The U.S. stock market witnessed its fair share of disappointment in 2022 due to high inflation rates, Fed’s monetary tightening measures with stern interest rate hikes, recessions fears, supply chain hiccups and geopolitical turmoil due to the Ukraine war. The resultant volatility has led to price fall for numerous stocks, creating lucrative investment opportunities.

The S&P 500, the Dow Jones Industrial Average and the Nasdaq Composite have declined 17.5%, 2.9% and 26.1%, respectively, in the year-to-date period. While severe macroeconomic challenges affected the markets, pent-up demand, higher savings during the pandemic and growing consumer spending have partially offset the negatives. Spending on travel and entertainment has significantly jumped with reduced COVID restrictions.

Right Time to Buy?

The market volatility has created the perfect window to buy growth stocks that fell significantly this year but has tremendous growth opportunity ahead. The market is expected to improve soon and early markers of recovery have already surfaced. Prudently choosing the stocks at a cheaper rate will generate above market average growth.

Here are three such stocks –

Zscaler, Inc.

ZS

,

DocuSign, Inc.

DOCU

and

Caesars Entertainment, Inc.

CZR

.

The Department of Labor showed that the consumer price index (CPI) data for November was encouraging. Although CPI and core CPI (excluding food and energy items) increased month over month and year over year, they were lower than the respective consensus estimates. The core CPI inflation came below the consensus marks for the last two months. Even though the decline is marginal, the peak inflation might be over, opines several analysts.

With a cooling inflation level on the horizon, the magnitude of the interest rate hikes is likely to decrease. Analysts expect the interest rate to be at 5.1% by the end of 2023, up from the current range of 4.25-4.5%. Also, Fed’s acts to bring down inflation have managed to not swell the unemployment rate. Instead, the unemployment rate remained stable over the past two months and lower than the year-ago period. This should boost market participants’ confidence going ahead.

The current interest rate environment is particularly nourishing for investment yields. Companies with robust interest rate-sensitive investment portfolios are bound to continue gaining.

Picking the Right Stocks

Growth stocks are fundamentally strong businesses that ensure solid portfolio returns. The Zacks

Growth Score

comes in handy while picking such stocks. Our research shows that stocks with a Growth Score of A or B when combined with a Zacks Rank #1 (Strong Buy) or 2 (Buy) offer good investment opportunities. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

We have taken the help of the

Zacks Stock Screener

to zero in on stocks that lost more than 30% in the year-to-date period, making them cheaper to own now and having a favorable Zacks Rank and Growth Score. Here are three solid bets for the coming year, each with a Zacks Rank #2 and a Growth Score A.

Zscaler:

Based in San Jose, CA, Zscaler is one of the world’s leading providers of cloud-based security solutions. Rising demand for security and networking products are buoying its results. Strategic acquisitions and alliances are boosting its capabilities and supporting product expansion. Zscaler boasts a strong balance sheet with ample liquidity and fewer debt obligations.

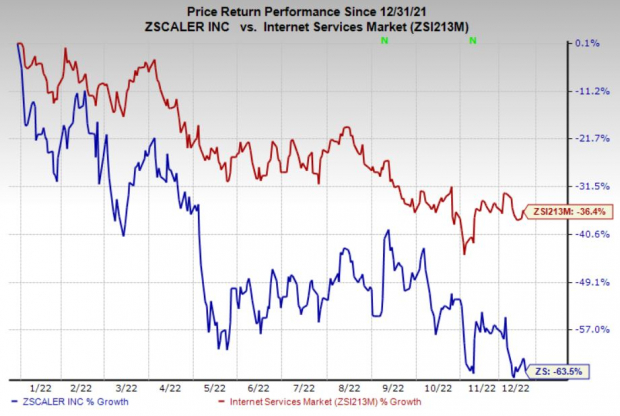

Shares of the company, with a $17.8-billion market cap, declined 63.5% in the year-to-date period compared with the

industry

’s decline of 36.4%. The company’s strong fundamentals are likely to help shares bounce back in the days ahead. The Zacks Consensus Estimate for ZS’ current year earnings per share indicates 78.3% year-over-year growth.

Image Source: Zacks Investment Research

Zscaler beat the Zacks Consensus Estimate for earnings in each of the last four quarters with average surprise of 27.3%.

DocuSign:

Headquartered in San Francisco, CA, DocuSign is a global provider of cloud-based software. Continued customer demand for eSignature keeps supporting its operations. International expansions, improving product offerings and client acquisitions are aiding its business. Higher subscriptions and professional services revenues will benefit its results.

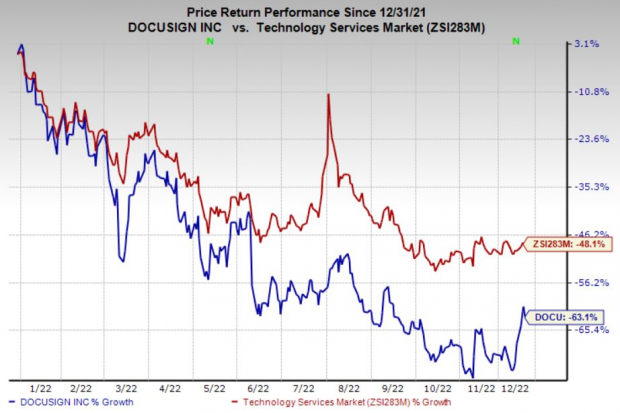

Shares of the company, with a $12-billion market cap, declined 63.1% in the year-to-date period compared with the

industry

’s decline of 48.1%. However, things are bound to improve going forward. The Zacks Consensus Estimate for DOCU’s current year earnings has improved 18.4% in the past 30 days. During this time, it witnessed seven upward estimate revisions against none in the opposite direction.

Image Source: Zacks Investment Research

DocuSign beat the Zacks Consensus Estimate for earnings in two of the last four quarters, met once and missed on the other occasion, with an average surprise of 6.6%.

Caesars Entertainment:

It is a diversified gaming and hospitality company based in Reno, NV. Pent-up demand and solid booking trends are aiding its business. Strong focus on partnerships, sports betting expansion and property development are expected to drive its long-term growth. Occupancy rate is expected to go up in the future as spending on travel and entertainment keeps rising.

Shares of the company, with a $10.7-billion market cap, declined 48.4% in the year-to-date period compared with the

industry

’s decline of 35.8%. This made the stock cheaper to buy now. The Zacks Consensus Estimate for CZR’s current year earnings has improved 6.4% in the past 60 days. During this time, it witnessed five upward estimate revisions against none in the opposite direction.

Image Source: Zacks Investment Research

Caesars Entertainment beat the Zacks Consensus Estimate for earnings twice in the last four quarters and missed on the other two occasions.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report