It was only a few weeks ago that investors had concluded that Advanced Micro Devices, Inc. (NASDAQ:$AMD) was approaching its eleventh-hour. It was at this time that shares took a nose dive from earnings, dealt with rumors of a partnership with Intel Corporation (NASDAQ:$INTC), and then shares fell when investors started to doubt the deal. At that time, AMD’s stock was just above the water’s surface and there were many who didn’t think that it would stay afloat for much longer.

The consensus was that the bulls were still in charge, but only marginally. If, for example, the $10 levels were to be unsuccessful, the bears would snatch control. This, of course, did not happen as AMD’s stock just put together a 13% rally over the past three days. So, the question that remains is: what should investors do? Is AMD a buy?

Before we tackle the technical perspective, let’s first look at the fundamentals.

Advanced Micro Devices: A Look Inside

A number of investors are puzzled by the boom the AMB stock saw in early June. As of right now, there are two known reasons for the drive. First, it was made known to the public that AMD’s RX 500 graphic chips can be used to “mine” cryptocurrencies, such as Bitcoin.

The project was initially released in April but it is still sold at a variety of online retailers. As a result, investors interested in the technology market are confident that revenue will be strong and the demand will continue after retailers restock. Seeing as Bitcoin became a sensation over a short period of time, it is likely that the craze will continue for quite some time.

In addition, Apple Inc. (NASDAQ:$AAPL) just had it’s 2017 WWDC conference. Along with massive announcements like a new iOS and a 10.5 inch iPad Pro, there was a little something for AMD as well.

Investors are very supportive of AMD’s RX Vega GPU. More specifically, investors hope that the iMac Pro will use either the Radeon Pro Vega 56 or the Radeon Pro Vega 64. Keep in mind that one is not better than the other, both are extremely powerful and will play a defining role in Apple’s latest devices.

Many speculate that this effort comes from Apple’s attempt in boosting their virtual reality capabilities.

Furthermore, AMD’s latest additions forecast that the business is moving forward. In 2017, management plans to bring the company back to profitability. Throughout the past nine months, debt has dropped 37% and its valuation, in comparison to Nvidia Corporation (NASDAQ:$NVDA) and Intel, is quite attractive.

Trading Advanced Micro Devices Stock

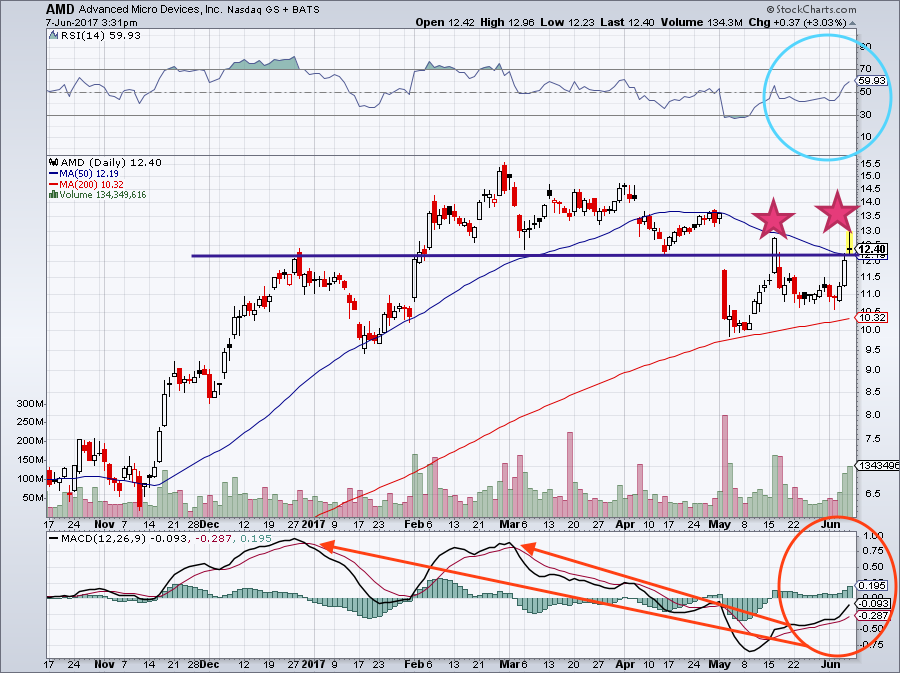

Many now find themselves asking, where does this leave AMD’s stock? To answer this question, we’re going to look at levels first, meaning that we are going to look for historic areas of support as well as defiance.

In regards to AMD, that level is seen around $12.25. On Tuesday, Advanced Micro Devices reached $12, but it was not clear as to whether it would climb any higher. On Wednesday, the stock surged passed it and reached $13 at one point.

Currently, Advanced Micro Devices is above the 50-day moving average. Despite there being a bulk of gains on Wednesday, the pullout from $13 was a smart move.

Last but not least, there’s the relative strength index and the MACD. The RSI, which the blue circle on the chart represents, illustrates when a stock is overbought (if the reading is higher than 70). Luckily, AMD stock has not reached this area yet. The MACD shows us momentum. In regards to AMD, momentum appears to have no indications of running out of gas. Thus making both of these indicators bullish.

So, are there any negatives? Sure, there’s a couple. Despite not being shown in the chart, AMD has not been able to get above its 100-day moving average. Plus, the two red stars indicate where the stock has run into some trouble, failing to get past $13.

Taking into consideration the strong volume of the past couple days, there’s more of chance that the stock will trade higher than lower. That said, a move below $12 and the 50-day moving average might change that. For now, however, AMD stock’s still runs with the bulls.

Featured Image: twitter