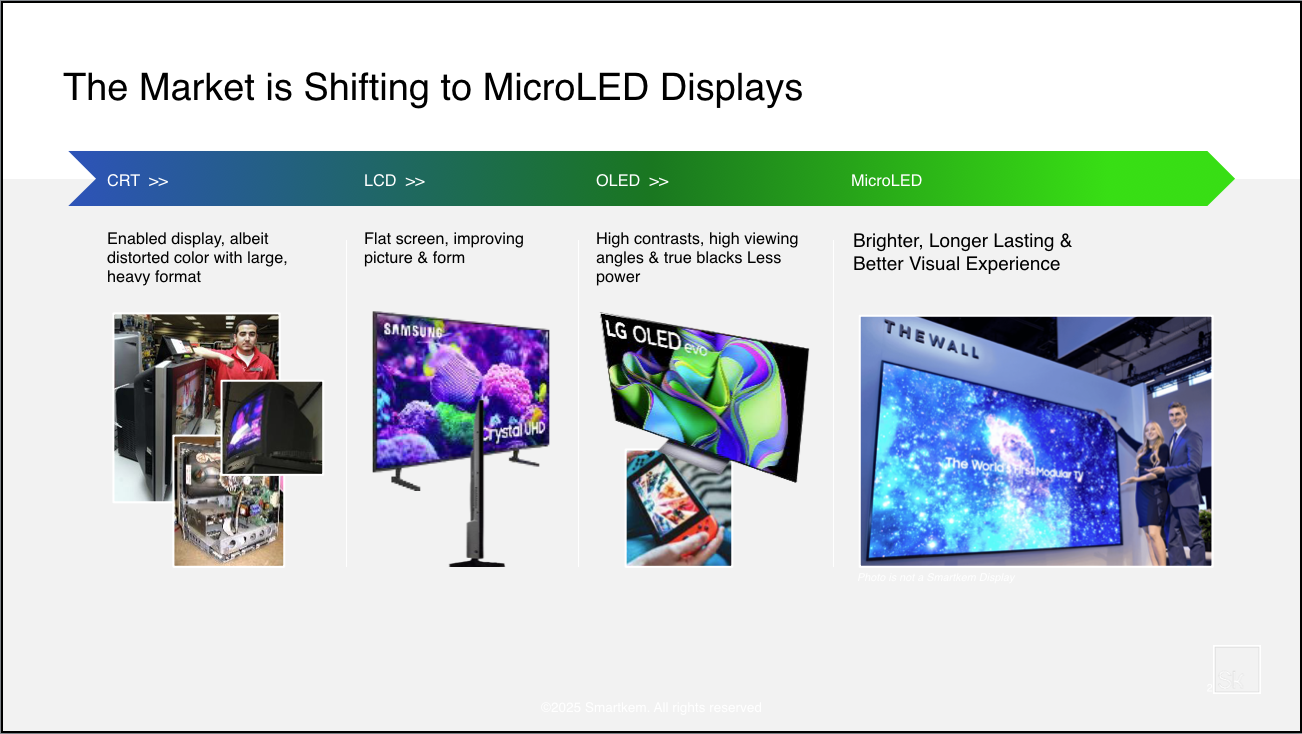

Three years ago, OLEDs were the gold standard in display technology.

Now?

There’s a new technology that is beginning to make waves.

The numbers don’t lie.

The MicroLED market is projected to surge from $592 million in 2021 to over $21 billion by 2027—a staggering 81.5% compound annual growth rate (CAGR).¹

That’s nearly 60x growth in less than a decade.

Over the years, tech giants like Samsung,² Meta,³ Foxconn,⁴ and Apple⁵ have bet billions on MicroLEDs—the next evolution of ultra-bright, energy-efficient displays.

But this isn’t the first time a new display technology has disrupted the market.

Remember OLED?

Universal Display Corporation (NASDAQ:OLED) was once an under-the-radar player.

Back in 1996, its IPO priced at just $6 per share.

Most investors ignored it.

But those who saw the potential early?

They won big.

When OLED tech went mainstream, the stock surged to a peak of $252.69 in 2021.⁶

A 4,090% gain.

A simple $1,000 investment at IPO would have turned into over $41,900.

