likely to enable carriers to penetrate physical barriers for extensive coverage and improved 5G connectivity.

These easy to install and cost-effective solutions are ideal for 5G-ready coverage in high-density environments like office buildings, factories, hotels, hospitals, and universities and can be seamlessly used with small-cell radio nodes across common frequency bands. These include the 28 GHz and 39 GHz frequencies that are primarily used by carrier networks and enterprise network operators for indoor 5G connectivity.

Corning’s Everon mmWave indoor small-cell systems are widely expected to enable carriers to address the exponential growth of 5G connectivity as people return to their work environment in the post-pandemic era. The company is likely to introduce additional products within the Everon portfolio in the near future with a faster pace of 5G deployment across the country.

Multiple factors are likely to drive Corning’s fiber optic solutions business over the next several years, primarily the increasing use of mobile devices that require efficient data transfer and efficient networking systems. Supporting this trend is the proliferation of clouds, which is resulting in increased storage and even computing on a virtual plane. Since both consumers and enterprises are using the network more, there is tremendous demand for quality networking. As optical networks are more efficient and most of the existing networks are copper-based, the demand for optical solutions is particularly strong. Corning has several products focused on the datacenter with a portfolio consisting of optical fiber, hardware, cable and connectors that helps it to create optical solutions to meet evolving customer needs.

Notwithstanding challenging macroeconomic conditions associated with the COVID-19 pandemic, Corning expects to witness 6-8% compound annual sales growth and 12-15% compound annual earnings per share growth through 2023, while investing $10-$12 billion in research, development & engineering, capital, and mergers and acquisitions. It plans to expand operating margin and return on invested capital and deliver $8-$10 billion to shareholders, including an annual dividend per share increase of at least 10%. To achieve its goals, the company expects to add an incremental $3-$4 billion in annual sales and improve profitability by the end of 2023. The company is extending performance under its 2020-2023 Strategy & Growth Framework, and focusing on improving its product portfolio and utilizing financial strength to enhance shareholder returns.

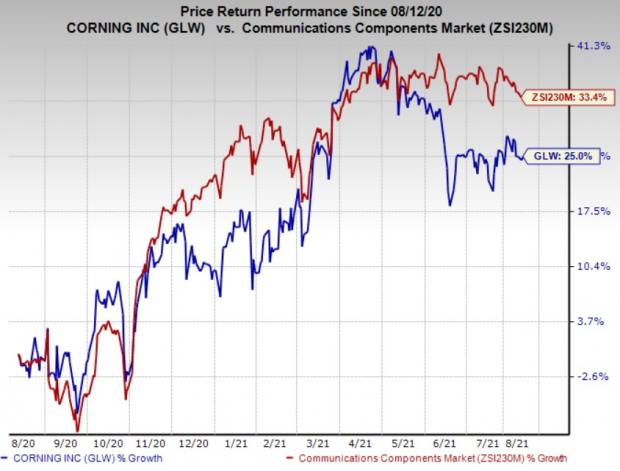

The stock has gained 25% over the past year compared with the

industry

’s rise of 33.4%.

Image Source: Zacks Investment Research

We remain impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock. Some better-ranked stocks in the industry are

Knowles Corporation

KN

,

Viasat Inc.

VSAT

and

SeaChange International, Inc.

SEAC

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Knowles has a long-term earnings growth expectation of 10%. It delivered an earnings surprise of 10.8%, on average, in the trailing four quarters.

Viasat has a long-term earnings growth expectation of 24.6%. It delivered an earnings surprise of 373.3%, on average, in the trailing four quarters.

SeaChange International has a long-term earnings growth expectation of 10%. It delivered an earnings surprise of 12.2%, on average, in the trailing four quarters.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released

Century of Biology: 7 Biotech Stocks to Buy Right Now

to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report