While it is rational and good to question whether an investment will be beneficial or not, there are many questions in particular when it comes to silver investing. This is because the silver market is quite small, despite the variety of its uses, and does not quite carry the same significance as gold.

However, given current situations, silver as an investment is seen as quite an asset to an investor’s portfolio. Below are some reasons why it would be beneficial to get into silver investing through physical silver.

1. Silver is Actual Money

Silver, along with gold, is the ultimate form of money, despite the fact that it is not used as currency. This is because the metal cannot be depreciated as easily as paper or digital forms of money (what is now fiat currency).

However, to keep the store of value in silver, one has to buy and invest in actual physical forms of silver — in bars or coins. Other forms of silver as an investment, such as ETFs, certificates, and futures contracts do not carry the same benefits in silver investing as physical silver because they are seen as paper investments.

- Physical silver has No counterparty risk. Unlike stocks or bonds, you won’t need to worry about whether or not a person/company will hold their part on a contract or a promise when you own physical silver.

- Never been defaulted on. You will virtually have no default risk if you hold physical silver.

- Long-term use as money. Silver has been used as currency ever since the creation of the Roman Empire. Although it is not used as actual currency now, it still holds some form of monetary value.

Because of its independence from fiat currency, owning physical silver can serve as a great asset.

2. Physical Silver is Solid Protection

In a world where digital online trading has gain traction and where stocks and bonds are simply numbers rising and falling, there is a certain comfort to the fact that you can hold physical silver. A silver coin can easily fit in your pocket and you can carry it wherever you go.

As well, physical silver can serve as a form of protection against hacking and cybercrime; you cannot erase or steal a coin or silver bar as easily as you can a digital asset.

3. Silver is Not Expensive

One of the biggest reason why people turn to silver as an investment rather than gold is that it is a lot cheaper. Not only is it more affordable (and thus accessible) for the average investor, it can also protect your portfolio and investments just as well as gold — if not more, due to its actual real life applications in things such as jewelry, medicine, photographs, electronics, and more.

If you want to get invest in precious metals but cannot afford gold, silver investing is the way to go.

4. Silver is Good for Buying Little Everyday Items

Not only is it less expensive to purchase, silver is also more practical when you need to sell it. Because it comes in smaller denominations than gold, you can sell it at whatever weight you choose. This is a lot more easier than having to sell a full ounce of gold when you only need to earn half of the value and keep the other half.

5. Silver Performs Better than Gold in Bull Markets

Because silver is such a small market, any small amount of money can impact the silver price more than any other assets, gold included. As a result, silver has a greater volatility, making silver investing a little riskier. This can be bad in a bear market, as silver will fall more than gold; but in a bull market, silver will typically rise faster and more than gold.

An example of this is the recent gain that occurred from the 2008 low market to the 2011 high market. Silver rose to about 448% in price, while gold only rose about 166%.

6. Silver Inventories Are Decreasing

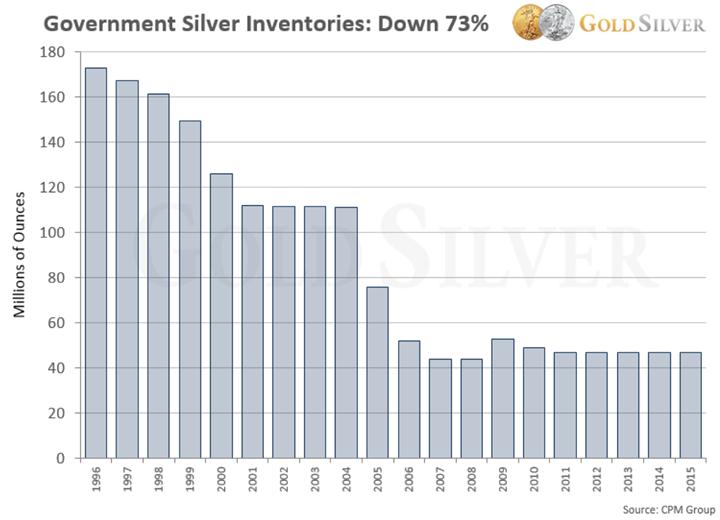

Due to the fact that silver is no longer being commonly used as currency in the form of coins, many governments no longer have stockpiles of silver. Since 1996, silver inventories have fallen dramatically.

The lack of inventory can be troubling, as silver has begun to have application and usages in a variety of industries. Not only that, many investors are beginning to lose faith in fiat currencies. As these things occur, silver investing in 2017 seems to be a smart move, as low supply and high demand will drive up prices.

