MoneyGram International, Inc. MGI recently announced that it is expanding its mobile wallet network in Asia by joining forces with Bangladesh’s mobile financial service provider, bKash. The deal brings in more than 55 million bKash users under MoneyGram’s radar, thus boosting its international exposure.

MoneyGram, a leader in digital peer-to-peer payment evolution, will provide multiple services to bKash users including instant fund receival worldwide. The deal will enable bKash wallet users to leverage MoneyGram’s extensive network globally.

The move further strengthens MoneyGram’s partnership with Thunes, a business-to-business company with a vast fintech payment network. The first phase of the partnership entailed rolling out of services in Africa. MoneyGram’s deal with bKash marks the second phase of the partnership with Thunes, which targets the Asia-Pacific and Latin America regions.

MoneyGram Benefits

This is a huge market considering that Bangladesh received around $22 billion in remittances last year, per World Bank. The figure represents roughly 7% of the Asian country’s GDP in 2020. The COVID-19 pandemic compelled consumers to opt for digital payments, which increased the demand for a secured digital payment platform. Hence, MoneyGram is expected to capitalize on this massive remittance services market. Also, more new deals in neighbouring countries can be expected from the company in the near future, further boosting its footprint in Asia. This positions the company for long-term growth.

MoneyGram’s total received digital transactions though the MoneyGram platform hit an all-time high in third quarter 2021, reflecting growth of 63% from the prior-year period. The latest deal with bKash is likely to stimulate the growth momentum. Given the stiff competition prevalent in the U.S market, the company’s focus on diversifying its revenue mix geographically to align with the global remittance market growth rate bodes well for the company.

Other Companies in the Scenario

MoneyGram is facing steep competition from peers like The Western Union Company WU , which joined forces with Cebuana Lhuillier in a bid to expand digital money transfer services across the Philippines, early-September. The move bolstered its presence in the Asia-Pacific region. Western Union is rapidly investing in its digital platform to stay ahead in the fast-changing remittance market.

For 2021, Western Union expects earnings per share to be $2.05-$2.10, the mid-point of which represents 11% growth from the 2020 reported figure. The company expects constant currency revenue growth of around 3-4% for 2021 against a 3% decline in 2020. WU expects the operating margin to remain at 21.5% for this year, compared with 20.8% in 2020.

The remittance space is also seeing movements from fintech players like PayPal Holdings, Inc. PYPL .

PayPal offers domestic and international person-to-person payment facilities with the help of PayPal and Xoom products. The company continues to gain solid traction in the global online payment market. In the Asia-Pacific region, it is expanding its presence via its growing operations in Australia, Philippines and other countries. It enables customers to send payments in more than 200 markets globally.

For 2021, PayPal anticipates revenues between $25.3 billion and $25.4 billion, indicating growth of 18% at current spot rates and 17% on a currency-neutral basis. Net new active accounts are expected to be 55 million in 2021. Its growing total payment volume, courtesy of increasing net new active accounts, are likely to continue to drive the results.

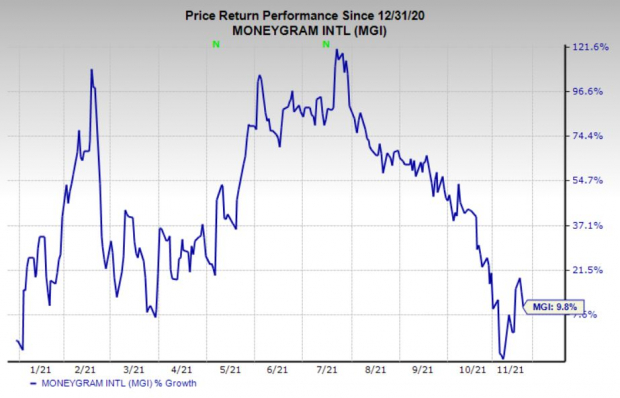

Price Performance

MoneyGram’s shares have risen 9.8% in the year-to-date period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank & Another Key Pick

MoneyGram currently sports a Zacks Rank #1 (Strong Buy). Another top-ranked player in the Finance space include Alerus Financial Corporation ALRS , which sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here .

Alerus Financial’s bottom line for 2021 is expected to jump 11.5% year over year to $2.81 per share. It has witnessed three upward estimates in the past 30 days and no movement in the opposite direction. Alerus Financial beat earnings estimates thrice in the past four quarters and missed once, the average surprise being 23.6%.

Based in Grand Forks, ND, Alerus Financial provides numerous financial services to clients. Its financial strength is reflected by massive total assets of $3.2 billion at the third quarter-end, which increased 5.4% for the first nine months of 2021. Rising investment securities are likely to keep boosting the company’s asset position in the coming quarters.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report