Intellia Therapeutics

NTLA

has been focused on developing curative therapeutics using the CRISPR/Cas9 technology.

Please note that CRISPR, short for Clustered Regularly Interspaced Short Palindromic Repeats, is a technology that can selectively delete, modify or correct a disease-causing abnormality in a specific DNA segment. Although there are several methods to use CRISPR for targeting genetic defects that cause specific diseases, the most promising is the use of an enzyme called Cas9 for delivering CRISPR to the affected cells.

Intellia is pursuing two primary approaches to fully realize the transformative potential of CRISPR/Cas9 in vivo programs wherein CRISPR is the therapy and ex vivo programs that use CRISPR to create the therapy.

Intellia is evaluating its leading in-vivo genome-editing candidate, NTLA-2001, in a phase I study for transthyretin amyloidosis with polyneuropathy. Per Intellia, NTLA-2001 offers the possibility to halt and even reverse the indication by reducing the transthyretin protein with a single-dose treatment.

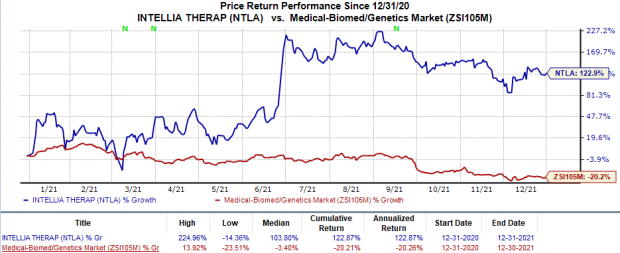

Shares of Intellia have skyrocketed 122.9% so far this year against the

industry

’s 20.2% decline.

Image Source: Zacks Investment Research

While Intellia is yet to have an approved marketable product in its pipeline, the company’s collaboration deals help it access capabilities and resources to support the ongoing therapeutic programs.

Earlier in 2016, both Intellia and

Regeneron Pharmaceuticals

REGN

initially entered into a partnership to co-develop and commercialize CRISPR/Cas-based therapies, primarily focused on genome editing in the liver. In fact, NTLA-2001 is part of a co-development and co-promotion agreement with Regeneron. While Intellia is the lead party for NTLA-2001, Regeneron will share 25% of the development costs and commercial profits.

In 2020, the collaboration between the two companies was further expanded to co-develop therapies for hemophilia A and hemophilia B, with Regeneron being the lead party.

Intellia’s collaboration with Regeneron has been encouraging. As of Sep 30, 2021, the company recorded $145.0 million in upfront payments under the collaboration.

In October 2021, Intellia partnered with SparingVision to develop novel genomic medicines utilizing the CRISPR/Cas9 technology for the treatment of ocular diseases. SparingVision will fund the preclinical and clinical development for genome editing product candidates under the collaboration. Intellia will receive a 10% equity ownership stake in SparingVision and milestone payments up to $200 million per product.

Apart from NTLA-2001, the company is evaluating another in-vivo CRISP/Cas9 candidate in hereditary angioedema (HAE). Earlier this month, Intellia

initiated

a phase I/II study to evaluate the safety, tolerability, pharmacokinetics and pharmacodynamics of NTLA-2002 in adults with type I or type II HAE.

Following the initiation of the phase I/II study, NTLA-2002 became the first single-dose CRISPR/Cas9 therapy designed to prevent attacks in HAE patients to enter clinical studies. NTLA-2002 aims to prevent HAE attacks by suppressing the plasma kallikrein activity. A reduction in kallikrein activity has been clinically validated in preventing HAE attacks.

NTLA-5001 is the company’s first wholly-owned ex-vivo genome editing candidate for the treatment of cancer. Intellia intends to start clinical studies for NTLA-5001 in acute myeloidleukemia.

A handful of other companies are also evaluating and/or developing their own in-vivo and ex-vivo therapies related to Intellia’s research and development programs.

One such company is

CRISPR Therapeutics

CRSP

, which is also developing therapies using the CRISPR/Cas9 technology.

CRISPR Therapeutics is evaluating its lead candidate, CTX001, in a phase I/II study for treating transfusion-dependent beta thalassemia and sickle cell disease. It expects regulatory submission for the therapy with the FDA in both indications by 2022-end.

Apart from CTX001, CRISPR Therapeutics is also pursuing the development of CRISPR candidates to create next generation CAR-T cell therapies.

Zacks Rank & Stock to Consider

Intellia currently carries a Zacks Rank #3 (Hold). A better-ranked company in the same sector is

Precision BioSciences

DTIL

, which currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Precision BioSciences’ loss per share estimates for 2021 have narrowed from $1.17 to $0.65 in the past 60 days. The same for 2022 has narrowed from $2.39 to $1.91 in the past 60 days.

Earnings of Precision BioSciences beat estimates in all the last four quarters, delivering a surprise of 76.9%, on average.

Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through November, the

Zacks Top 10 Stocks

gained an impressive +962.5% versus the S&P 500’s +329.4%. Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First To New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report