There’s One Junior Minor Perfectly Positioned To Become America’s LONE Major Vanadium Producer.

You may not have heard of vanadium before. It’s OK, most investors haven’t. Vanadium has flown under the average investor’s radar, but that hasn’t stopped its price from surging by 300% since 2017, making it the best performing battery metal of the year. With most investors still unaware of what vanadium is, or what it can do, there’s definitely room for this trend to continue.

Vanadium’s Price Has Increased 300% Since 2017

Steel And Rebar Demand Is Off The Charts

Vanadium use is increasing every day thanks to applications in the trillion-dollar infrastructure and construction industries. In China, a recent increase in regulations regarding the reinforcement of steel rebar has increased demand across the globe. According to The Northern Miner[1], the vanadium price jump reflects these higher standards and the Chinese government’s newfound interest in enforcing these rules.

According to CRU International[2], the Chinese government is expected to increase its enforcement of existing regulations as well, which could cause a demand spike.

“CRU expects Chinese demand for vanadium in the steelmaking sector to increase by 18% in 2018 and 14% in 2019, adding 12,000 tonnes and equivalent to 14% of the total vanadium market size.” – Willis Thomas, CRU International

One vanadium company that’s targeting this potential billion-dollar market is United Battery Metals (OTC:UBMCF) (CSE:UBM). This vanadium explorer has the unique opportunity to become the first mover in the North American vanadium space; a key advantage on a continent with ZERO vanadium production.

America Needs, But Doesn’t Have Vanadium

China currently holds all the keys to production, accounting for over 50% of the total global supply. The United States currently imports 100% of its vanadium, and what little production it has comes from recycling.

America is 100% reliant on other vanadium-producing countries for this critical mineral. But with China (currently embroiled in an escalating trade war with the United States) as the world’s largest producer, and Russia as the second largest, there is nothing short of a supply-side nightmare for the United States.

Despite this critical situation, very few companies inside the United States are capable of reaching domestic production. Of all the possible miners, United Battery Metals (OTC:UBMCF) (CSE:UBM) appear to have the upper hand in becoming America’s lone vanadium produce.

Vanadium is crucial to the US for its domestic steel production which has been burgeoning since the current Trump administration was elected. With U.S. Steel and other major steel companies opening new plants and reopening previously closed plants nationwide, once again the American steel industry is flourishing – and the nation’s producers will require a serious amount of vanadium to strengthen their products. A recent executive order by Trump recognized vanadium as one of 35 minerals deemed critical to both the economic and national security of the U.S. As the trade war with China intensifies, its crucial for America to secure a domestic supply of vanadium and focus on putting mines into production. The United States has no choice but to begin domestic production and with our current administration, the red tape for companies like United Battery metals to get their resources into production will be expedited.

A Head Start in the Race to Become America’s Lone Vanadium Producer

So what makes United Battery Metals (OTC:UBMCF) (CSE:UBM) a favorite to win the domestic production race?

Three words: Location. Location. Location.

Located in Montrose County, Colorado, USA, United Battery Metals’ (OTC:UBMCF) (CSE:UBM) Wray Mesa project offers a promising land package consisting of 152 contiguous claims spanning over 3,000 acres of property, including assets in both Colorado and Utah. Wray Mesa’s resource has been estimated using 715 historical and 15 recent drill holes cut on the property. According to the 43-101 conducted in 2013[3], Wray Mesa has an estimated resource of 2.64 million pounds of vanadium (based on a conservative V:U ratio of 6:1).

United Battery Metals’ (OTC:UBMCF) (CSE:UBM) Wray Mesa project also offers unique logistical advantages that separate it from the pack. Municipal water access is a mere six miles away; a highly optimal situation for the company. Wray Mesa also allows for dry drilling techniques, which will reduce the need to pump water, another big advantage over its competitors

On the west side of the basin, United Battery Metals (OTC:UBMCF) (CSE:UBM) also has a much shorter route to the White Mesa Mill, the only fully-licensed mill in the United States capable of processing uranium-vanadium.

Wray Mesa is a vanadium miner’s dream location. The area has a rich history of vanadium exploration and production efforts dating back all the way to the 1940s, including hundreds of tiny ‘mom-and-pop’ vanadium mining operations. This mining interest, combined with the uranium in the area, has resulted in 739 existing drill holes, putting Wray Mesa on the radar of the world’s top vanadium geologists.

