What was once confined to the realm of sci-fi has now become our day-to-day reality.

No longer confined to the cinema screen, robots are now serving as our protectors resembling but resembling more the friendliness of R2D2 from Star Wars than Terminator.

Autonomous Security Robots (ASRs) are rapidly becoming a crucial component of our future,1 given the burgeoning global population that has exceeded 8 billion people and the emerging need for law enforcement and security guards.

The global security robots market has already grown exponentially, reaching $27.32 billion in 2021 and it’s expected to grow at an impressive CAGR of 17.65% to reach $116.44 billion by 2030.2

Leading us into this future secured by robots is Knightscope, Inc. (NASDAQ:KSCP), a cutting-edge security technology company located in the heart of Silicon Valley.

The company manufactures ASRs (Made in America) equipped with state-of-the-art technology capable of deterring, detecting, and reporting crime—an innovation that is poised to bring about the greatest disruption to public safety in history.

In the USA alone, where the population exceeds 331 million, there are merely 660,288 full-time law enforcement officers3 and just over a million security guards4—roughly one protector for every 200 people.

But this urgent need isn’t going unnoticed.

Since its establishment in 2013, Knightscope, Inc. (NASDAQ:KSCP) has raised over $120 million and attracted more than 35,000 investors by the time it was listed on NASDAQ in January 2022.

The company has leveraged four key technologies (autonomy, robotics, artificial intelligence, and EV technology) to create its unique tech, which has been rolled out for over 2.3 million hours of field operation to date.

To better equip both domestic law enforcement and private businesses, Knightscope, Inc. (NASDAQ:KSCP) has come up with timely solutions for the road ahead.

According to InvestorPlace, Knightscope could be a surprise hit among must-own AI stocks. Why?

As high-profile incidents spark heated tension between law enforcement and the general public, it “may be easier for robots to address certain situations in a perfectly unbiased manner.”5

Knightscope was just awarded Authority to Operate by the U.S. Government. This authorization from the Federal Risk and Authorization Management Program (FedRAMP) is a massive win that makes this company’s cutting-edge technology available to federal agencies.6

But that isn’t the only exciting news this company has shared in recent months. Knightscope (NASDAQ:KSCP) has inked dozens of major deals across the country – which is likely why its first nine months of 2023 revenue nearly tripled year-over-year.

It’s caught the attention of investment banking and equity research firm Ascendiant Capital Markets. In their recent research report, Ascendiant Capital analyst Edward Woo highlighted the company’s Q3 wins as a sign of what’s to come in 2024.

Some notable deals include a $1.2 million inventory replenishment order for its K1 Call Boxes,7 and a $1.25 million contract with Rutgers, The State University of New Jersey, for a whopping 145 devices.8

Another major win for Knightscope recently was the launch of a pilot contract with the New York Police Department (NYPD) for a K5 robot to patrol a Manhattan subway station with the support of the Metropolitan Transportation Authority (MTA).9

“The NYPD must be on the forefront of technology and be 2 steps ahead of those utilizing technology to hurt New Yorkers.” – NYC Mayor Eric Adams10

Some of the other big-name clients utilizing Knightscope’s (NASDAQ:KSCP) technology include the Port Authority New York New Jersey, Penn Entertainment, University of Tennessee, New York City Fire Department (FDNY), San Bernardino County Transportation Commission (SBCTC), San Luis Obispo Council of Governments (SLOCOG), Orange County Transportation Authority (OCTA) and Ventura County Transportation Commission (VCTC).

The company’s products have also been deployed at endless hospitals, casinos, campuses, sports arenas, military bases, malls, airports – the list goes on.

If that’s not enough, Knightscope, Inc. (NASDAQ:KSCP) just began sales of its Automated Gunshot Detection (AGD) technology to cut the response time to dangerous situations down to two seconds!

Let’s take a look at some of the reasons this company is a force to be reckoned with in the public safety arena.

7 Reasons

To Pay Close Attention to Knightscope, Inc. (NASDAQ:KSCP)

1 Innovation Leader: Knightscope, Inc. (NASDAQ:KSCP) is a first mover security technology firm manufacturing Autonomous Security Robots (ASRs) equipped with advanced technology that can deter, detect, and report crimes.

2 Advanced Technology Integration: Knightscope, Inc. (NASDAQ:KSCP) uses four key technologies – autonomy, robotics, artificial intelligence, and EV technology to develop its unique and efficient security solutions. Recently launched real-time, Automated Gunshot Detection (AGD) and the Knightscope Emergency Management System (KEMS).

