Over the past ten years, the semiconductor industry has produced some of the biggest market winners including,

Nvidia

NVDA

, Advanced Micro Devices (AMD),

and

Broadcom

AVGO

.

However, the industry is going through a contraction period, and many former leaders are now becoming laggards.

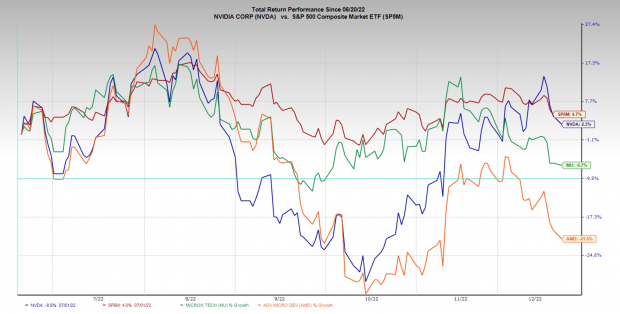

Image Source: Zacks Investment Research

Pictured: The big name semiconductors are beginning to lag.

In the semiconductor space, there could be many reasons for such a weak period, including:

1.

Macroeconomic factors:

A slowing economy can lead to weakening demand.

2.

Supply chain issues:

In 2022, supply chain issues caused higher input costs for some semis,

3.

China Lockdowns:

Lockdowns in China have led to weakened global demand and production issues.

Overall, the industry is subject to various factors that can impact performance. Investors can get a clearer picture of what stocks are leading and which are lagging by looking at the Zacks Ranking, consulting a chart, and sizing up the performance of the stock relative to the group.

Laggards:

Micron

MU

:

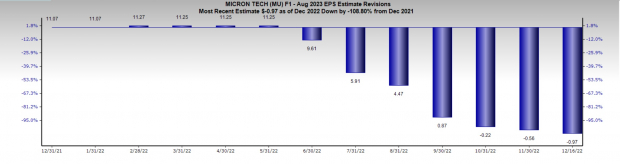

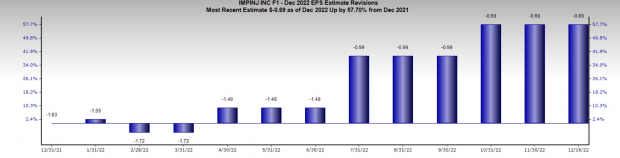

After several quarters of double-digit earnings and sales growth, the semiconductor memory solutions provider saw a big slowdown in growth. Last quarter, Micron reported -40% EPS growth on -20% revenue growth. Financial results were negatively impacted by weakening consumer demand and significant inventory adjustments across all end markets. Recent EPS Estimate Revisions continue to be dropped lower, and consensus estimates anticipate the company will lose money in 2023. Micron holds a lowly Zacks Ranking of 4 and is part of the Semiconductor Memory Industry Group which is ranked in the bottom 4% of all groups tracked by Zacks. The company is set to report earnings Wednesday.

Image Source: Zacks Investment Research

Pictured: Recent earnings revisions have trended downward.

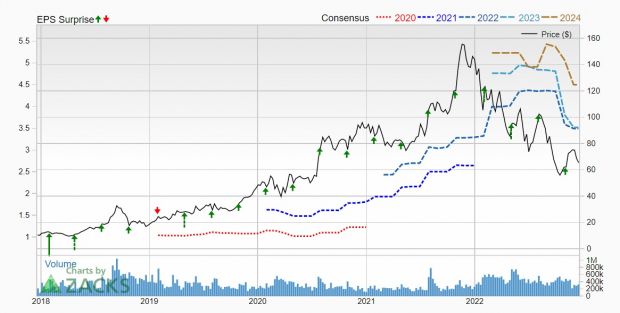

Advanced Micro Devices (AMD)

is a provider of microprocessors, media, and graphics chip sets on a similar path to Micron. In the most recent report, AMD saw its first EPS slowdown in 12 quarters. The stock holds a Zacks Rank of 3 and is stuck in a multi-month downtrend. AMD is part of the Zack’s Electronics – Semiconductors Group, which is ranked 175 out of 248. On the recent earnings call CEO Lisa Su confirmed the soft environment by saying, “Third quarter results came in below our expectations due to the softening PC market and Substantial inventory reduction actions across the PC supply chain”.

Image Source: Zacks Investment Research

Pictured: AMD’s multi-year growth phase has come to an end and the stock has suffered as a result.

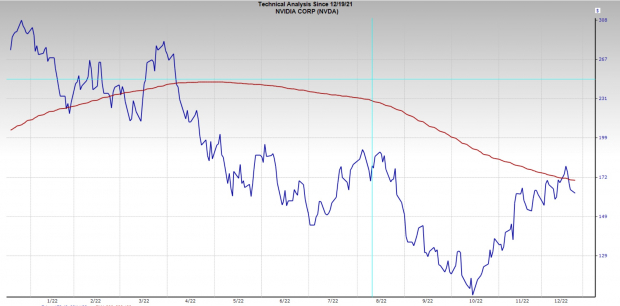

Nvidia (NVDA)

is a producer of visual computing technologies, and GPUs has unquestionably been the leader in the semiconductor industry in recent years. However, eventually, all companies succumb to higher and higher expectations – at least in the short term. While NVDA has outperformed Micron and AMD from a price-performance perspective, earnings have been disappointing. The last two quarters showed NVDA’s EPS growth slowing by 50%. NVDA currently has a Zacks ranking of 4 and failed at its 200-day moving average.

