The latest meme stock (or ‘stonk’) craze has many people worried. It’s also the reason many have made massive returns on stocks like Gamestop (NYSE:GME) and AMC Entertainment (NYSE:AMC).

If you’ve followed this year’s market-shattering phenomenon, you’ll understand the implications of one big thing:

Just how much effect social media has on the stock market

A chair at the SEC recently had harsh words for what he called the ‘gamificaton’ of retail investing, citing that while apps and social media might cause us to exercise or buy something online we don’t need, it can have the adverse affect of convincing people to pour more money than they can afford when they don’t understand the risks.

A few days ago, the Crypto world saw a frightening move from Kim Kardashian posting about Ethereum-based coin Ethereum Max.

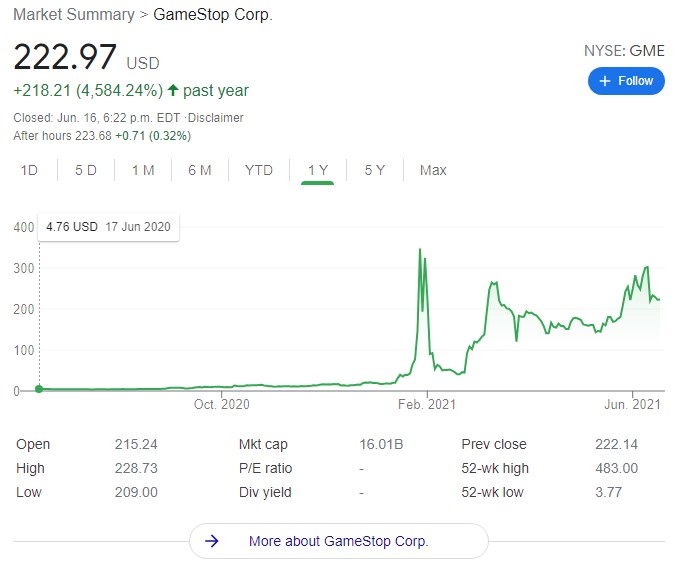

The power of a mass movement can be seen most clearly from the counter-response to hedge funds shorting Gamestop (NASDAQ:GME). A galvanized effort by Reddit community WallStreetBets saw the spike of a lifetime as the stock shot up 300% in mere days.

Yet, there is a lesser known player that might also be contributing to the increase in retail “meme stock” investing. This platform is a simple messenger app that allows voice and video calling, and is built around community engagement. Originally, the company saw its product strictly as a communication tool for gamers.

Discord Investing Communities have Arrived

Discord is a voice-over-IP (VoIP)instant messaging service and digital distribution platform designed for community creation. Users install the app, then find or receive invites to “Servers” which are communities with their own chat rooms, voice chat rooms, rules, themes, and most importantly: Topics. At this time there are over 6.7 million active Discord servers.

The app has 140 million active users per month. There are approximately 300 million registered accounts. To put it in perspective, it took a mere fraction of that number to cause Gamestop’s (NASDAQ:GME) stock to skyrocket 4000%:

The story of how Discord came to be fits in to the narrative the company finds itself. It’s probably not likely that the app’s creators realized it would have such a profound effect on society for good or ill. In March of 2020 the company changed their motto from “Chat for Gamers” to “Chat for Communities and Friends” and added server templates for types of communities. This was in response to the massive influx of users: So many people had to stay at home due to CV19 orders.

The pandemic could be the primary catalyst in drawing so much retail investment interest into Discord communities.

So Are Investors Really On Discord?

The answer is yes. According to discord.me, there are 498 ‘Financial’ servers, 422 ‘Investing’ servers and 927 servers related to ‘Business’. Each of these Discord channels avoids the term Meme Stock for the most part, but it’s undeniable they are being used to possibly pump up securities in a similar manner as Gamestop (NASDAQ:GME). Not to mention, advertisers are no doubt paying shady promoters and ‘bots’ to push their clients. Discord really got into the public eye after the meme stock craze subsided and those with a legal background started to weigh in.

Meme Stock Investigation by Texas AG

Texas Attorney General Ken Paxton launched an investigation into Discord, Robinhood, and others.

“Today, I’m launching an investigation into @RobinhoodApp, @discord and hedgefunds who rigged our free market for the benefit of Wall St elites. The US econ should be transparent, open. This week’s coordinated corruption bya cabal of olgarchs shows it isn’t. I’ll help fix that.” tweeted a fiery Paxton.

Yeehaw!

In the investigation, Paxton claimed Discord prevented or limited access to the Reddit community r/WallStreetBets’s Discord server. Paxton continued by saying:

“Wall Street corporations cannot limit public access to the free market, nor should they censor discussion surrounding it, particularly for their own benefit. This apparent coordination between hedge funds, trading platforms, and web servers to shut down threats to their market dominance is shockingly unprecedented and wrong. It stinks of corruption,” Paxton said. “I’m hopeful that these companies will step up and cooperate with these CIDs in order to clear any confusion over why stock purchases were forcibly closed and why even conversation around these stocks was silenced.”

So what does this mean for me as a retail investor?

The bottom line is this: Take everything you read with a grain of salt outside of what your financial advisor tells you. Just like the 20th century saw an explosion in new investors entering a market previously reserved for the elites, it also saw a massive rise in investment fraud.

Not much is different today. There is only more technology, faster turnaround, and some funnier images.

Featured Image From of ©DepositPhotos