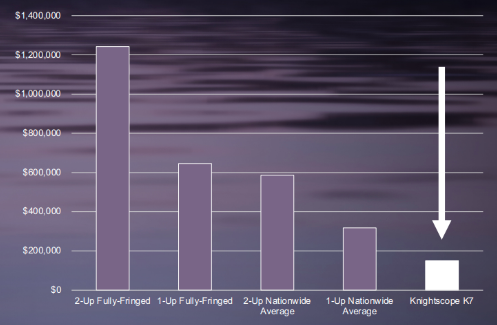

3 Cost-Effective Solution: Knightscope‘s Machine-as-a-Service (MaaS) business model provides a cost-effective alternative to traditional security. Their services cost between $0.75 to $9.00 per hour. In comparison, an unarmed guard makes $15 to $35 per hour and an off-duty armed law enforcement officer can be well over $85 per hour.

4 Ongoing Revenue Growth: In the first nine months of 2023, Knightscope, Inc. (NASDAQ:KSCP) announced a 198% increase in revenue year-over-year, generating $9.8 million in revenue in the first nine months of 2023.11

5 Successful Client Acquisition and Recurring Revenue Stream: Knightscope, Inc. (NASDAQ:KSCP) signed or renewed contracts with dozens of new and existing clients since the beginning of 2023 making well over 75 major announcements this year alone.

6 Strong Growth Prospects: Knightscope’s autonomous security robots market is expected to grow significantly, reaching $116.44 billion by 2030. The company also has a clear roadmap to profitability, targeting Q4 2024, and is currently running at an approximate $11 million revenue run rate, which is about double of last year..

7 Relentless, Experienced Leadership Team: Most of the management team consists of the original founders holding over 10 million shares of the company’s outstanding shares. Knightscope’s Co-founder & CEO, Chairman William Santana Li personally holds 7 million shares. He was the youngest senior executive at Ford Motor Company out of 430,000 employees at the time and later became COO at Ford subsidiary GreenLeaf LLC, the world’s second-largest automotive recycler.

AI-Powered Autonomous Security Robots for Persistent Surveillance and Threat Detection

Knightscope (NASDAQ:KSCP) sets itself apart by employing cutting-edge technology in a unique approach towards combating violent crime in the US and beyond.

Leveraging advanced data analysis and AI, Knightscope has been at the forefront of public safety innovation, delivering efficient and targeted solutions to counter crime effectively. Its forward-thinking approach and application of modern technology are making a significant difference in the safety and security industry.

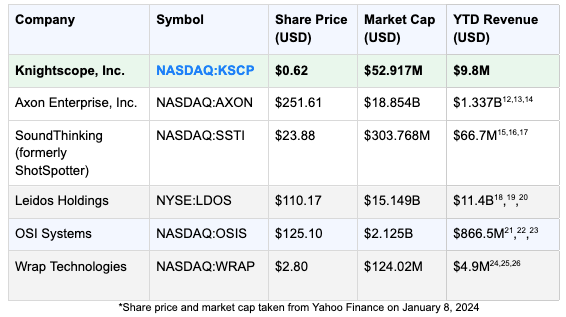

Knightscope, Inc. (NASDAQ:KSCP) is the only company that’s publicly traded and makes fully autonomous security robots (ASRs) for both indoors and outdoors at scale, but let’s compare them to other data-driven solution developers in the security space who are combating violent crimes in the US and beyond.

Knightscope’s comparables include companies like Axon Enterprise, which makes Tasers, body cameras, and VR training for officers. Wrap Technologies makes a device called BolaWrap that police can use to restrain people from a distance.28

SoundThinking (formerly ShotSpotter) makes systems that can detect gunshots, high-tech security cameras, and a search engine for law enforcement29— Knightscope has also recently added its own real-time, Automated Gunshot Detection (AGD) to its portfolio.30

Stacked and Growing Roster of Clients

Since the launch of its ASRs, Knightscope (NASDAQ:KSCP) has been working tirelessly to present this new technology to potential clients across the US, and its efforts are paying off immensely.

Since the beginning of 2023, Knightscope has signed on or renewed contracts for dozens of new and existing clients. These clients, which span the entire United States, include hospitals, universities, military bases,31 and endless public spaces where crime prevention is essential.

