Finding companies and areas of the economy that will see growth in 2023 might be challenging. Now is a good time to search for stocks that will be winners in December and in 2023.

The Business Services sector offers opportunities, particularly in the Outsourcing Industry which is currently in the top 13% of all Zacks Industries.

Let’s take a look at three of these highly-ranked stocks for investors to consider buying as we head into the new year.

Automatic Data Processing

ADP

Sporting a Zacks Rank #2 (Buy) Automatic Data Processing is worthy of consideration in the top-rated Outsourcing industry. Earnings estimate revisions have risen over the last quarter for the cloud-based human capital management company.

ADP’s technology solutions include payroll, talent management, human resources and benefits administration, and time and attendance management.

Earnings are now expected to climb 16% in the company’s current FY23. Fiscal 2024 EPS is expected to pop another 12% at $9.09 per share. On the top line, sales are projected to be up 9% in FY23 and rise another 7% in FY24 to $19.23 billion.

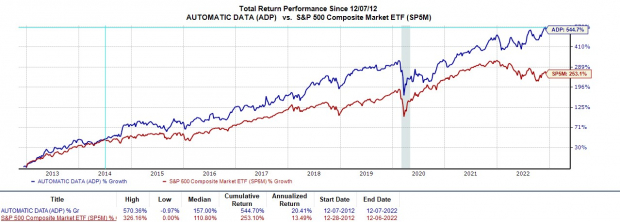

Automatic Data Processing stock is up +5% YTD to outperform the S&P 500’s -18% and its Outsourcing Markets -5%. Looking at the last decade, ADP is up an impressive +545% when including its dividend to also beat the benchmark and its Zacks subindustry’s +328%.

Image Source: Zacks Investment Research

Trading around $258 per share, ADP trades at 31.8X forward earnings. This is above the industry average of 14.9X but ADP is a proven industry leader. ADP shares also trade 13% below its decade high of 36.4X and closer to the median of 27.6X.

Plus, Automatic Data Processing is a dividend aristocrat, raising its dividend for at least 25 consecutive years. ADP currently has a solid 1.57% annual dividend yield at $4.16 a share.

Barret Business Services

BBSI

Barret Business Services (BBSI) is the highest-ranked stock on the list with a Zacks Rank #1 (Strong Buy). Barret provides light industrial, clerical and technical employees to a variety of businesses through staff leasing, contract staffing, site management, and temporary staffing arrangements.

Earnings estimate revisions are noticeably up over the last 90 days for FY22 and FY23.

This year’s earnings are now expected to climb 31% at $6.55 per share compared to $6.30 a share last quarter. FY23 earnings are forecasted to jump another 10%. Sales are projected to rise 12% this year and another 9% in FY23 to $8.09 billion.

BBSI stock has climbed an impressive +42% YTD to blast the benchmark and the Outsourcing Markets -5%. Over the last decade, BBSI’s total return is +217% to slightly underperform the benchmark’s +253% and lag its Zacks Subindustry’s +328%.

However, BBSI trades at just 14.9X forward earnings despite its impressive rallies this year. This is on par with the industry average and below the benchmark. Even better, BBSI trades at a 54% discount to its decade high of 32.8X and nicely below the median of 15.4X.

Image Source: Zacks Investment Research

BBSI recently hit 52-week highs and currently trades around $96 a share. Higher highs look like a possibility with BBSI shares still appearing to be fairly valued and even somewhat of a discount. The average Zacks Price Target offers 16% upside. Plus, BBSI offers a respectable 1.23% annual dividend yield at $1.20 per share.

Brink’s

BCO

To round out the Business Services list, Brink’s (BCO) stock is worth a look. Brinks is well known for its international transportation of valuables which includes cash management, secure route-based logistics, and payment solutions.

Brinks is down -12% YTD to edge the benchmark but lag the Outsourcing Markets -5%. BCO’s total return over the decade is +129% which is behind the broader market and its Zack Subindustry’s +336%.

However, with earnings estimates rising BCO lands a Zacks Rank #2 (Buy) and could see more movement to the upside. This year’s earnings are expected to climb 17% with FY23 projected to jump another 15% to $6.42 per share.

FY22 earnings revisions have remained the same over the last quarter but FY23 EPS estimates have risen 7% over the last 90 days. Sales are now forecasted to rise 7% this year and jump another 8% in FY23 to $4.87 billion.

Brink’s valuation also stands out at just 10.3X forward earnings. This is lower than the industry average of 14.9X and 68% beneath its decade high of 32.3X. BCO also trades at a 45% discount to its decade median of 18X.

Image Source: Zacks Investment Research

Brinks sports an “A” Style Scores grade for Value and its overall VGM grade is an “A” as well. BCO stock is 20% from its highs trading around $57 per share with the average Zacks Price Target suggesting 35% upside. BCO also offers a respectable 1.39% annual dividend yield at $0.80 per share.

Bottom Line

These Business Services stocks look impressively poised for growth heading into 2023 which could be a rarity for most companies. With an economic slowdown still looming in FY23 along with the possibility of at least a mild recession, these three stocks are viable options to outperform the market.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report