That’s the kind of tremendous upside that happens when a new display technology takes over.

Now, MicroLED is on the same trajectory.

Recently, a partnership with AUO—the largest display manufacturer in Taiwan—has just been announced to jointly develop the world’s first rollable, transparent MicroLED display.⁷

This collaboration could be the tipping point for bringing rollable, transparent MicroLED displays to market.

And it’s happening right now.

A New Player Emerges in the MicroLED Display Revolution

We’ve witnessed it before.

When new technology arrives at the ideal moment, it can completely transform an industry.

The right technology at the right time can completely reshape an industry.

And now, one company’s technology could make MicroLED displays more affordable, scalable, and ready for mass production.

Meet Smartkem (NASDAQ:SMTK).

A British innovator with a breakthrough technology that could make MicroLED display manufacturing cheaper, faster, and more efficient than ever before.

The secret?

Smartkem’s (NASDAQ:SMTK) patented transistor technology could eliminate a major bottleneck in MicroLED production.⁸⁹¹⁰

Its liquid polymers are processed at a low-temperature (80°C) and can be poured directly on top of the MicroLEDs—potentially making manufacturing cheaper and more efficient.

Instead of relying on mass transfer and laser welding—which have high manufacturing costs, low yields and significant inefficiencies—Smartkem’s (NASDAQ:SMTK) transistor tech uses a new process that is compatible with existing manufacturing lines.

Smartkem’s (NASDAQ:SMTK) low-temp process also means that it can be used to manufacture MicroLED displays that are very thin, lightweight, bendable and transparent.

This isn’t just theory.

Smartkem (NASDAQ:SMTK) is partnering with AUO—Taiwan’s largest display manufacturer—to co-develop the world’s first rollable, transparent MicroLED display.¹¹

And that’s only the beginning.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

How Smartkem (NASDAQ:SMTK) is Setting Itself Apart

World-First Innovation

Smartkem (NASDAQ:SMTK) has already made history with the first-ever monolithic MicroLED display built using its patented OTFT technology.

This isn’t an incremental improvement—it’s a fundamental shift in how MicroLEDs are made.

Smartkem has developed a ‘chip-first’ approach (as opposed to ‘chip-last’) that is unique – literally turning the manufacturing process upside down.

The result?

- Ultra-bright displays (150,000 nits)¹²

- High-resolution clarity (254 ppi)

- A promising breakthrough in cost-efficient manufacturing for MicroLED displays that can be used in applications including smartphones, TVs, and VR devices and more.

Smartkem’s technology isn’t just another step forward—it could be a complete game-changer.

Game-Changing Partnerships

When industry giants start paying attention, you know something big is happening.

Smartkem (NASDAQ:SMTK) isn’t going at this alone.

It has already partnered with Chip Foundation to develop MicroLED backlights for LCDs and with AUO on board, Smartkem (NASDAQ:SMTK) is now working alongside one of the most influential display manufacturers in the world to co-develop the world’s first rollable, transparent MicroLED display.

High-Growth Markets

MicroLEDs aren’t just for televisions.

This technology is spilling into additional billion-dollar industries—and Smartkem (NASDAQ:SMTK) has the opportunity to be a part of this major shift.

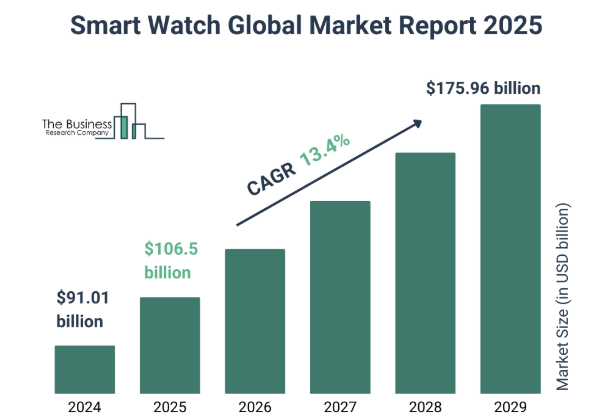

- Wearables: The smartwatch market is growing at an astonishing 17% CAGR from $91.01 billion in 2024 to $106.5 billion in 2025 fueled by demand for brighter, longer-lasting, energy-efficient screens.¹³

- Consumer Electronics: The 3000 ppi-5000 ppi segment, which includes smartphones, smartwatches and VR devices, accounted for 34% of MicroLED revenue in 2023.¹⁴ The >5000 ppi segment is expected to see the fastest growth, with a 79% CAGR from 2024 to 2030, driven by rising demand for high-resolution displays in AR/VR headsets like Apple’s Vision Pro and Meta Quest Pro.