7. Industrial Use of Silver Increasing

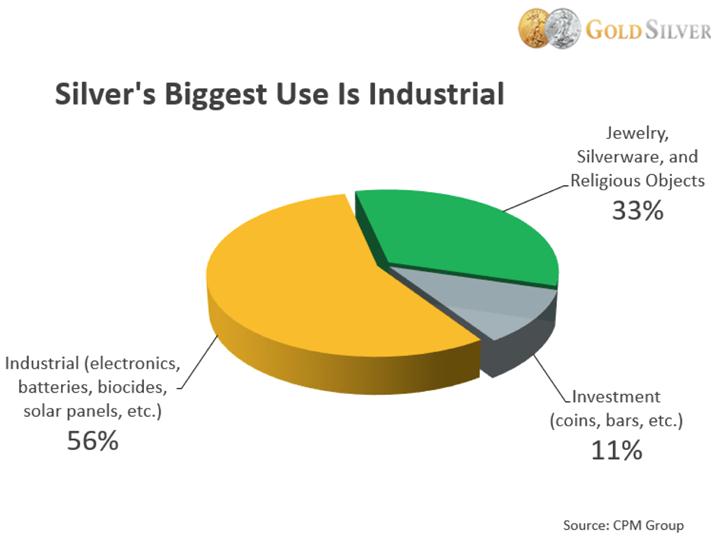

Silver is not just for minting coins. Mike Maloney, author of Guide to Investing in Gold and Silver, points out that, “Of all the elements, silver is the indispensable metal. It is the most electrically conductive, thermally conductive, and reflective. Modern life, as we know it, would not exist without silver.”

As mentioned previously, silver has begun to grow in industrial use. Electronics, medical applications, batteries, and solar panels are just some of the products in which silver plays a part in making. This means that, unlike gold, silver can still remain a valuable asset even if fiat currencies do not fall. This can make silver as an investment more worthwhile than gold.

Some examples of silver in various industries and products are:

- Cell phones. A single cell phone contains about one-third of a gram of silver. As demand for cell phones rise, so does the demand for silver. An estimate of 5.75 billion cellphones are predicted to be purchased between 2017 and 2019, according to information technology research and advisory company Gartner. This would mean 1.916 billion grams of silver, or 57.49 million ounces, will be needed.

- New self-heating windshield seen in recent Volkswagen models uses silver.

- As clean energy begin to garner attention, so does the production of solar panels. As a result, silver use in photovoltaic cells, a main component to solar panels, will soar. The Silver Institute predicts that this demand will be 75% greater in 2018 than in 2015.

- Silver is used as a catalyst for the production of ethylene oxide. Ethylene oxide, in turn, is an important part in the production of plastics and chemicals. The Silver Institute predicts that 32% more silver will be needed by 2018 compared to 2015.

Because of its characteristics as highly electrical and thermal conductivity, industrial use for silver will no doubt grow. As such, demand for silver can rise. However, once silver is used in the industrial setting, it is discarded. The metal is not recyclable, which can raise concern if supplies fall. And that, sadly, is what is happening.

