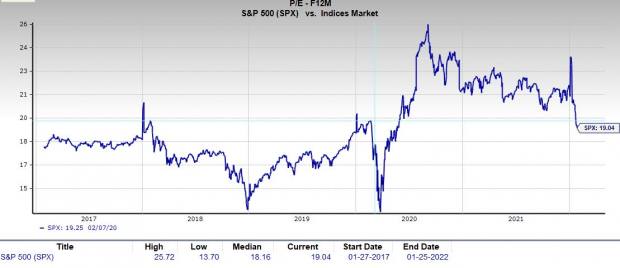

The S&P 500 and the Nasdaq last week posted their worst performances since the pandemic began. The benchmark index is officially in correction territory (down 10% or more from its highs) and the tech-heavy Nasdaq is down around 16%.

Both indexes are currently trading beneath their 200-day moving averages for the first time since the initial covid selloff. And the downturn to start 2022 has hit nearly every corner of the market.

Thankfully, the substantial and lightning-quick selloff has already significantly recalibrated valuations. And countless growth names, as well as some large-cap giants have seen nearly all of their pandemic gains washed away.

There could be more selling, and stocks fell in afternoon trading Wednesday, after climbing most of the day. The downturn came after the Federal Reserve signaled its plans to raise short-term interest rates as soon as mid-March. Stocks then popped Thursday morning amid mountains of earnings data and stronger-than-expected economic growth.

Even with rising interest rates causing market jitters, they will have to climb a lot higher before investors start to park their money outside of equities. And it’s worth constantly reminding ourselves that the outlook for S&P 500 revenue and earnings are strong for 2022 and 2023, with margins historically high.

With this backdrop in mind, we dive into two strong stocks that also pay a dividend that investors might want to consider buying heading into earnings.

Image Source: Zacks Investment Research

AbbVie

ABBV

–

Q4 Financial Results Due

Wednesday, Feb. 2

AbbVie is prepared for a bright future even as patent protections run out for one of the world’s best-selling drugs, Humira—biosimilars are available outside of the U.S., with domestic competition to start in 2023. AbbVie readied itself for a post-Humira world, in part, through its $63 billion acquisition of Allergan in May 2020.

ABBV’s deal brought Botox and other popular drugs into a diversified medicine cabinet that includes immunology, oncology, neuroscience, a strong R&D pipeline, and much more. CEO Richard Gonzalez said last year that it’s “on the cusp of potential commercial approvals for more than a dozen new products or indications over the next two years–including five expected approvals in 2021.”

ABBV’s FY20 revenue surged 38%, driven by its Allergan deal. Most recently, it beat our Q3 estimates and raised its full-year guidance. Zacks estimates call for the firm’s 2021 revenue to surge 23%, with FY22 set to climb another 6.4% higher to $60 billion, as the YoY comparisons normalize. Meanwhile, its adjusted earnings are projected to jump 20% and 11%, respectively.

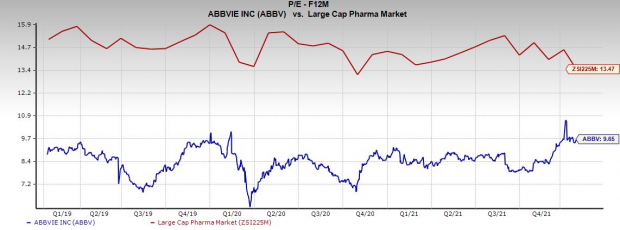

AbbVie lands a Zacks Rank #3 (Hold) at the moment and it’s seen its FY22 consensus estimate climb recently. ABBV also sports “B” grades for Value and Momentum and an “A” for Growth in our Style Score system. Plus, Wall Street is high on the stock, with nine of the 13 brokerage recommendations Zacks has at “Strong Buys,” with nothing below a “Hold.”

Image Source: Zacks Investment Research

Alongside its solid outlook, the firm continues to ramp up its dividend payment at impressive clips, including an 8.5% raise for 2022. It has now raised its dividend by 250% since its inception in 2013 and its current 4.2% yield crushes its industry’s 2.5% average and the 10-year U.S. Treasury’s 1.8%. This payout could help boost any diversified portfolio and provide some nice protection from inflation.