In fact, Knightscope’s (NASDAQ:KSCP) robots are in such high demand that the company has been working around the clock to fulfill $5 million in backlog orders.32

As mentioned, some of the largest deals made so far this year include a $1.25 million contract with Rutgers, The State University of New Jersey, for a whopping 145 devices,33 and the newly launched pilot contract with the New York Police Department (NYPD) for a K5 robot to patrol a Manhattan subway station.34

The company’s Florida-based reseller Transportation Solutions & Lighting (TS&L) also purchased 40 K1 Blue Light Towers to support its growing emergency communications business.35

What’s more, Knightscope partnered with ABM, a big parking service provider, to improve parking infrastructure at a US international airport with three robots.36

And let’s not forget about PG&E, a top-tier client that recently doubled its order because of the positive return on investment.37 Knightscope, Inc. (NASDAQ:KSCP) is not just growing, it’s impressing its clients and proving its worth.

And this is just the beginning. Knightscope’s Robot Roadshow has been so successful at generating new clients that it’s led to millions of dollars in backlog orders for ASRs across the country.38

Knightscope’s Unique Service Model and New Tech

Knightscope, Inc.’s (NASDAQ:KSCP) business model is called Machine-as-a-Service (MaaS), and it’s already generating significant revenue.

Think about it this way: a police officer’s salary can be between $57,000 and $67,00039 and with all the extra costs, it can go up to $149,000.40

Knightscope’s service costs between $0.75 to $9.00 per hour. This includes everything from setting up the robot to storing the data it collects.  For example, a single K5 Autonomous Security Robot (ASR) can make $309,700 over five years.41 The cost of running the robot is $133,000, so the profit is $176,700—a 57% profit margin!

For example, a single K5 Autonomous Security Robot (ASR) can make $309,700 over five years.41 The cost of running the robot is $133,000, so the profit is $176,700—a 57% profit margin!

Knightscope’s ASRs are not only cheaper to run, but they’re also reliable. Look at how they compare to the average security guard:  Plus, they’ve already helped solve crimes, like catching a hit-and-run suspect and identifying a gunman.

Plus, they’ve already helped solve crimes, like catching a hit-and-run suspect and identifying a gunman.

New Gunshot Detection Tech and Emergency Management System Platform

Knightscope (NASDAQ:KSCP) recently created a lot of buzz in the industry with the addition of real-time, Automated Gunshot Detection (AGD). This system can help police and security respond faster to threats. It’s a response to requests from schools, corporations, airports, hotels, and cities. The benefits of gunshot detection include:

- Helping to stop active-shooter events and save lives

- Reducing false alarms

- Working with other security solutions to protect people

Knightscope’s (NASDAQ:KSCP) gunshot detection system will be added to new K1 Blue Light Towers and can be upgraded to over 7,000 devices already in use. The system can work on its own or with Knightscope’s K5 Outdoor and K3 Indoor ASRs. It can also use solar power or light pole kits for more flexible installation.

The system can locate shots indoors and outdoors and sends notifications in less than two seconds. Knightscope believes that a focused, real-time system is more effective than a city-wide approach.

Sales of the gunshot detection system are expected to start in Q4 2023. The market for gunshot detection systems is expected to reach $646 million by 2031 in North America.42

Knightscope (NASDAQ:KSCP) also announced the launch of its innovative Knightscope Emergency Management System (KEMS).43

Because the company operates a wide-reaching network of more than 7,000 devices across the US, including K1 Blue Light Towers, E-Phones, and Call Boxes, the introduction of the KEMS platform will boost these devices’ capabilities by allowing real-time monitoring, instant error detection, and system performance reporting.

It’s an exciting leap forward, made even more significant by Knightscope’s (NASDAQ:KSCP) integration of artificial intelligence throughout its product range.

The company’s continued rollout of the KEMS platform throughout 2023 promises a dynamic shift in public safety infrastructure, making the nation’s security more efficient and smarter than ever.

But that’s just the beginning of what this company has in mind.

Knightscope has a long-term technology strategy that will include several new exciting capabilities including

- AUTONOMY – Autonomously navigate both outdoors and indoors in dynamic or static environments providing a physical deterrence 24/7/365 at low and high speeds

- SEE – Computer Vision and Video Analytics (people, faces, vehicles, plates, gait, weapons)

- FEEL – Thermal Imaging and Emotion Detection (fire, crowds, forensics)

- HEAR – Acoustic Event Detection and Machine Listening (gunshot, vehicle crash, yelling, glass breaking)

- SMELL – WMD Threat Detection (Devices, Pathogens, Chemical, Biological, Radiological and Nuclear)

- SPEAK – Automated Pre-Recorded Broadcasts, Live Public Address, Text-to-Speech, Concierge

Solid Growth Plans Secure Its Place in a Growing Market

Knightscope, Inc. (NASDAQ:KSCP) has a clear vision for both its short-term and long-term growth, which is already helping it secure a strong position in the market.