8. Supply is on the Brink of Falling

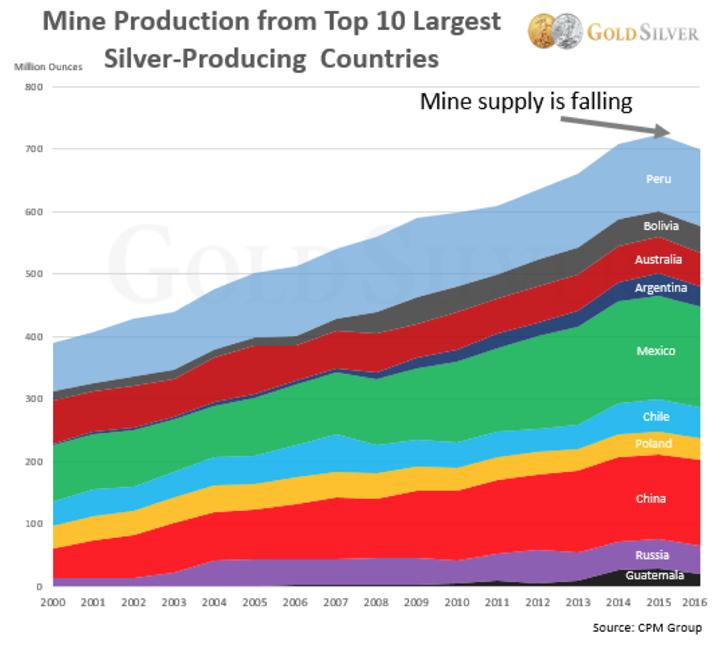

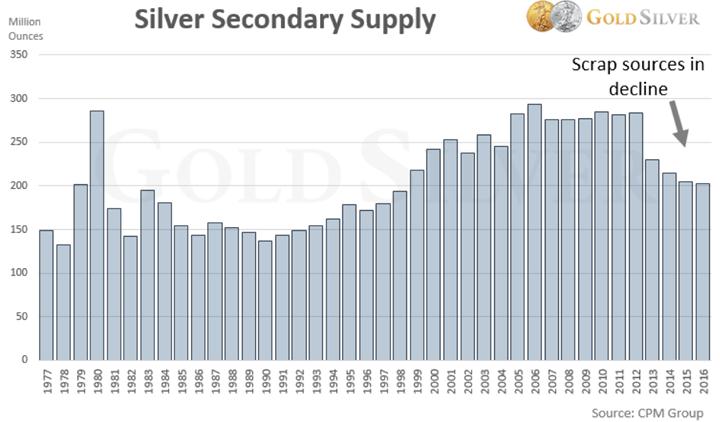

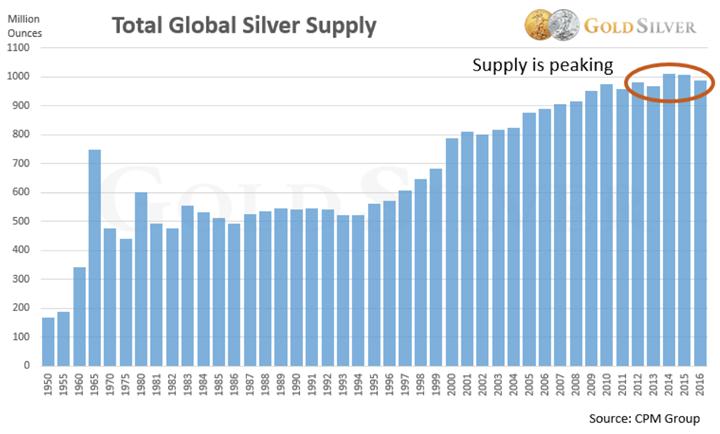

Like most metals, silver price fell hard after its peak price in 2011. From 2011 to 2016, prices fell at 72.1%. In order to gain profit during the price fall, mining companies began to cut budgets. One of largest budget cuts was in the exploration and development of new silver mines. As such, this lack of development has caused a decline in silver production, availability of scrap silver supply, as well as the total global silver supply.

Another concern regarding supply is the fact that most silver is produced as a byproduct from other metal operations, such as copper and zinc. Thus, sources of other metal supplies will also have an impact on the supply of silver.

A piece of silver investing advice: invest in the metal now. As supplies fall, and industrial demand grows, prices will surely rise.

But it is about to rise even more dramatically, as it is not just industrial demands of a handful of countries, but worldwide.

9. World Demand for Silver is on the Rise

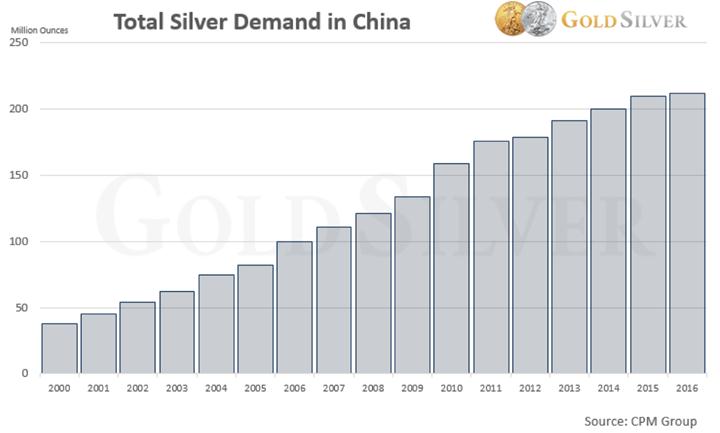

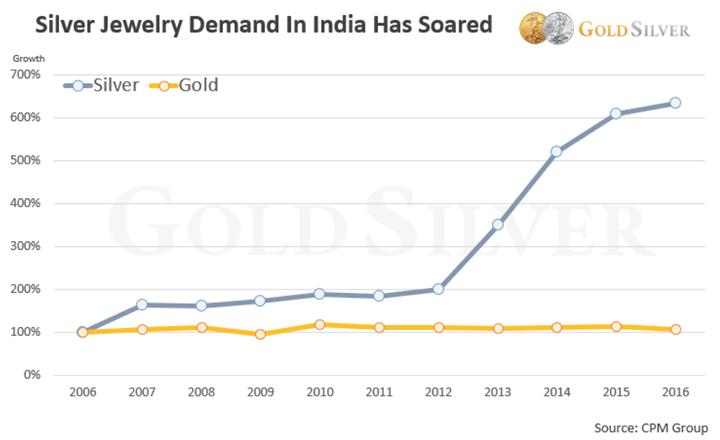

While lots of governments have seen a record level of sales in regards to silver, the most evident in growing demand is China and India. With a growing population and key roles in some of the world’s largest industries, the demand for silver is sure to continue to rise.

Silver demand in China is for all uses of the metal (industrially, culturally, etc) while in India, the demand in silver comes from a rising popularity of silver jewelry.

Demand rising of silver jewelry in India:

As demands surge and supply dwindles, this can only mean positive outcomes if you own the metal.

10. Gold/Silver Ratio

When deciding between whether to choose silver as an investment or gold, most will look to the gold/silver ratio. The gold/silver ratio — the price of gold divided by the price of silver — helps predict which metal would be more advantageous to buy at any time.

During the 20th century, the gold-to-silver ratio averaged 47:1. In the 21st century, the ratio averaged 61:1. Thus, a ratio at or above 70 is in outlier territory, making silver favourable compared to gold. Silver investing 2017 seems be more profitable, rather than gold.

Featured Image: depositphotos/Alexis84