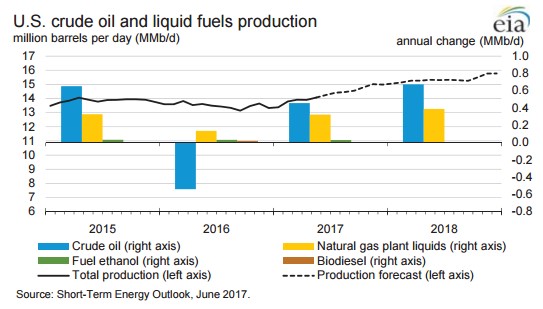

According to the U.S Energy Information Administration, the United States will break a 47-year record in 2018 as shale production continues to recover from global industry deterioration. The EIA has stated that there will be a 7.2% output growth next year.

In November of 1970, the United States reached their highest monthly output ever, which was 10,044 MBOPD. The most recent month that the EIA could provide data for was March, which showed that output in March 2017 was 9,098 MBOPD. Oil output has steadily been on the rise since September.

Oil prices are only going up from here

The majority of United States shale producers are satisfied with oil prices sitting at $50/bbl, but there are a number of producers who are planning momentous growth in the coming year. According to the EIA, this growth will lead the United States past its previous records in 2018. They have predicted that output will average roughly 10.01 MMBOPD next year, which means individual months are very likely to surpass the record made in 1970.

All in all, in 2017, oil production is expected to grow by 5.2% and 7.2% in 2018. That said, due to recent activity, the EIA has modified their initial oil production forecast by 0.3% in 2017 and 0.4% in 2018.

If, however, you want to start energy investing and you’re set on natural gas, you should be aware that natural gas output does not look as promising as oil output. The EIA has revised its production estimates for 2017 and 2018 by roughly 1% each this month. Current predictions for 2017 and 2018 production sit at 73.3 Bcf/d and 76.6 Bcf/d. These predictions suggest that output will grow by roughly 1.4% in 2017 and 4.5% in 2018.

Commodity prices will maintain stability

Over the next two years, commodities prices are thought to remain rather stable, only increasing marginally. According to the EIA, West Texas Intermediate is expected to remain at around $50/bbl throughout 2018, then it will rise marginally. The EIA has forecasted that prices of natural gas will be at $3.50/MMBTU in the winter of 2017 and the prices will be very similar in the winter of 2018-2019. In the third quarter of 2017, gas prices are predicted to be at around $3.20/MMBTU. That said, the EIA has stated that it is likely that there will be higher prices in the summer of 2018, with $3.30/MMBTU predicted.

Featured Image: twitter.com