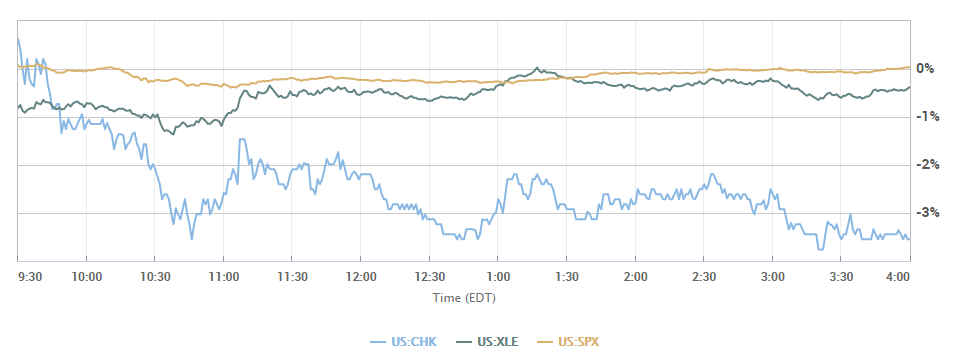

Chesapeake Energy Corporation (NYSE:$CHK) shares dropped 2.8% today in afternoon trade. As a result, the Oklahoma City-based company is in position for a third-straight loss as investors prepare for Chesapeake’s Q2 results later this week.

Set to post results before Thursday’s opening bell, the oil and natural gas exploration company is expected to swing to an adjusted profit for the fourth straight quarter. With this, on average, analysts polled by FactSet predict earnings per share of 14 cents.

Furthermore, according to FactSet, revenue is forecast to fall for the ninth time in the past 10 quarters to $1.06 billion. Options traders are ready for a rather large stock reaction to results. There is a volatility play – otherwise known as a straddle – that is pricing in a 7.1% one-day post-earnings move in the company’s stock in either direction. Keep in mind this is compared with the average one-day move of 6.0% after the past 20 quarterly reports.

Analysts predicted an “interesting” quarter for the company, as production may end up performing slightly better than previously expected. However, the price of crude and natural gas needs to hold level and then slowly rise in order for Chesapeake to retain value as a stock. With oil in the low $50 range, it will be hard for the company to prove that it can be profitable.

So far this year, Chesapeake’s stock has dropped 34%.

Featured Image: twitter