Sector Performance

Things have been relatively positive in the agribusiness sector for the week ending in June 9, 2017. One of the most popular agribusiness ETFs, VanEck Vectors Agribusiness ETF (NYSE:$MOO), had risen to about 72 basis points while the S&P 500 Index (NYSEARCA:$SPY) fell 24 basis points.

Below, the performance of several major agribusiness companies with a focus on fertilizers will be discussed. The performance is on a weekly basis (the week ending June 9) as well as a year-to-date basis (ending June 9).

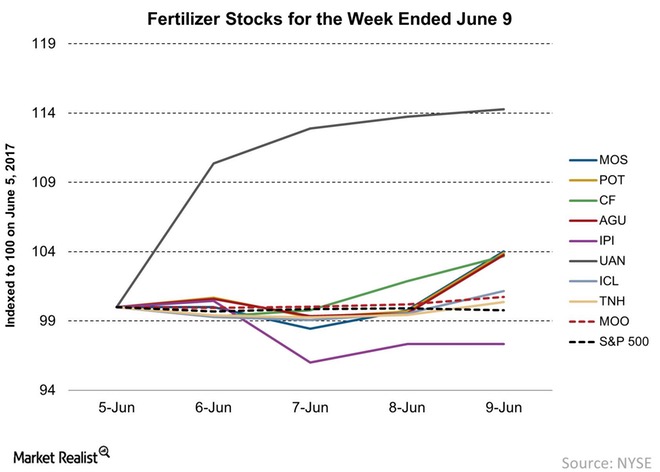

Weekly Performance

In the week ending June 9, Texas-based company CVR Partners (NYSE:$UAN) gained the most — the company’s stock prices shot up 14.3%, resulting in $4.70 per share. Coming in second was Mosaic (NYSE:$MOS) with a 4% rise that allowed prices to be at $23.50 per share. PotashCorp (NYSE:$POT) got a similar 3.9% rise, ending the week with $16.50 per share.

With a 3.8% rise, Agrium’s (NYSE:$AGU) stock got to be $91.50 per share at the end of the week. Meanwhile, CF Industries (NYSE:$CF) rose 3.7%, ending the week with $27.80 per share. Israel Chemicals (NYSE:$ICL) saw a 1.2% rise, landing the company’s stock to be at $4.30 per share. Terra Nitrogen (NYSE:$TNH) rose to $90.90 and obtained about 38 basis points during the week ending June 9.

For major agriculture stocks, last week was full of rises. However this was not the case for Intrepid Potash (NYSE:$IPI), whose stocks fell 2.7%. At the end of the week, the company had a stock of $2.2 per share. Investors should look into why that stock in particular fell, and keep in mind to always remain cautious in what to invest in.

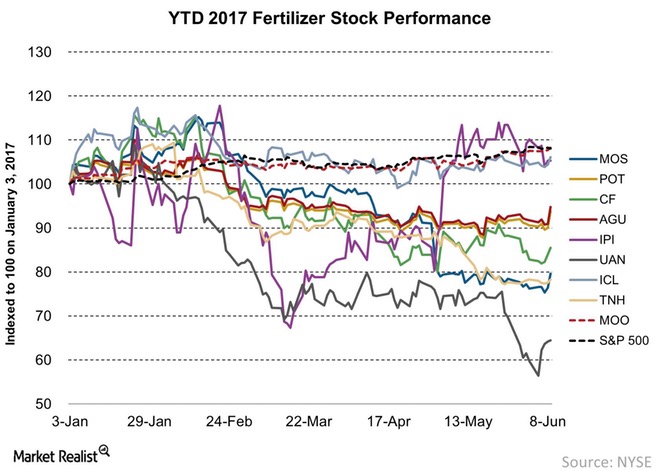

Year-To-Date Gainers and Losers

Year to date (as of June 9), Israel Chemicals gained the most with an impressive rise of 6.1%. Coming in about 1% behind is Intrepid Potash, whose stocks have risen 5.3% year to date.

While most of the companies mentioned above have seen good rises in the last week ending June 9, their year-to-date performance had not seen the same kind of gains. The remaining companies — CVR Partners, Mosaic, PotashCorp, Agrium, CF Industries, and Terra Nitrogen — all saw a fall when it came to stock performance year to date as of June 9. Despite having the best weekly performance in the week ending June 9, CVR Partners has the worst performance year to date in comparison to the other major fertilizer companies, with its stock falling by a drastic 35.6%. Meanwhile, Terra Nitrogen fell 21.7% and Mosaic fell 20.4%.

Agribusiness ETFs like VanEck Vectors Agribusiness ETF seems like a much safer bet to investors compared to individual stocks — not only has the ETF gained 72 basis points in the week ending June 9, it has also risen 8.3% year to date as of June 9. Although its basis points fell, the S&P 500 Index has risen 8.1% year to date as of June 9.

Featured Image: Depositphotos/©timbrk