According to a 2013 Technical Report, these claims have an estimated resource of 2.6 million pounds of vanadium and an additional 436,000 pounds of uranium.

Having recently concluded private placements and warrant issuances worth $2.1 million, United Battery Metals is now sufficiently equipped to quickly move forward with its efforts toward production, with drilling planned to begin before the end of the year. As United Battery Metals (OTC:UBMCF) (CSE:UBM) moves forward with its drilling program, positive test results could draw attention to this unique vanadium producer.

UBM Believes Vanadium is the Super Metal of the Future

Why is United Battery Metals (OTC:UBMCF) (CSE:UBM) so bullish on vanadium?

There are many reasons that China and the United States are fighting over vanadium. In fact, one special attribute of this super metal could change the future of both countries infrastructure forever. Adding just a small amount of vanadium to steel can double its strength while simultaneously lightening the weight of the resulting alloy.

In China, which consumes half of all the world’s steel, government-instituted construction standards have limited the use of inferior steels in the industry[5]. The country has unveiled an unprecedented $900 billion infrastructure initiative to create a New Silk Road, a project that could require significant amounts of vanadium to build.

In The United States, The American Society of Civil Engineers has suggested that as much as 50% of the country’s bridges and tunnels need to be replaced[6] and estimates a startling $123 billion backlog in bridge rehabilitation alone. Vanadium-reinforced steel is almost certainly a necessity here, and potential domestic producers such as United Battery Metals (OTC:UBMCF) (CSE:UBM) could stand to benefit.

Your future car is also almost guaranteed to be built using vanadium. It is estimated that by 2025, 85% of all automobiles will use vanadium alloy, reducing their weight and increasing fuel efficiency. This is driven by both the market and regulation. Consumers want more fuel-efficient vehicles, and regulators such as the EPA have been setting increasingly-strict fuel economy standards. This is a big positive for the prospects of vanadium companies like United Battery Metals (OTC:UBMCF) (CSE:UBM), who are optimally positioned to meet American demand.

The continued adoption of EVs could put significant pressure on the electric storage industry, where new technologies such as the vanadium redox battery offer a unique solution to charging woes. VRB’s can be used in providing EV’s with a “power station” to recharge vehicles. The way gas stations have been an intricate part of US automotive history, so will the new EV charging stations using VRBs to store their power in a battery that can discharge power to 50 cars at a time simultaneously.

But there’s one more application of vanadium that has the potential to really send demand through the roof.

Vanadium Redox Batteries – Revolutionizing the Energy Storage Market

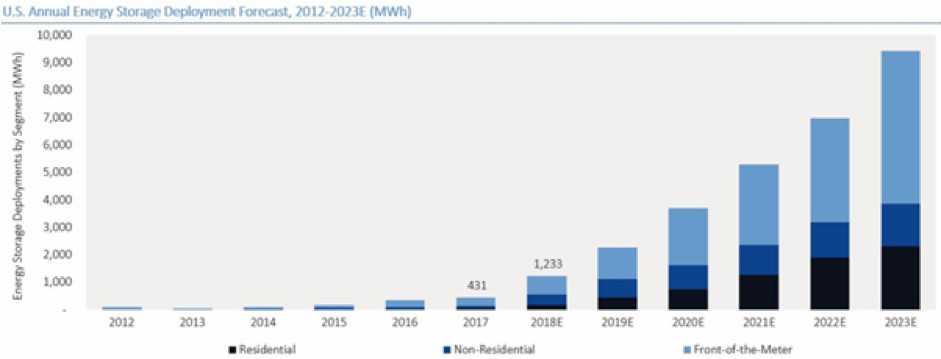

Experts are unanimous: sustainable energy is the future. The American energy storage market could reach $2.5 billion USD by 2020, according to McKinsey[7]. As nations move towards reducing emissions and embrace more sustainable energy sources, battery systems could play a large role in distributing and storing energy. While lithium-ion batteries are currently used to power everything from vehicles to homes, they do not appear to be the best solution for large-scale energy storage.

The vanadium redox battery (VRB) is a promising new technology that threatens to displace lithium’s dominance in the fast-growing energy storage market for a few key reasons:

- VRBs can charge and discharge simultaneously

- VRBs never lose capacity – they actually increase capacity over time

- VRBs have a battery life of over 20 years

- VRBs have a higher battery density compared to lithium-ion batteries

Because of these advantages (coupled with their large size), VRBs are ideal for storing large amounts of energy, particularly wind and solar energy.