- Automotive & Healthcare: High-resolution MicroLEDs are making their way into advanced driver-assistance systems (ADAS) and medical imaging devices, where precision and durability are critical.

The Market is Waking Up

The biggest display revolution since OLED may be happening right under our noses.

And Smartkem (NASDAQ:SMTK) isn’t just riding the wave—it’s creating it.

The MicroLED display market is projected to explode 2,948% by 2031.¹⁵

And Smartkem’s technology could be a key participant in this surging market.

The industry’s biggest players know the stakes.

The question is—do investors?

Press Releases

8 Reasons

Watch Smartkem (NASDAQ:SMTK) Closely

1

MicroLED Market Explosion: The MicroLED market is set to skyrocket from $592M in 2021 to over $21B by 2027, an 81.5% CAGR¹⁶ and Smartkem (NASDAQ:SMTK) shows considerable promise to be a major player.

2

Breakthrough Manufacturing Process: MicroLED production is costly and inefficient. Smartkem’s low-temperature (80°C) OTFT process could significantly reduce costs, increase yields, and make mass production viable.

3

Small Cap With a Tight Share Structure: Smartkem (NASDAQ:SMTK) is a small cap company with a tight share structure and a market cap of just $8M, meaning plenty of room for growth.¹⁷

4

Game-Changing Partnership with AUO: Taiwan’s largest display manufacturer AUO has partnered with Smartkem to develop the world’s first rollable, transparent MicroLED display—a substantial technological step forward.

5

First-to-Market Innovation: Smartkem (NASDAQ:SMTK) is the first company to create a monolithic MicroLED display using OTFT technology, demonstrating the capability of their unique ‘chip-first’ manufacturing approach to MicroLED displays.

6

Expanding into Multiple Billion-Dollar Markets: MicroLED technology is expected to transform wearables, smartphones, automotive, and medical imaging—each a multi-billion-dollar opportunity.

7

Strong Intellectual Property Portfolio: Smartkem (NASDAQ:SMTK) holds 138 granted patents across 17 patent families and 40 trade secrets, creating a competitive moat that makes replication difficult.

8

Positioned for Mass Adoption: Unlike many early-stage disruptors, Smartkem’s technology is compatible with existing manufacturing infrastructure, lowering barriers to adoption and enabling industry-wide adoption.¹⁸

First-to-Market Innovation: The Smartkem (NASDAQ:SMTK) Advantage

The next generation of display technology is on the horizon.

And Smartkem (NASDAQ:SMTK) is in a prime spot to benefit from MicroLED adoption.

The MicroLED display market is projected to explode into a $21 billion industry by 2027.

But while most companies are still trying to overcome the high production costs and manufacturing inefficiencies, Smartkem (NASDAQ:SMTK) has already demonstrated its ability to overcome these hurdles.

With its patented transistor technology, Smartkem is focused on eliminating problematic and costly manufacturing processes that have resulted in sky-high prices for MicroLED TVs.¹⁹

AUO Partnership: A Partnership with an Industry Giant

Taiwan’s largest display manufacturer, AUO and Smartkem are teaming up to develop the world’s first advanced rollable, transparent microLED display.

AUO’s involvement signals confidence from a major industry player, and if this collaboration succeeds, it demonstrates potential for taking today’s microLED TVs from high end market prices of $100,000 down to mass market prices.²⁰

A Fortress of Intellectual Property: 138 Patents & 40 Trade Secrets

Being first isn’t just about speed—it’s about protection. Smartkem (NASDAQ:SMTK) has built an extensive IP portfolio with:

- 138 granted patents across 17 patent families, safeguarding its core technology.

- 40 codified trade secrets, preventing competitors from reverse-engineering its process.

- A unique low-temperature printing process (80°C) that eliminates the costly and problematic mass-transfer process used in traditional MicroLED production.

