Moderna Inc . MRNA reported earnings of $8.58 per share for the first quarter of 2022, comfortably beating the Zacks Consensus Estimate of $5.18. The company had reported earnings of $2.84 per share in the year-ago quarter. The significant improvement in the bottom line was driven by strong year-over-year growth in revenues.

Revenues in the quarter were $6.1 billion, significantly beating the Zacks Consensus Estimate of $4.50 billion. In the year-ago quarter, revenues were $1.93 billion. The significant increase in revenues was driven by the strong sales of its COVID-19 vaccine, Spikevax, and its booster doses.

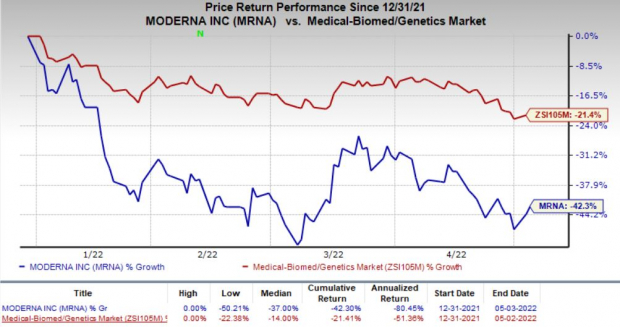

Moderna’s shares were up 4% in pre-market trading on May 4, following strong quarterly results. Shares of the company have declined 42.3% so far this year compared with the industry ’s 21.4% decrease.

Image Source: Zacks Investment Research

Quarter in Details

Product sales, entirely from the COVID-19 vaccine, were $5.93 billion during the quarter. In the fourth quarter of 2021, product sales were $6.94 billion. The company had recorded product sales of $1.73 billion in the year-ago period.

Grant revenues were $126 million compared with $194 million in the year-ago quarter. Collaboration revenues were $15 million compared with $10 million in the year-ago quarter. The company earns collaboration revenues from agreements with several big pharma/biotech companies, including AstraZeneca AZN , Merck MRK and Vertex Pharmaceuticals VRTX .

Selling, general and administrative expenses were $268 million, compared with $77 million in the year-ago quarter. The significant increase was primarily due to an endowment to the Moderna Charitable Foundation along with an increase in certain commercialization costs.

Research & development expenses were $554 million, up 38.2% from the year-ago period. The significant increase was primarily attributable to higher clinical costs, personnel-related cost, technology and facility-related costs, and a few others.

The company ended the quarter with $19.3 billion in cash and cash equivalents, compared with $17.6 billion as of Dec 31, 2021.

2022 Guidance

Moderna stated that it has advance purchase agreements with different countries for Spikevax and its booster doses worth approximately $21 billion. The company believes that sales will be slightly higher in the second half of 2022 compared to the first half.

The company expects R&D and SG&A expenses to be approximately $4 billion in 2022. It expects capital expenditure to be in the range of $600 million to $800 million.

In February 2022, Moderna authorized a share repurchase program of $3 billion. It completed its previous share repurchase program, initiated during the third quarter of 2021, of $1 billion in January.

Coronavirus Vaccine Update

In January, the FDA approved Moderna’s biologics license application for its COVID-19 vaccine, mRNA-1273. The company also received emergency use authorization (EUA) from the FDA for the use of its second booster dose in adults aged 50 years or older as well as in all adults with certain kinds of immunocompromise in March.

The Committee for Medicinal Products for Human Use (CHMP) recommended the conditional marketing authorization for the use of Spikevax in children aged 6 to 11 years in February. In March, Canada’s government authorized the use of Spikevax in similar individuals.

In April, Moderna submitted regulatory applications in the United States and Europe, seeking emergency/conditional authorization for the use of Spikevax in children aged six months to six years. The company had previously initiated filing an EUA with the FDA for the use of Spikevax in children aged 6 to 11 years.

However, the authorization of mRNA-1273 for use in adolescents is pending in the United States. The authorization for the younger population is likely to happen after potential approval to the EUA request for adolescents.

A phase II/III study is evaluating Moderna’s bivalent booster candidate targeting Omicron and the original COVID-19 strain. The company expects initial data from the study in June and plans to start the phase III portion later in 2022. A phase II study evaluating the Omicron-specific booster candidate is ongoing.

Other Key Pipeline Updates

Moderna has several other mRNA-based pipeline candidates targeting different indications in its pipeline. The leading candidates among them are mRNA-1345 and mRNA-1647, evaluated in pivotal studies as a respiratory syncytial virus (RSV) vaccine and a cytomegalovirus (CMV) vaccine, respectively.

During the first quarter, Moderna initiated a phase III study to evaluate its CMV vaccine candidate. An ongoing pivotal phase III study is evaluating the RSV vaccine candidate.

The company has reported promising initial data from a phase II study evaluating its seasonal flu vaccine candidate, mRNA-1010. The company plans to start a phase III study in the Southern Hemisphere during the second quarter to evaluate the safety and immunogenicity of mRNA-1010. It may also start a late-stage study to evaluate the candidate’s efficacy during Fall 2022, if needed.

The FDA has approved its investigational new drug application for its Nipah-virus vaccine candidate, mRNA-1215. A clinical study may begin soon.

Menawhile, we note that Moderna has regained all rights to its mutant KRAS vaccine, mRNA-5671, from its partner, Merck. Moderna is evaluating the next steps for the program. Currently, Merck is conducting a phase I study on mRNA-5671 as monotherapy or in combination with its anti-PD 1 drug, Keytruda. Please note that Moderna continues to develop a personalized cancer vaccine candidate in collaboration with Merck.

Moderna is also developing different candidates in collaboration with AstraZeneca. The candidate under the collaboration with AstraZeneca is in early- to mid-stage studies targeting oncology and cardiovascular indications. The leading candidate being developed in partnership with AstraZeneca is AZD8601 as a treatment for ischemic heart disease in a phase II study.

Moderna is developing an mRNA therapeutic in collaboration with Vertex. Moderna and Vertex are developing the candidate to treat the underlying cause of cystic fibrosis. Vertex is planning to file an investigational new drug application to support the initiation of an early-stage clinical study in 2022.

Zacks Rank

Currently, Moderna carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report