California has recently announced that all homes and mid-rises by 2020 will be required to install solar panels. It is here that VRB’s can play a part. The ability to store power from the low usage periods and then spill it back into the grid at peak demand periods makes VRBs a far more superior choice for large-scale energy storage than lithium-ion batteries. Experts predict that it is just a matter of time that this law that implemented by California will inevitably be adopted nationwide. Laws such as this will make vanadium demand soar, and it will be crucial for the US to have a domestic source of this most valuable resource

Here’s what mining legend Robert Friedland, member of the Canadian Mining Hall of Fame, had to say about vanadium redox batteries:

As the world pivots even further toward renewable energy, companies such as United Battery Metals (OTC:UBMCF) (CSE:UBM) could become critical players in the energy storage industry. In China, energy giants such as Rongke Power have already begun building massive VRBs to aid in peak load shifting to provide backup power to important facilities like hospitals and data centers[10].

UBM Has Assembled a Team of Legendary Geologists With Proven Track Records

United Battery Metals (OTC:UBMCF) (CSE:UBM) has built an experienced management team comprising of professional geologists with solid track records in the resource and mining industries including:

President and CEO, Matthew Rhoades – A former State Geologist for New Mexico with 35 years experience, Rhoades has direct working experience in Wray Mesa. Between 2010 and 2015 Rhoades operated as the principal geologist at WorleyParsons, a resource and energy consultancy with a market cap of $5.59 billion AUD. Complementing Rhoades’ geological expertise is his long history working in the La Sal Creek District, giving him a familiarity with the area and the expertise needed to lead this project.

Director, Anthony Kovschak – Wray Mesa expert Anthony Kovschak is a professional geologist with over 40 years experience focusing on rare earth discoveries such as uranium. Having previously made direct discoveries in Wray Mesa, his familiarity and experience working in the Wray Mesa “UraVan” belt are invaluable assets to the team.

Director, John Read – A geologist with over 30 years experience in precious metals mining and exploration, John Read brings valuable experience in managing exploration programs. During his time at Newmont Mining, a $16.35 billion USD company, Read managed exploration programs in Nevada, Alaska, and the Yukon Territory. Read also directed the prospecting activity that led to the discovery of the El Gallo silver deposit, and is a Qualified Person under NI 43-101 standards.

Advisor, Eric Saderholm – An advisor and professional geologist with almost 3 decades of experience in the minerals industry. Saderholm has a long track record of success, having been a part of teams that added millions of ounces of gold to reserve bases in Nevada, Washington, and Peru. Saderholm spent 12 years working at Newmont Mining Corp, where his final position was Carlin Trend Exploration Manager, Regional Geologist. Saderholm also worked with Newmont Mining as Chief Geologist on the Phoenix Mine, Lone Tree Complex, and Mule Canyon Mines.

Vanadium Already Has Many Impressive Success Stories

With increasing use in the construction, automotive, and energy storage industries, market dynamics could be looking positive for vanadium companies. Over the past year, global vanadium companies have seen huge stock price gains of well over 100%; with some as high as 400%!

Yet despite these strong performances, none of these companies are focused on North America. United Battery Metals (OTC:UBMCF) (CSE:UBM) is the only one, and it has seen its own stock appreciate by a massive 143% over the past year.

Western Uranium & Vanadium Corp (CSE:WUC)

Market Cap: $59.1 million

A mining corporation specializing in uranium and vanadium assets, Western Uranium owns projects located in both Colorado and Utah. The company first acquired assets from Energy Fuels Inc. in 2014, and have since acquired additional properties through the purchase of Black Range Minerals Limited in 2015. Western Uranium’s stock appreciated 453% this year alone.

Largo Resources Ltd (TSX:LGO)

Market Cap: $1.18 billion

A near pure play vanadium producer, Largo Resources’ primary project is the Maracás Menchen Mine in Bahia State, Brazil. Over the past year, investors have seen their investment appreciate by 180%.

Bushveld Minerals Ltd (LN-AIM:BMN)

Market Cap: $387.5 million

A London-listed vanadium producer with assets in Southern Africa and Madagascar that aims to become a vertically-integrated vanadium company. Over the past year, investors have seen their investment appreciate by 198%.