Manufacturers still rely on high-temperature, micron precision alignment and laser welding methods—leaving them with low yields, and high costs.

Why Others Can’t Compete

- Patent Protected – Smartkem’s (NASDAQ:SMTK) transistor tech is robustly protected

- Compatibility – Smartkem’s processes are being designed to work on existing display manufacturing lines, enabling seamless integration with current production infrastructure.

- Materials Advantage – Traditional MicroLED makers need to use expensive glass substrates that can withstand high processing temperatures, while Smartkem’s low-cost flexible plastic substrates open the door to entirely new form factors.

A Web of Strategic Partnerships

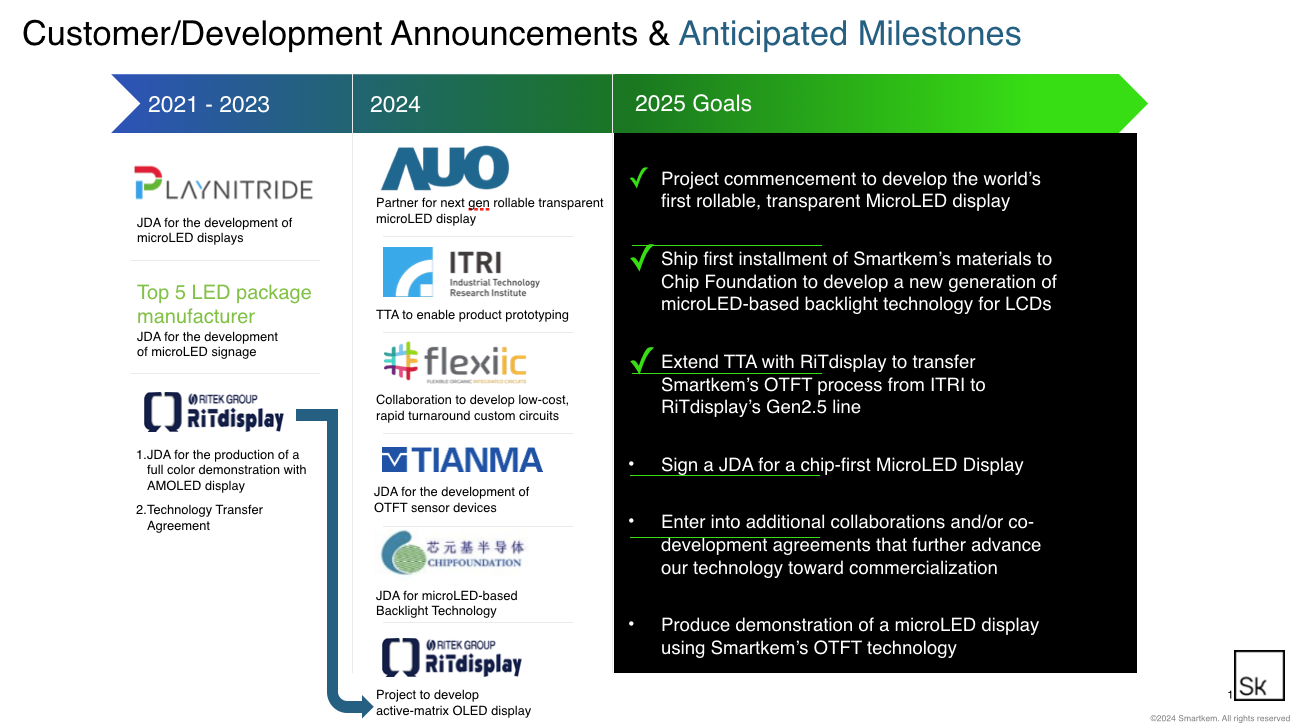

Smartkem’s (NASDAQ:SMTK) collaborations span global industry leaders, each bringing unique expertise that will help with the commercialization of this next-generation display tech:

- AUO: This partnership aims to create the world’s first rollable, transparent microLED display. This project, supported by the Taiwan-UK Research & Development Collaboration, aims to demonstrate how Smartkem’s technology can simplify microLED manufacturing by eliminating mass transfer and laser welding processes, potentially improving production efficiency and cost-effectiveness.²¹