The dividend yield is even better since ABBV shares are up 127% in the past five years vs. Large-Cap Pharma’s 65%. The stock is also up 33% in the last year and 25% in the past three months. In fact, Abbie is currently trading near its highs as Wall Street clamors for safety amid all the market turmoil.

Even though it’s trading right near its all-time records, AbbVie trades at a 10% discount to its own year-long highs at 9.7X forward 12-month earnings, which also represents 30% value compared to its industry. AbbVie’s valuation and strong dividend payout are a few of the reasons Warren Buffett’s Berkshire Hathaway own ABBV in its portfolio.

Ford Motor Company

F

–

Q4 Financial Results Due

Thursday, Feb. 3

Ford is the nation’s No. 2 automaker by sales and its F-Series was the best-selling vehicle for the 40

th

straight year in 2021. More importantly, especially where Wall Street is concerned, Ford was the No. 2 overall electric vehicle seller last year, behind only Tesla

TSLA

. Ford’s EVs grew 36% faster than the segment as a whole, and it’s just getting started.

Ford rolled out an EV version of its famous Mustang in late 2020. The Mach-E, which is more of a crossover that competes against Tesla’s small SUVs, was named the “Electric Vehicle of the Year” by Car and Driver. Plus, it announced in early January that roughly 200K reservations have been placed for its all-electric F-150 Lightning. And it plans to nearly double its Lightning manufacturing target to over 150K a year—deliveries start this spring.

Ford will boost its EV appeal and relationships through its array of commercial customers from contractors to police departments. Its commercial business is set to bring in more recurring revenue as companies pay to monitor their connected fleets and upgrade software. Ford is prepared to launch an EV line of its best-selling commercial vans soon, and it has teased plans to sell EV Explorers and the Lincoln Aviators.

Image Source: Zacks Investment Research

Ford is investing over $30 billion in EVs through 2025 and it plans to cement its place as the No. 2 EV maker in North America and “then challenge the No. 1 spot” (from Tesla). These efforts crucially include major investments in battery technology and manufacturing. The company said it will have the global capacity to produce 600K battery EVs annually within the next two years.

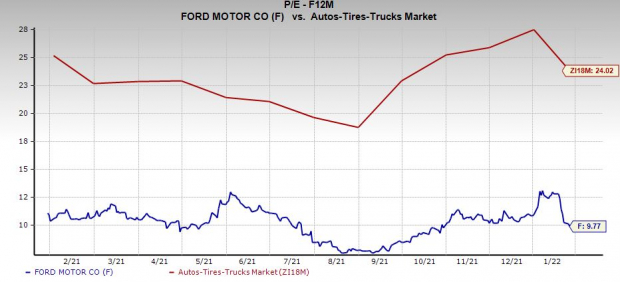

Ford shares have climbed 80% in the last 12 months to blow away its industry and the S&P 500. The stock surpassed its 2018 levels last year, but it still trades far below the $30 a share levels of the late 1990s. Ford is down 20% from its mid-January highs. The drop has it trading at a discount to its year-long median at 9.8X forward 12-month earnings. Ford also reinstated its dividend after a pandemic pause, with its 2% yield above the recently-climbing 10-year U.S. Treasury.

Zacks estimates call for Ford’s adjusted FY21 earnings to soar 346% to $1.83 a share on nearly 8% higher revenue. Peeking ahead, its FY22 earnings are projected to climb another 10.5% on 18.5% better sales that would see it pull within striking distance of its pre-pandemic total.

Ford’s consensus EPS outlook has improved since its last report, with some strong revisions for FY22 recently. The bottom-line positivity helps Ford grab a Zacks Rank #1 (Strong Buy) right now, alongside its overall “A” VGM grade.

Ford has destroyed our bottom-line estimates by an average of 355% in the trailing four periods. And investors should be pleased to know that even with all of the hype, EVs made up around 3% of all vehicle sales in 2021, which means there is still plenty of time to get in near the ground floor.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report