The last few days of price action within the market is very promising. Investors have undoubtedly welcomed the green with open arms, as the first half of the year has been anything but kind to portfolios.

Today, the market looks to record another solid day, with all major indexes heading for another close in the green. If the price action remains strong, it’ll be the S&P 500’s third weekly close in the green out of the last ten.

With some buyers finally arriving, bears will be forced back into hibernation. After all, they’ve had more than enough fun in the first half of 2022.

Of course, the bottom could still not be in, but we’re still well above 2022 lows – a major positive.

It’s critical that investors have high-quality stocks in their portfolios amid a rebounding market. A few market leaders that will help lead a rebound include Microsoft

MSFT

, Apple

AAPL

, and Adobe

ADBE

.

The five-year chart below shows just how well these companies have performed over the years, and there’s no glaring reason why they can’t continue this stellar long-term performance for some time.

Image Source: Zacks Investment Research

Now, for the ugly. The chart below illustrates the year-to-date share performance of all three companies.

Image Source: Zacks Investment Research

Clearly, it’s been a rough stretch. However, this market downturn has presented us with buying opportunities not seen in some time – something any long-term investor is surely celebrating.

Let’s get into why owning these stocks would be beneficial amid a market turnaround.

Adobe

Adobe

ADBE

is an American multinational computer software company headquartered in California.

Adobe’s forward earnings multiple sits on the pricey side at 34.9X but is well below its five-year median value of 45.6X and is nowhere near 2020 highs of 66.3X. Additionally, the value is the lowest we’ve seen since early 2019.

Image Source: Zacks Investment Research

The company has reported strong quarterly results consistently, exceeding bottom-line estimates in 14 consecutive quarters dating back to 2018. In Adobe’s latest quarter, the company beat the Zacks Consensus EPS Estimate by 1.5% and reported quarterly EPS of $3.35.

In addition to strong quarterly results, growth estimates for the top and bottom-line display the company’s successful business operations.

For FY22, the Zacks Consensus EPS Estimate resides at $13.51, resulting in a strong 8% growth in earnings year-over-year. Furthermore, in FY23, earnings are expected to tack on an additional double-digit 16%.

Image Source: Zacks Investment Research

Additionally, ADBE is forecasted to rake in $17.7 billion in revenue in the current fiscal year, which reflects a double-digit 12% expansion in the top-line year-over-year. Looking ahead, the FY23 revenue estimate of $20 billion represents an additional 14% growth in revenue.

Image Source: Zacks Investment Research

Apple

We’re all familiar with Apple

AAPL

, the tech titan that has taken the mobile phone landscape to new heights.

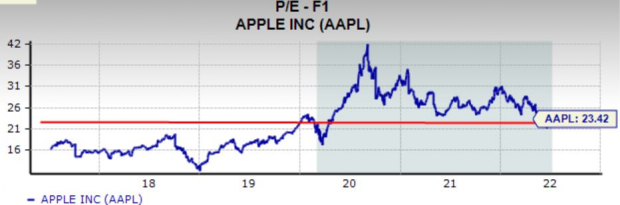

Apple’s current forward earnings multiple resides at 23.4X, nowhere near 2020 highs of 41.5X and modestly above its five-year median value of 20.5X. Furthermore, it’s the lowest we’ve seen the value since the early months of 2020.

Image Source: Zacks Investment Research

EPS beats have become the norm for the tech titan, exceeding bottom-line estimates in 19 of its last 20 quarterly reports. In the most recent quarter, the company surpassed the $1.43 Zacks Consensus Estimate by a notable 6.3% in the face of adverse business conditions.

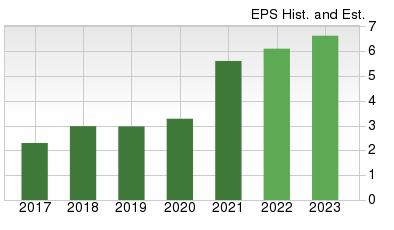

The Zacks Consensus EPS Estimate for FY22 resides at $6.10, reflecting a nearly 9% expansion in the bottom-line year-over-year. In addition, earnings are expected to grow an additional 8% in FY23.

Image Source: Zacks Investment Research

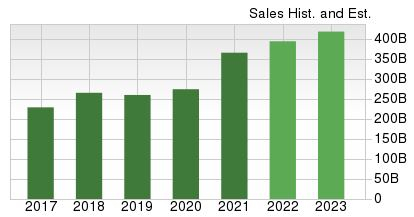

Revenue estimates reflect an expanding top-line for the current and next fiscal year. For the current fiscal year, revenue is forecasted to be a mighty $393 billion – notching a 7.6% growth in revenue year-over-year. The $417 billion estimate for the next fiscal year reflects a 6% growth in revenue year-over-year.

Image Source: Zacks Investment Research

Microsoft

Microsoft

MSFT

is one of the largest broad-based technology providers in the world.

MSFT sports relatively enticing valuation metrics. Its 25.2X forward earnings multiple resides on the pricey side, but it is well below its five-year median of 28.4X and well below its 2021 high of 37.5X. Shares trade at their cheapest level since early 2020.

Image Source: Zacks Investment Research

Microsoft has been on a scorching-hot earnings streak, exceeding bottom-line estimates in 24 consecutive quarters. In its latest quarterly release, the tech giant surpassed the Zacks Consensus EPS Estimate by a sizable 5.8%.

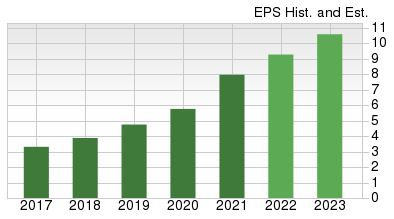

Looking at growth estimates, the $9.28 EPS estimate for the current fiscal year represents a strong double-digit 18% growth in earnings year-over-year. In addition, earnings are forecasted to grow a further 13% in the next fiscal year.

Image Source: Zacks Investment Research

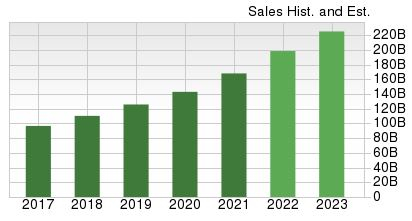

Annual revenue is estimated to come in at $198 billion in FY22, penciling in an 18% expansion in the top-line year-over-year. Pivoting to the next fiscal year, the $225 billion revenue estimate displays a 14% increase year-over-year.

Image Source: Zacks Investment Research

Bottom Line

The market will rebound eventually, and the recent streak of green over the last several days is promising. However, nobody knows where the market heads next, but we do know this – indexes are nicely above 2022 lows.

In the sea of red that has been 2022, we’ll take any green we can get.

These three proven long-time winners will continue to cruise along once the market shapes back up, allowing investors to reap a multitude of gains.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report