Despite delivering such huge gains to early investors, the vanadium industry has yet to spark its own battery revolution, much like lithium-ion batteries did for lithium. Once vanadium’s public profile is raised, companies such as United Battery Metals (OTC:UBMCF) (CSE:UBM) could stand to benefit.

5 Reasons For Investors To Keep An Eye On United Battery Metals (OTC:UBMCF) (CSE:UBM)

- 1

Wray Mesa Is A Miner’s Dream Scenario: United Battery Metals’ (OTC:UBMCF) (CSE:UBM) Wray Mesa project is located above a significant resource, with historical drill estimates inferring an estimated resource of 2.64 million pounds of vanadium according to a 43-101 conducted in 2013. With access to municipal water, an experienced workforce, and a sizeable land package, the Wray Mesa project is a dream scenario for a junior mining company. The project even allows for dry drilling and is optimally set up for an underground mine configuration.

- 2

UBM has the First Mover Advantage in the United States: Donald Trump and the U.S. government have deemed vanadium critical to the United States’ economy and national security. With China and Russia in control of the world’s vanadium supply, and no current domestic vanadium mines in operation, the United States desperately needs a domestic producer. The first-mover in the American vanadium industry could greatly benefit from this domestic supply shortage, and United Battery Metals (OTC:UBMCF) (CSE:UBM) appears to be on track to become America’s lone vanadium producer.

- 3

Infrastructure and Steel Reinforcement Continue to Drive Vanadium Demand: China’s massive $900 billion Belt and Road Initiative, coupled with increased construction standards, could continue to drive vanadium demand. Ailing infrastructure in the United States is another potential future demand driver. Half of America’s bridge infrastructure is in need of replacement, which could greatly benefit a domestic vanadium producer such as United Battery Metals (OTC:UBMCF) (CSE:UBM) that is capable of meeting domestic demand. In the automotive industry, vanadium-reinforced steel in car bodies could provide another catalyst for the growth of vanadium.

- 4

Vanadium Redox Batteries Could be the De Facto Energy Storage Solution of the Future: Renewable energy and electric vehicles are the future. Vanadium redox batteries, with their ability to charge and discharge simultaneously, give them the edge for large-scale energy storage solutions. As demand for renewable energy and energy storage systems continues to rise, vanadium redox batteries have the potential to begin a new battery revolution. The mass adoption of VRBs could greatly benefit vanadium producers such as United Battery Metals (OTC:UBMCF) (CSE:UBM) who are capable of producing large amounts of the super metal.

- 5

An All-Star Team Of Geological Experts: The United Battery Metals (OTC:UBMCF) (CSE:UBM) team is comprised of expert geologists with proven track records of resource discovery and development. CEO Matthew Rhoades has over 30 years of experience as a professional geologist, working with billion dollar companies as a consultant and geological expert. Director Anthony Kovschak is a Wray Mesa expert, having made previous discoveries in the area.

[1] https://soundcloud.com/northern-miner/episode-87-moly-vanadium-free-trade-ft-maclean-engineering#t=10:03

[2] https://www.crugroup.com/knowledge-and-insights/insights/2018/a-price-spike-with-staying-power-a-look-into-the-vanadium-market/

[3] http://ubmetals.com/docs/Wray-Mesa-43-101-Report-29July2013_TA.pdf

[4] http://ubmetals.com/docs/Wray-Mesa-43-101-Report-29July2013_TA.pdf

[5] https://roskill.com/news/vanadium-new-chinese-rebar-standards-positive-ferrovanadium-demand/

[6] https://www.infrastructurereportcard.org/

[7] https://www.mckinsey.com/business-functions/sustainability-and-resource-productivity/our-insights/the-new-economics-of-energy-storage

[8] http://www.northernminer.com/people-in-mining/robert-friedland-celebrating-lifetime-achievement/1003785716/

[9] https://globenewswire.com/news-release/2017/11/01/1172376/0/en/Pu-Neng-Wins-Contract-for-the-Largest-Vanadium-Flow-Battery-in-China-as-the-China-National-Development-and-Reform-Commission-Initiates-a-Major-Push-for-Energy-Storage-in-Support-of.html

[10] http://www.rongkepower.com/Product/show/catid/175/id/103/lang/en.html