- FlexiIC: By collaborating with FlexiIC, Smartkem (NASDAQ:SMTK) is working on low-cost, rapid-turnaround custom circuits for smart sensors and IoT devices.²²

- Industrial Technology Research Institute (ITRI): Together, they are developing a commercial process for printing circuits using SMTK’s inks on ITRI’s Gen 2.5 prototype line.²³

- Shanghai Tianma Microelectronics: This partnership focuses on developing OTFT-based biochips for advanced sensor applications.²⁴

- Chip Foundation: Together, they’re co-developing microLED-based backlight technology for LCDs.²⁵

- RiTdisplay: Smartkem is also working with RiTdisplay to manufacture active-matrix OLED displays using its OTFTs.

Looking Ahead to 2025

Smartkem (NASDAQ:SMTK) has laid out a clear roadmap:

- Project Commencement with AUO to co-develop the world’s first rollable, transparent MicroLED display ✔

- Sale of Materials to Chip Foundation to develop a new generation of microLED-based backlight technology for LCDs ✔

- Extend Technology Transfer Agreement with RiTdisplay to transfer Smartkem’s OTFT process from ITRI to RiTdisplay’s Gen2.5 line ✔

- Sign JDA for a chip-first MicroLED display.

- Additional collaborations and co-development agreements that further advance our technology toward commercialization.

These partnerships are more than just business deals—they’re validations of Smartkem’s technology.

By collaborating with established industry players, Smartkem (NASDAQ:SMTK) gains access to resources and expertise that would otherwise take years to develop independently.

Each collaboration represents a stepping stone toward Smartkem’s goal of making its organic thin-film transistors (OTFTs) a standard in flexible displays, sensors, and other next-generation electronics.

A Low-Float Stock with Major Potential

The right market disruption + tight share structure is why Smartkem (NASDAQ:SMTK) could be a stock to watch.

With a limited number of shares outstanding and an even smaller public float, SMTK is considered a low-float stock.²⁶

In the small-cap world, stocks with limited float can see rapid price appreciation on the right news—and Smartkem has already attracted the attention of major players like AUO.

Institutional Investors Have Barely Tapped In—Yet

Right now, institutional ownership is low—just 10 institutions hold a combined 252,555 shares (7.09% of the company).

Major shareholders include²⁷:

- Laurence Lytton (9.826%)

- Myda Advisors LLC (9.826%)

- Octopus Investments Ltd. (6.297%)

- The Hewlett Fund LP (5.108%)

- Five Narrow Lane LP (5.108%)

But here’s the key: If Smartkem (NASDAQ:SMTK) continues to secure partnerships, strengthen its IP portfolio, and move toward commercialization, the stock could become far more attractive to institutional investors.

What Happens When Institutional Buying Kicks In?

- More institutional ownership could impact liquidity, making shares harder to acquire.

- Increased demand + limited supply = potential for rapid price appreciation.

- Retail investors who recognize the play before the institutions move in often see the biggest gains.

A Short Interest Setup That Could Work in Bulls’ Favor

SMTK’s short interest remains low—only 9,800 shares shorted (0.81% of the float).

This means there’s very little bearish pressure on the stock, and if momentum builds, short sellers could be forced to cover, pushing prices higher.

Low-float stocks could potentially be highly-rewarding.

- A positive catalyst (new partnership, tech breakthrough, commercial adoption) could ignite a major breakout.

- A negative development (funding concerns, delays in commercialization) could lead to sharp pullbacks.

But the risk-reward ratio here is clear—Smartkem has:

- A first-mover advantage in next-gen display technology.

- A strong IP moat with 138 patents and 40 trade secrets.

- A potential wave of institutional interest.

The microLED revolution is coming. Will Smartkem be the company that enables mass adoption?

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

The Leadership Behind Smartkem (NASDAQ:SMTK): The Right Team at the Right Time

Game-changing technology is only as good as the people driving it forward.

At the helm of Smartkem (NASDAQ:SMTK) is a leadership team stacked with decades of experience in semiconductors, advanced materials, and high-growth tech industries.

This isn’t their first rodeo—they’ve built companies, secured major industry partnerships, and delivered real-world commercial successes.

