Edge computing is a distributed computing architecture that relocates processing and data storage near data sources. The speed of 5G, combined with edge computing, further reduces the latency to support use cases, wherein near-real-time processing is critical.

The edge computing industry is being shaped by several trends. With the rise of the Internet of Things (IoT), and the increasing need for greater data processing and analytics, the demand for edge computing is growing.

According to a

report

by Grand View Research, the global edge computing industry is expected to attain a value of $11.24 billion by the end of 2022, and grow, witnessing a compound annual growth rate (CAGR) of 38.9% from 2022 through 2030, reaching a value of $155.90 billion at the end of the forecast period.

This is driving companies such as

Arista Networks

ANET

and

Cloudflare

NET

to adopt edge solutions to better manage their data, reduce latency and improve overall user experience. With the rising demand for edge computing solutions, investors are pouring money into the space.

Edge computing use cases are expanding, as businesses look for new ways to leverage the technology. Because 5G creates a bigger, faster medium to carry data, it can deliver the ultra-low latency required for many applications, including the widespread deployment of autonomous vehicles, advanced healthcare services such as remote telesurgery and the metaverse.

Edge Computing Players Leading the Way to Growth

Some of the top companies leading the global edge computing industry are

Microsoft Corporation

MSFT

,

Alphabet

GOOGL

and

NVIDIA

NVDA

. These are well-positioned to benefit from the secular tailwinds in the enterprise software and edge computing space.

Microsoft has a large and diverse portfolio of products and services, from cloud computing and machine learning to artificial intelligence and IoT. This gives the company a unique advantage in the edge computing market, as it can offer customers a comprehensive solution that covers all their needs. Azure Edge Zones provide customers with secure, low-latency networks that help them optimize their edge computing performance.

Alphabet is an industry leader in edge computing, allowing businesses to leverage the power of cloud computing, while maintaining control of their data. The company is investing heavily in edge computing solutions, such as its Google Distributed Cloud Platform, to help businesses reduce latency and increase efficiency.

NVIDIA is at the forefront of the edge computing market. The company is a leading provider of edge computing hardware and chips. NVDA’s edge computing solutions leverage its graphic processing units to enable organizations to process large amounts of data quickly and efficiently. The NVIDIA EGX platform is designed to bring AI, machine learning and other advanced analytics to the edge. The platform can be used in a wide range of applications, including autonomous vehicles, factory automation and smart cities.

Our Picks

Given the above-mentioned positives, we have picked two tech stocks that offer solid investment opportunities and are well-poised to grow in 2023. Each company sports a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) and has a positive earnings estimate revision. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

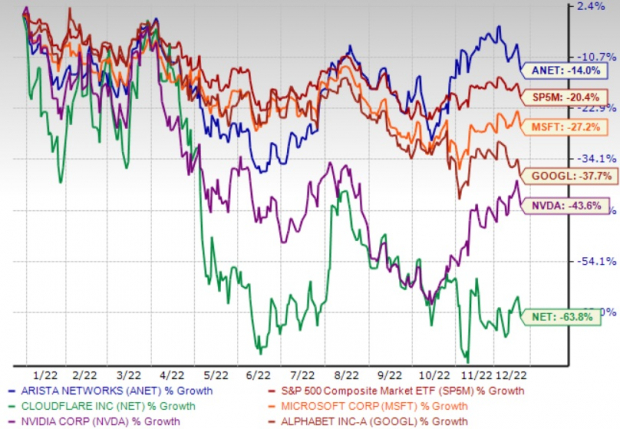

Year-to-Date Performance

Image Source: Zacks Investment Research

Arista Networks

is engaged in providing cloud networking solutions for data centers and cloud computing environments. The company offers 10/25/40/50/100 Gigabit Ethernet switches and routers optimized for next-generation data center networks. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. It is well-poised for growth in the data-driven cloud networking market with its proactive platforms and predictive operations.

ANET’s edge computing solutions are designed to help customers reduce latency, increase network performance and improve security. Arista announced unified edge innovations across wired and wireless networks for its Cognitive Campus Edge portfolio for Enterprise Workspaces. It presented an enterprise-grade Software-as-a-Service offering for the flagship CloudVision platform. The company also introduced several additions to its multi-cloud and cloud-native software product family with CloudEOS Edge, which are expected to drive demand in 2023.

This Zacks Rank #1 company expects continued growth within its enterprise vertical in the forthcoming quarters, with customer mix being the key driver. The Zacks Consensus Estimate for the company’s 2023 earnings has been revised upward by 0.6% to $5.19 per share, indicating growth of 18.6% from the year-ago reported figure.

Cloudflare

is an internet services company that provides a range of services, including cloud computing, cybersecurity and edge computing. The company’s integrated cloud-based security solution helps secure a range of combinations of platforms, including public cloud, private cloud, on-premise, software-as-a-service applications and IoT devices worldwide.

NET’s security products comprise cloud firewall, bot management, distributed denial of service, IoT, SSL/TLS, secure origin connection and rate limiting products. Cloudflare offers performance solutions, which include content delivery and intelligent routing, as well as content, mobile and image optimization solutions. NET provides reliability solutions, comprising load balancing, anycast network, virtual backbone, DNS, DNS resolver, and online and virtual waiting room solutions.

Increasing demand for the Zacks Rank #2 company’s cloud-based solutions from new large customers (annual billings of more than $100,000) is expected to boost its top-line growth in 2023.

The Zacks Consensus Estimate for the company’s 2023 earnings is has been unchanged at 15 cents per share, indicating year-over-year growth of 33.6%.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report