The New Year is rapidly approaching, with just a few trading days remaining on the calendar. After the market’s tantrum in 2022, investors are undoubtedly hoping that 2023 will be more generous.

Despite a poor performance in December, a historically strong month in the market, several mid-cap stocks are hot heading into the New Year, including Smartsheet Inc.

SMAR

, GDS Holdings

GDS

, and Exact Sciences Corp.

EXAS

.

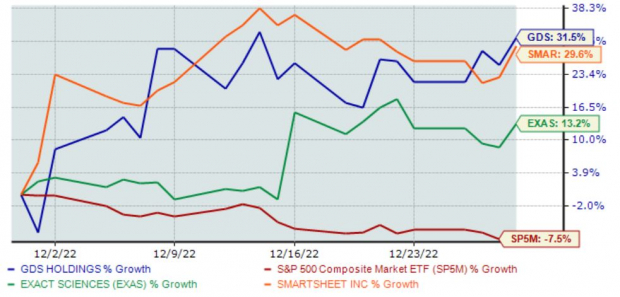

Below is a chart illustrating the December performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three stocks have snapped the overall bearish trend in December, providing investors with considerable gains. Let’s take a closer look at each one.

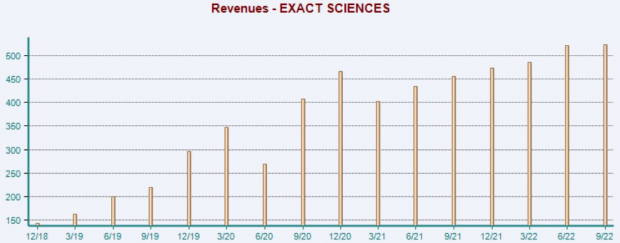

Exact Sciences Corp.

Exact Sciences is a molecular diagnostics company focused on the early detection and prevention of some of the deadliest forms of cancer. The company sports a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

EXAS posted strong quarterly results in its latest quarter, exceeding the Zacks Consensus EPS Estimate by more than 23% and posting revenue 4.4% above expectations. Impressively, it represented the company’s third consecutive quarter of exceeding both top and bottom line estimates.

Image Source: Zacks Investment Research

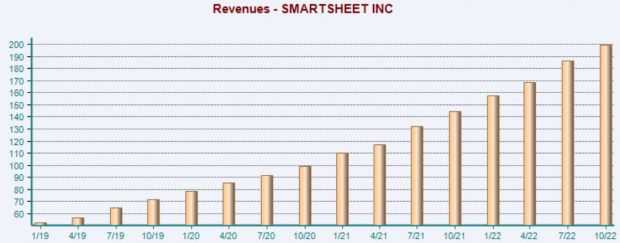

Smartsheet Inc.

Smartsheet provides a modern work management platform that assists companies of all sizes capture and track plans, resources, and schedules. SMAR’s earnings outlook has turned bright as of late, helping land the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Like EXAS, Smartsheet has posted impressive quarterly results as of late; the company has exceeded the Zacks Consensus EPS Estimate by at least 20% in nine of its last ten quarters. In its latest release, SMAR registered a sizable 93% EPS beat.

Image Source: Zacks Investment Research

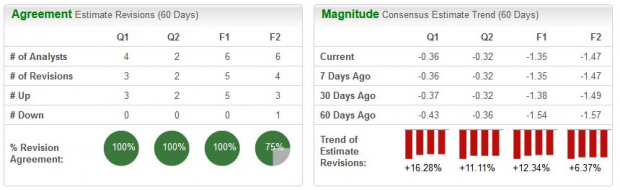

GDS Holdings

GDS Holdings is a leading developer and operator of high-performance data centers strategically located in China’s primary economic hubs. GDS boasts a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

In addition, valuation multiples aren’t stretched; the company’s forward price-to-sales ratio resides at 2.8X, well beneath the 8.2X five-year median and Zacks Business Services sector average.

GDS carries a Style Score of a “B” for Value.

Image Source: Zacks Investment Research

Bottom Line

2022 certainly wasn’t kind toward investors, with a hawkish Fed and geopolitical issues shaking the market to its core.

Still, despite the poor performance year-to-date, many investors remain confident there is plenty of upside for stocks in 2023.

And some are already hot heading into the New Year.

Three mid-caps, including Smartsheet Inc.

SMAR

, GDS Holdings

GDS

, and Exact Sciences Corp.

EXAS

, have all been hot in December, putting their relative strength on full display.

In addition, all three have witnessed favorable earnings estimate revisions as of late, indicating that their near-term business outlooks are positive.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report