Vertex Pharmaceuticals Incorporated VRTX announced data on the first patient from an ongoing phase I/II study evaluating its investigational cell-based therapy, VX-880 for the treatment of type I diabetes (T1D) with impaired hypoglycemic awareness and severe hypoglycemia. After 90 days of the single infusion of VX-880 at half the target dose along with immunosuppressive therapy, restoration of insulin production was observed.

The first patient in the phase I/II study had a history of 40 years with T1D and was dependent on treatment with exogenous insulin. The patient had severe, potentially life-threatening hypoglycemic episodes five times in one year prior to the start of treatment with VX-880. Data from the study showed that after 90 days of administration of VX-880, basal insulin production was restored. The treatment also restored glucose-responsive insulin production. The insulin production was measured by C-peptide levels. Fasting C-peptide was 280 pmol/L while stimulated C-peptide was 560 pmol/L at day 90 compared to undetectable levels at baseline.

The blood glucose level, as measured by HbA1c, reduced from 8.6% at the baseline to 7.2% at day 90. The patient needed 34 units of insulin dose per day prior to the treatment with VX-880, which got reduced to an average dose of 2.9 units per day at day 90, reflecting a decrease of almost 91% in daily insulin requirement.

Vertex believes the candidate has the potential to restore the body’s glucose levels by restoring pancreatic islet cell function, including insulin production. The company stated that the data support continued evaluation of the candidate in T1D patient. The candidate also holds the potential to be used without the need for immunosuppression. Data from the study also demonstrates the potential of the candidate as a one-time, life-changing therapy for T1D patients.

We note that the FDA has granted a Fast-Track Designation to VX-880 for TD1. The designation facilitates the development and expedites the review of drugs that treat serious conditions.

VX-880 is Vertex’s first of the two investigational programs for the transplant of functional islets into patients. VX-880 is for the transplantation of islet cells alone, using immunosuppression to protect the implanted cells. The second program will involve the implantation of the islet cells inside an immunoprotective device.

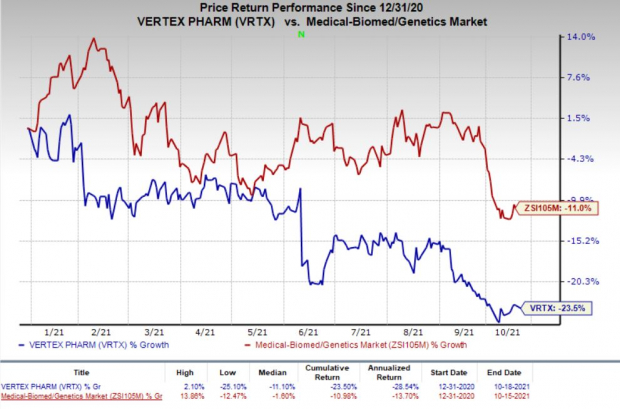

Vertex’s stock has declined 23.5% this year so far compared with a decrease of 11% for the industry .

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

While Vertex’s main focus is on the development and strengthening of its cystic fibrosis (CF) franchise, the company also has a rapidly advancing early-stage portfolio in seven other specialty disease areas like pain, alpha-1 antitrypsin deficiency (AAT), sickle cell disease (SCD), beta-thalassemia, APOL1-mediated kidney diseases and cell therapy for type I diabetes.

Vertex is co-developing a gene-editing treatment, CTX001 in partnership with CRISPR Therapeutics CRSP for SCD and thalassemia in phase I/II studies. Meanwhile, phase II studies are ongoing for Vertex’s small molecule corrector for the AAT disease, VX-864, its oral small molecule medicine in APOL1-mediated focal segmental glomerulosclerosis, and its NaV1.8 inhibitor for pain, VX-150.

Zacks Rank and Key Picks

Vertex currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Some other top-ranked stocks from the biotech sector include Moderna MRNA and Adaptimmune Therapeutics ADAP , both with a Zacks Rank #2.

Moderna’s earnings per share estimates have moved up from $29.04 to $29.13 per share for 2021 and from $22.26 to $26.12 for 2022 in the past 60 days. The stock has risen 220.5% so far this year.

Adaptimmune’s loss estimates per share have narrowed from $1.05 to 72 cents for 2021 and from $1.09 to $1.01 for 2022 in the past 60 days.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report