Primarily produced as a byproduct of copper and nickel mining, the supply of cobalt used to meet its demands. However, with its growing popularity and importance in the creation of lithium-ion (rechargeable) batteries, many are now looking for sources of cobalt that are not tied to the production of copper and/or nickel.

This is because as production for copper and/or nickel falls, the production of cobalt falls as well. As such, Fortune Minerals Limited (OTCMKTS:$FTMDF), a Canadian mining company based in Ontario, is a company to look out for if you want to invest in cobalt. This is due to its discovery of a large cobalt-containing, polymetallic deposit in the Northwest Territories in 1996.

Robin Goad, president and CEO of Fortune Minerals, notes how the discovery “was at the infancy of demand for cobalt in batteries as the lithium-ion battery was just being commercialized.”

He goes on to explain, “The cobalt chemicals are now a much more important part of the business, with batteries now accounting for more than half of global cobalt demand.”

Besides the rechargeable batteries in various electronic devices and electric vehicles, Goad explained the other uses of cobalt. “It’s used in metallic forms as well as chemicals,” he said. “Cobalt is also used in catalysts, to make plastics and as a source of vitamin B12. It is used in pigments to give you that brilliant blue color, and in superalloys.”

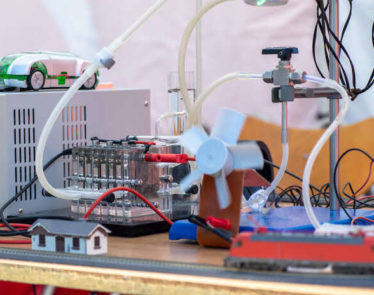

An electrified automobile industry

Researching for cobalt stocks and wondering what goals Fortune Minerals will be working towards? Goad says they are addressing the significant growth in the demand for lithium-ion batteries, especially for those used in electric cars.

If you want to invest in cobalt, do it now. With the rising popularity of electric cars, not only is the automobile industry changing, so are the mining and energy industries. “Because,” Goad explains, “the electric cars — as well as stationary storage cells — are going to require huge batteries and large volumes of cobalt. These batteries typically are comprised of cathode chemistries called NCA, which stands for nickel, cobalt, and aluminum; or NMC, which is nickel, manganese, and cobalt. These are 10 and 20% cobalt by weight.”

Contrary to popular belief, Tesla (NASDAQ:$TSLA) is not the only automobile company vying for these batteries, Goad notes, “in fact, almost every major automobile company in the world is putting out electric models.” With this push, a lot of money are being invested in developing giant factories all over the world in order to produce more batteries to meet demand, and lower the prices of these electric cars so that they can be affordable to the mass public.

Investing in cobalt in this context is pretty meaningful: the attempt to switch new power sources means a giant step towards making environmentally friendly vehicles both possible and accessible to the public.

The NICO Project

One of the biggest concerns when investing in cobalt is the unsteadiness of its supply chain. Most of the world’s supply of cobalt was produced from the DRC, a country that is unstable politically and full of corruption. To try and get passed the risks of the supply chain, Fortune Mineral has proposed and tested a ready-to-built mine, mill, and refinery. It aims to make North American a source of cobalt chemicals for global battery manufacturers.

NICO is not a significant global deposit, but a cobalt-gold-bismuth-copper deposit. It is a good choice for those investing in cobalt but wants to include other metals as well. “NICO is a polymetallic deposit that contains more than one million ounces of gold,” said Goad; the same amount as most significant gold deposits. Alongside the gold, NICO is also the world’s largest bismuth deposit.

Fortune Minerals have invested $115 million in since its discovery — about $600 million is required to build the mine and mill in the Northwest Territories as well as the refinery planned for Saskatchewan. Investors that want to get involved in investing in cobalt, the company is currently in discussion with interested parties to aid in the financing of NICO.

Featured Image: depositphotos/jpainting