Anyone who is interested in the technology market is probably aware that Apple Inc. (NASDAQ:$AAPL), an American multinational technology company, has had quite the week. For the second time in 7 days, the California-based company got its investment rating cut from a buy to neutral. This cut was mostly due to concerns that optimism over the new iPhone 8 has been “baked into the stock”.

On Sunday, Abhey Lamba and Parthiv Varadarajan at Mizuho Securities stated, “the stock has meaningfully outperformed on a YTD (year-to-date) basis and we believe enthusiasm around the coming product cycle is fully captured at current levels, with limited upside to estimates from here on out.”

When experts cut Apple’s investment ranking from a buy to neutral, this caused their price target to drop from $160 per share to $150. Despite expecting a powerful iPhone cycle, officials have stated that they are wary of Apple Inc’s estimates for a number of reasons, such as growth being potentially driven mostly by loyal users who are replacing their phones.

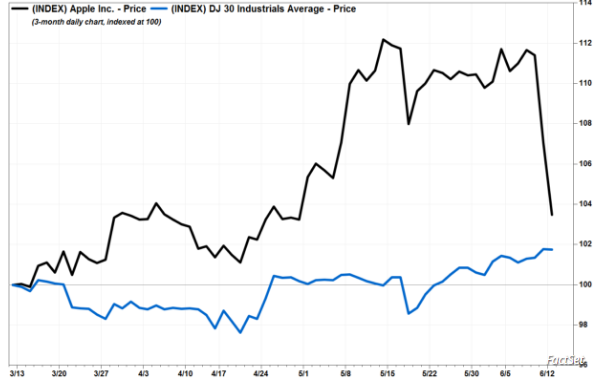

In a morning trade on Monday, Apple Inc. shares declined 3.8%; this was after dropping 3.9% on the previous trading session during a wide tech-sector selloff. As a result, Apple’s stock is on the path to beating its 2016 record of dropping 9.1% during two trading sessions which ended on April 28.

It shouldn’t be surprising that this investing rating downgrade came one week after experts at Pacific Crest dropped Apple shares to neutral. Pacific Crest expressed similar concerns over the course of direction the iPhone will be taking. According to Pacific Crest, $145 is a fair price for Apple shares over the coming 12 months.

Unfortunately, Mizuho’s degrade came at a bad time for technology stocks and only proceeded to make matters worse. On Friday, Nasdaq Composite ($COMP) dropped 1.8%. As a result, Apple fell 3.9% and big technology companies such as Facebook (NASDAQ:$FB) and Amazon (NASDAQ:$AMZN) slid as well.

One of the key concerns that analysts have is that the momentum for the wider market has been carried on the back of major technology companies. Goldman Sachs, an American investment banking company, reported its own warning stating that these moves might be overextended.

Main Concerns:

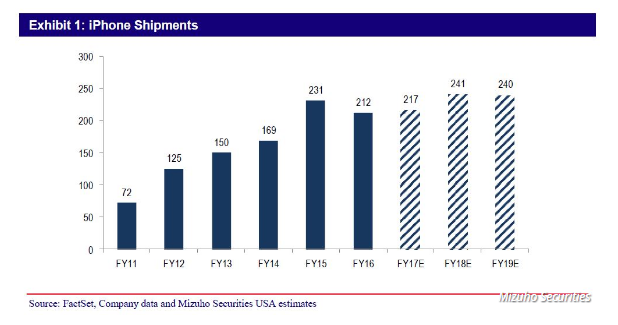

According to Lambda and Varadarajan, there is a “very robust product cycle” for Apple in the upcoming holiday season. That said, there is cause for concern as there will most likely be initial constraints on supply and risk to production due to the iPhone 8’s new features.

Plus, as seen in the past, Apple Inc. is very defenseless when it comes to “sell-the-news” reaction after investors notice data points on scales. As of right now, Apple has gained 29% whereas the S&P 500 ($SPX) gained 8.6%. According to analysts, Apple’s stock has positioned itself where there is “limited room for further multiple expansion.”

That said, one of Mizuho’s biggest worries is that iPhone 8 sales will come down to current and loyal users upgrading to a new iPhone. Also, strong shipments of the iPhone 8 could potentially pull forward demand from quarters in the future, thus making tough comparisons when looking into the second half of next year or early 2019.

Keep in mind that Apple will need to do three things in order to see gains in their stock. First, there has to be more meaningful expansion in the installed base. Second, there needs to be higher recurring revenue growth from current users. And finally, Apple will need to create deeper penetration of the installed base via new product sectors.

Featured Image: Twitter