At the beginning of 2023, Knightscope shared its roadmap to profitability, which it aims to reach within the next 24 months.44

The company is targeting an annualized revenue run rate of $12 million to $14 million. The company just announced its Q3 2023 revenue, generating $9.8 million in the first nine months and nearly tripling revenue year-over-year.

Knightscope’s top-line revenue growth is accelerating, thanks to new sales contracts, expansion with existing clients, contract renewals, and increased engagement through its reseller program. The company is also making significant progress in fulfilling its backlog of new orders worth millions of dollars, as many supply chain issues have eased.

In the News

- Knightscope’s New CFO Weighs in on 2024 Roadmap

- From Silicon Valley to City Streets: Knightscope’s Robotic Guardians – Benzinga

- Ohio Mall Uses Robot to Help Keep Shoppers Safe – Fox News

- Knightscope: We’re working ‘to fix’ injustices for security guards, CEO says – Yahoo Finance

- Knightscope is Still Winning Against Crime! – KnightScope

Here’s a look at what Knightscope, Inc. (NASDAQ:KSCP) is doing to maintain this momentum: MACRO

- Long-term we are targeting to put 1 million machines-in-network to assist the 1 million law enforcement professionals and 1 million security guards with a recurring revenue business model for a recurring societal problem

- Analogous to building a defense contractor but instead of focusing on the DoD, the Company is focused on the U.S. DHS, U.S. DOJ and the 19,000+ law enforcement agencies and 8,000+ private security firms

SHORT TERM

- Verticals – focus on commercial real estate, hospitals, hotels, residential, manufacturing, logistics, casinos, corporate campuses, and transportation

- Marketing – continue the Robot Roadshow as a highly unique selling tool to place our advanced technology at the doorstep of prospective clients

LONG TERM

- FedRAMP – continue to work towards a targeted ATO (“Authority to Operate”) with the U.S. Federal Government during 2023

- Technology – building a wide-ranging portfolio of form factors that can see, feel, hear and smell and operate across environments both outdoors and indoors at low and high speeds – and do 100x more than a human could ever do

- Everywhere – criminals and terrorists can be anywhere and therefore in order to meet our mission Knightscope needs to be everywhere

Meet the Minds Guiding Knightscope’s Security Revolution

The same team that founded, funded, grew, and listed Knightscope, Inc. (NASDAQ:KSCP) over the last decade is leading the company today, and they plan to continue growing the company organically over the next two to three decades, while achieving their goal of making America safer. Among the talented roster, includes:

RECAP: 7 Reasons

To Put Knightscope, Inc. (NASDAQ:KSCP) on Your Watchlist

1 Pioneering in Security Tech: Knightscope is at the forefront of security technology, creating Autonomous Security Robots (ASRs) with capabilities to deter, detect, and report crimes..

2 Cutting-Edge Tech Integration: Utilizing autonomy, robotics, AI, and EV technology, Knightscope recently added Automated Gunshot Detection to its portfolio and the Knightscope Emergency Management System..

3 Affordable Security Solutions: Offering Machine-as-a-Service, Knightscope provides cost-effective security options, ranging from $0.75 to $9.00 per hour, a more economical solution compared to traditional security personnel..

4 Impressive Revenue Increase: The company reported a 198% revenue growth in Q3 2023, earning $9.8 million in the first nine months of the year..

5 Expanding Client Base: In 2023, Knightscope secured numerous new contracts, announcing over 75 major client acquisitions and renewals.

6 Market Growth Potential: The market for Knightscope’s autonomous security robots is projected to hit $116.44 billion by 2030, with the company targeting Q4 2024 for profitability and doubling its revenue run rate from last year..

7 Dedicated Leadership: Led by Co-founder & CEO William Santana Li, a former senior executive at Ford and COO at GreenLeaf LLC, the management team, including original founders, holds over 10 million company shares, demonstrating a strong commitment to the company’s vision..

The autonomous security space is still in its infancy with Knightscope (NASDAQ:KSCP) positioning itself as the first mover. The problem of crime is not going away any time soon and this story is one to pay attention to.

Do your own due diligence on this startup that has taken the idea from the movies and created a real-life R2D2 security robot. Knightscope, Inc. (NASDAQ:KSCP) nearly a decade since its founding, and over 2.3 million hours in operation in the field, has the business model and technology to make a big impact on society.

Don’t forget to click here to subscribe for email updates and ensure you don’t miss out on any of Knightscope’s news and milestones.

P.S. To learn more about the Rise of the Robots, visit www.knightscope.com/rise.