Are you interested in the healthcare stock market? If so, you should catch up on what’s been happening in the sector over the course of the past couple months.

On Wednesday, May 24, the Canadian Association of Neuroscience Nurses reiterated their outperform rating on TESARO Inc. (NASDAQ:$TSRO) shares.

There are a number of other equities analysts who have also joined in on the discussion of the company. For instance, Zacks Investment Research removed TESARO from a hold rating to a sell rating in a research report announced on Wednesday, March 22. A few days later, Jefferies Group LLC raised their price target on TESARO to $124.00 from $80.00 and gave the stock a hold rating. New York City-based company Cowen and Company cut their target price from $155.00 to $145.00 as well as giving them a market perform rating.

On Wednesday, April 12, Piper Jaffray Companies assumed coverage on TESARO and they gave an overweight rating and a $180.00 price objective. Last but not least, Vetr upgraded TESARO to a strong-buy rating and set a $178.33 price objective on Monday, March 27. All in all, there have been nine equities analysts who rated the stock with a hold rating, thirteen have provided a buy rating, and only one gave a strong buy rating to the stock. Currently, the stock has an average rating of Buy and an average target price of $174.42.

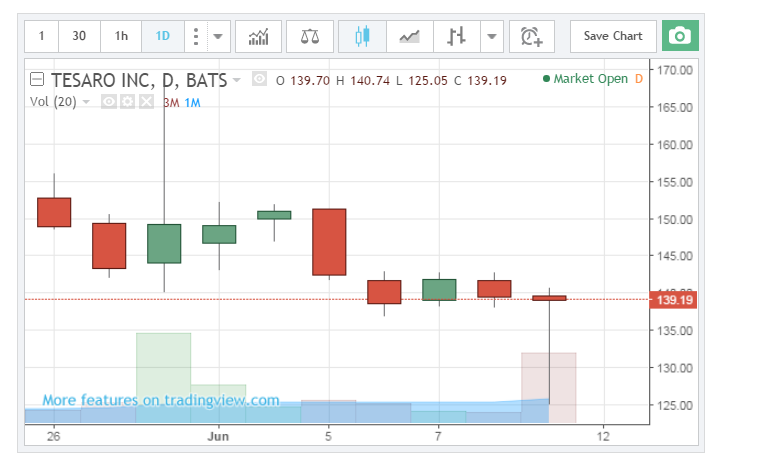

On Wednesday, TESARO opened at 140.60. As of right now, the stock’s 50 day moving average price is $145.40 and its 200 day moving average price is $151.00. The firm also has a market capitalization of $7.57 billion.

On Tuesday, May 9, TESARO released its latest quarterly earnings ratio. TESARO, who is a biopharmaceutical company, announced $2.55 earnings per share for the quarter, which indicates that they missed their consensus estimate of $2.26 by $0.29. During the quarter, TESARO had a revenue of $3.10 million, while their consensus estimate was $3.84 million. According to equities analysts, TESARO should post $8.75 earnings per share for fiscal 2017.

Closely related, SVP Martin H. Jr. Huber sold 829 shares of the stock in a deal on Monday, April 3rd. The shares of the business’s stock were sold for a price of $153.02, making the total transaction $126,853.58. Now that the transaction is over, the senior vice president owns 6,522 shares in the company. These shares are valued at $997,996.44. Additionally, VP Edward C. English sold 8,500 shares in a deal on Tuesday, June 6. These shares were sold for $135.65, making the total transaction $1,178,525.00. As a result, Mr. English owns 5,396 shares of the stock, placing their value at $748,155.40. It’s worth noting that insiders own 40.50% of the stock.

Additionally, hedge funds have added to or helped to reduce their share in the company. For instance, Capital Analysts LLC purchased a new stake in the biopharmaceutical company during Q4 worth roughly $134,000. Then there’s Pacer Advisors Inc. who bought a new stake during Q3 which was worth $216,000. Last but not least, Soros Fund Management LLC purchased a new stake in the Massachusetts-based company during Q1. This stake was worth roughly $262,000. Keep in mind that 98.48% of the stock is possessed by institutional investors and hedge funds.

A Brief Overview: TESARO

As mentioned, TESARO Inc. is a biopharmaceutical company. TESARO functions by developing and commercializing the oncology-focused therapeutics segment. As we speak, the company is developing oncology-related product candidates, such as rolapitant and niraparib.

Featured Image: twitter