Generally speaking, increasing interest rates tends to damage dividend-paying stocks, thus making them less appealing to investors as bond earnings get bigger. However, like most things, there is an exception to this policy: stocks that frequently increase dividends send a “signal to the market of their own growth prospects.” As a result, these companies will: A) outperform over the long run and B) lose less during a time of market corrections.

Below is a brief overview of five companies whose shares are thought to be “safe” stocks. Keep in mind that these stocks are not just for this year, but rather they are ideal stocks for long-term investing.

-

Canadian Tire (TSE:$CTC.A)

Some might say that Canadian Tire Corp. LTD has an unusual business model, as they lead the market of auto supplies and maintenance, hardware, and sporting goods. However, the company has built on this model by acquiring Mark’s, an outdoor and construction apparel retail store, and the Forzani Group, which is a sporting-goods chain which includes both SportChek and Atmosphere.

Additionally, Canadian Tire has now started to embrace the world of digital technology and e-commerce. Their catalogue is now interactive, as a smartphone app has turned their iconic catalogue into an online showroom. Furthermore, Canadian Tire has opted to use virtual reality devices in-store so prospective buyers can test out products.

Like anything, Canadian Tire has its fair share of competition, but that has not stopped the store’s profits from increasing more than 32% since 2012. Plus, Canadian Tire’s stock has increased 23.5% in each of the past five years.

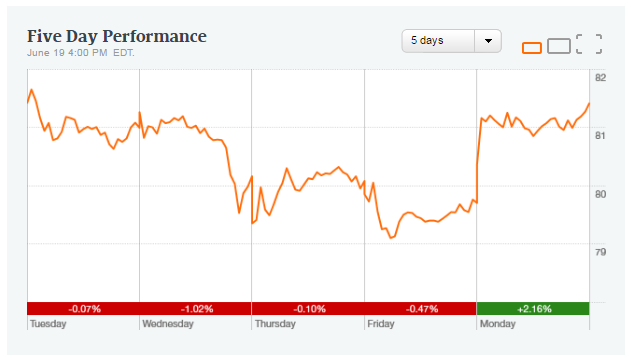

On June 19, 2017, Canadian Tire’s shares increased 0.52% over the last five days and 7.29% so far this year.

-

Apple Inc. (NASDAQ:$AAPL)

In 2012, Apple reintroduced a dividend and, since then, the California-based technology company has increased it annually and is on its way to paying more over the coming 12 months than any other company.

As Apple’s cash hoard exceeds $250 billion, investors should expect to see more of the same. However, Apple trades at a 15% discount to the S&P 500 Index (INDEXSP:$.INX). Ankur Crawford, the manager of Alger Spectra Fund stated, “That doesn’t really compute for us. It’s cheap.”

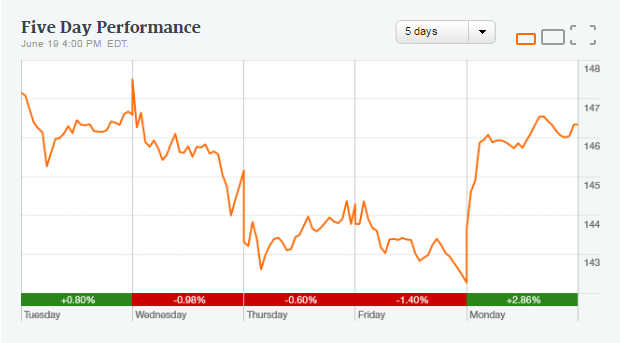

On June 19, 2017, Apple Inc. rallied 2.86% to (U.S) $146.34. Apple shares increased 0.63% over the past five days, and 26.35% so far this year.

-

Texas Instruments (NASDAQ:$TXN)

It shouldn’t come as a surprise to see TXN on this list as the Texas-based company has increased its dividend for 13 years straight. TXN is a semiconductor manufacturing company that produces chips that are used in biometric readers, 3D printers, and robotic equipment. On June 19, 2017, Texas Instruments Inc. started to cross above its 50-day moving average. TXN shares have increased 0.46% over the past five days, thus making the company 3.82% off of their 52-week high.

-

The Home Depot Inc. (NYSE:$HD)

Over the past five years, Home Depot has increased its dividend 22%. In the meantime, the Georgia-based company has been buying back millions of shares. We know that both the economy and the real estate market are improving, which, according to Susan Hirsch of TIAA Investments, means that we “have all the stuff that makes Home Depot work at this time in the cycle.”

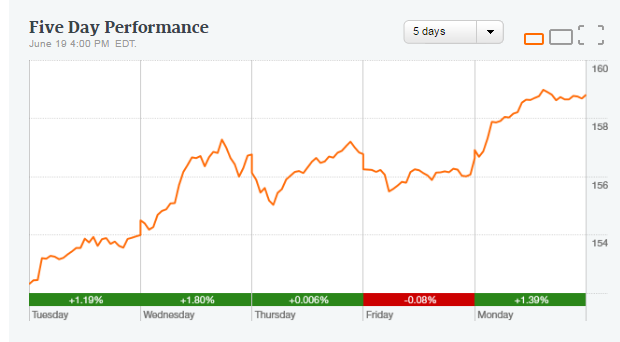

On June 19, 2017, Home Depot closed up by 1.39% to (U.S) $158.81 and set a new 20-day high. At the time of writing, Home Depot shares increased 4.36% over the last five days and are 1.27% off of their 52-week high.

-

ATCO Ltd. (TSE:ACO.X)

As a diverse global corporation, ATCO provides services and solutions to electricity, pipelines, and retail industries around the globe. In comparison to its counterparts, ATCO’s yield is not very high, but the corporation makes up for it in regards to dividend growth. ATCO has increased its annual dividend payment for 23 years straight, which includes a compound annual growth rate of roughly 15% from 2012 to 2017. Plus, the corporation’s 14.9% hike in January has allowed 2017 to be the 24th year with an increase. For these reasons, ATCO has a strong chance of continuing to be one of the top dividend grows in the market.

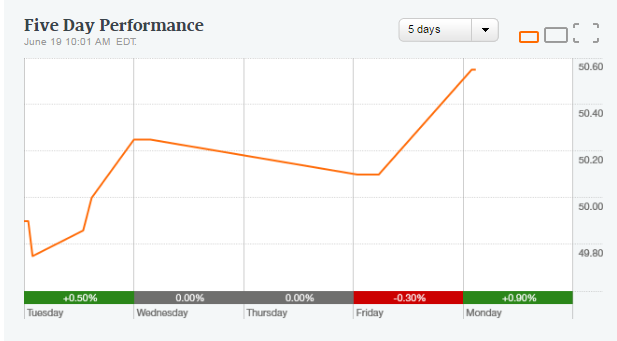

On June 19, 2017, ATCO Ltd. closed by 0.90% to $50.55 and crossed above its 50-day moving average. Over the past five days, ATCO’s shares have increased 1.10% and are 4.17% off of their 52-week high.

Featured Image: twitter