Image Source: Zacks Investment Research

Pictured: NVDA bumped its head on the 200-day moving average and failed.

Leaders:

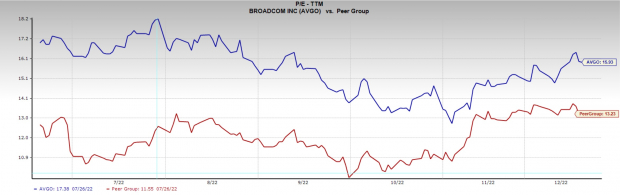

Broadcom (AVGO)

isa premier designer, developer, and global supplier of a broad range of semiconductor devices. Recently AVGO reported fourth-quarter fiscal non-GAAP earnings of $10.45 per share, beating the Zacks Consensus Estimates and improving 33.8% year over year. AVGO also reported strong top-line performance, growing full-year revenues by 25.9%. Unlike the laggards mentioned above, AVGO sees strong, and consistent top and bottom-line growth, and the stock is above its 200-day moving average. Broadcom is growing at a healthier pace than its peer group, but also remains attractive on a valuation basis. Broadcom’s P/E for the trailing 12 months is 15.93, roughly in line with the 13.23 P/E for its peer group.

Image Source: Zacks Investment Research

Pictured: AVGO has a good combination of growth and value.

Impinj (PI)

is a provider of referral and information network radio frequency identification solutions to retail, pharmaceutical, healthcare, food, beverage other industries. Unlike most semiconductor companies, Impinj’s technology is not primarily used in computers. Companies such as

Delta Airlines (

DAL

),

use its tiny RFID tag technology to track items (in Delta’s case, it is used to track luggage and ensure it does not get lost. Impinj holds a Zack’s Ranking of 2 and is pulling into its 50-day moving average. The stock has drastically outperformed its peer group over the past year.

Image Source: Zacks Investment Research

Pictured: Recent EPS revisions for PI have skyrocketed as demand for its unique product offering increases.

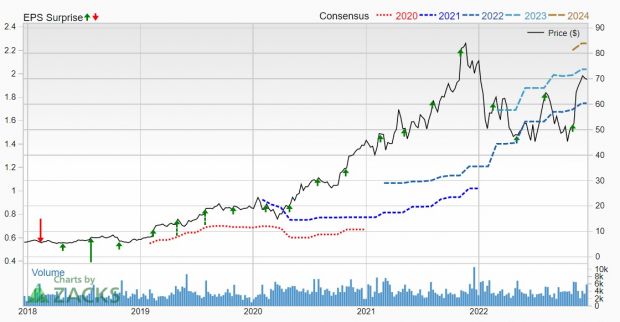

Lattice Semiconductor

LSCC

designs, develops, and markets high-performance programmable logic devices and related system software. Lattice’s chip technology focuses on Artificial Intelligence, a segment that is expected to see tremendous growth in the coming years. Applications for the technology include smart homes, cars, and factories. While AI is still in its infancy, the company is already producing impressive growth. EPS has grown at an impressive clip of more than 60% for three straight quarters. While LSCC holds a mediocre Zack’s Ranking of 3, it makes up for it with its ability to consistently produce upside surprises on earnings.

Image Source: Zacks Investment Research

Pictured: LSCC has consitently beat EPS estimates and the stock has benefitted as a result.

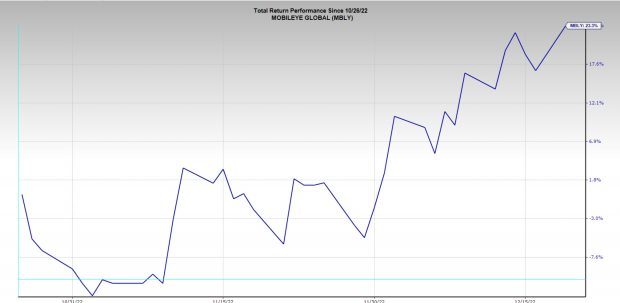

Mobileye Global Inc

MBLY

isthe most recent stock to go public in the semiconductor space. Mobileye’s technology looks to prevent automotive accidents, one of the leading causes of death in the United States each year. The Israel-based company has been in business for more than 20 years and is gaining momentum by inking partnerships with several leading automakers, including

General Motors

GM

, Toyota Motor (TM),

and

Nio Inc

NIO

.

The company is at the forefront of autonomous driving technology. Though MBLY is extended in price, the new issue has shown tremendous relative strength in a weak market for IPOs.

Image Source: Zacks Investment Research

Pictured: Despite a rough market environment, MBLY has provided strong outperformance.

Conclusion

For now, the semiconductor industry is a tale of the “haves” and “have-nots”. Newer, innovative companies are taking the baton from older industry stalwarts. Investors should gravitate toward companies with solid growth, expectations, and relative price strength.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report