Ian Jenks – The Visionary CEO with a Track Record of Scaling Disruptive Tech

Leading the charge is Ian Jenks, Smartkem’s CEO and Chairman. With more than 30 years of experience in technology-driven businesses, he has a history of taking cutting-edge innovations and turning them into commercial successes.

- Formerly President of Uniphase (now JDS Uniphase), a company that he grew from a market cap of $300 million to $16 billion during his tenure.

- Past roles include serving as Chairman of companies in photonics, nanotech, and advanced manufacturing.

- Has successfully navigated early-stage companies through commercialization, growth, and acquisition.

Simply put—he knows how to take a revolutionary idea and turn it into an industry standard.

A Leadership Team with Deep Industry Ties

Backing Jenks is a team of display technology industry leaders, material science experts, and high-level executives with deep-rooted connections across the semiconductor and electronics industries.

A Team Built for Disruption

With strategic minds leading R&D, commercialization, and industry engagement, Smartkem (NASDAQ:SMTK) isn’t just another small-cap tech play—it’s a company led by industry veterans who’ve already delivered breakthroughs in semiconductor technology.

The bottom line?

This isn’t an early-stage startup run by outsiders—it’s a company with proven leadership, a clear roadmap, and a technology that could reshape the microLED industry.

8 Reasons

Reasons Smartkem (NASDAQ:SMTK) Deserves Your Attention

1

First-to-Market Advantage: Smartkem’s organic thin-film transistor (OTFT) technology is a game-changer, eliminating costly manufacturing bottlenecks and enabling the commercialization of MicroLED displays at scale.

2

Noteworthy Industry Partnerships: AUO, Taiwan’s largest display manufacturer, is working directly with Smartkem to develop the world’s first rollable, transparent microLED display. This collaboration validates Smartkem’s tech and positions it at the center of microLED’s mass adoption.

3

Incredible Market Potential: The microLED industry is forecasted to explode from $150M in 2024 to $4B by 2031—a 2,500% surge. Smartkem is positioned to participate in this transformation.

4

Strong Intellectual Property Moat: With 138 patents and 40 trade secrets, Smartkem has a fortified position against competitors, ensuring its technology remains ahead of the curve.

5

Ultra-Low Float, High Growth Potential: With a tightly limited share count and a small public float, any significant buying pressure could trigger aggressive price movement.

6

Proven Leadership in High-Growth Sectors: Smartkem’s (NASDAQ:SMTK) CEO, Ian Jenks, has successfully led multiple tech-driven businesses, including JDS Uniphase, and has a track record of turning disruptive innovations into commercial successes.

7

Expanding Beyond Displays: The application of Smartkem’s transistor technology extends beyond microLEDs displays, with applications in OLED displays, smart sensors and the Internet of Things (IOT).

8

Low Institutional Ownership = Early Opportunity: Institutional investors haven’t yet piled in, with only 7.09% institutional ownership. As more funds recognize the potential, increased institutional buying could drive higher valuations.

Final Thoughts: This Could Be the Next Big Small-Cap Tech Play

Every so often, a disruptive technology emerges that changes the game.

- OLED had its moment, and investors who spotted it early saw enormous gains.

- Now, microLED is taking center stage.

Smartkem (NASDAQ:SMTK) isn’t just another company riding the wave—is poised to be a key player in this new industry.

With a first-mover advantage, a development partnership with AUO and other industry leaders, a locked-in patent portfolio, and a technology that could make MicroLED manufacturing cheaper and more efficient, SMTK has all the hallmarks of a breakout opportunity.

With a low float, growing industry validation, and a leadership team that knows how to scale disruptive technology, this is a stock that deserves to be on every investor’s radar.

MicroLED isn’t just the future of displays—it’s happening now.

And Smartkem (NASDAQ:SMTK) is a company with the potential to become a key player in this $21 billion market, with opportunities to create meaningful value for its shareholders in the future.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Jonathan WatkinsChief Operating Officer

Jonathan WatkinsChief Operating Officer Dr. Beverley BrownChief Scientist

Dr. Beverley BrownChief Scientist Dr. Simon OgierChief Technology Officer

Dr. Simon OgierChief Technology Officer Barbra KeckChief Financial Officer

Barbra KeckChief Financial Officer