Inogen, Inc.

INGN

is well-poised for growth in the coming quarters, courtesy of its high prospects in the portable oxygen concentrator (POC) space. Solid performance in the third quarter of 2022 and a strong product portfolio also buoy optimism. Headwinds resulting from stiff competition and foreign exchange fluctuations are major downsides.

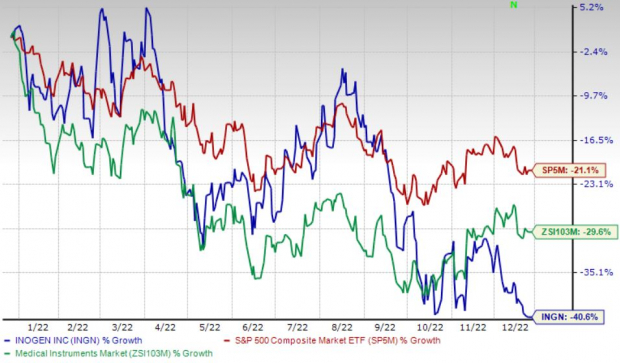

Over the past year, the Zacks Rank #3 (Hold) stock has lost 40.6% compared with the 29.7% decline of the

industry

and 21.1% fall of the S&P 500.

The renowned provider of POCs has a market capitalization of $456.6 million. The company projects 9.2% growth for 2023 and expects to witness continued improvements in its business. Inogen surpassed the Zacks Consensus Estimates in three of the trailing four quarters and missed the same in one, delivering an earnings surprise of 33.9%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

High Prospects in the POC Space:

We are optimistic about the POCs’ superiority over conventional oxygen therapy (known as the delivery model). POCs provide unlimited oxygen supply anywhere, thereby enhancing patient independence and mobility. Management at Inogen expects this to have an incremental positive impact on its industry and POC adoption.

Product Portfolio:

We are optimistic about Inogen’s expanding product portfolio. The company provides oxygen concentrator solutions for portable and stationary use. Notable products offered by the company include Inogen One G5 in the domestic business-to-business and direct-to-consumer channels, besides the Inogen One G3 and One G4 POC. Inogen At Home is aptly formulated for patients who need oxygen therapy during sleep.

Strong Q3 Results:

Inogen’s robust year-over-year uptick in overall, as well as rental and sales revenues in third-quarter 2022, buoy optimism. The strength in domestic business-to-business was encouraging. During the earnings call, management confirmed that it is making impressive progress against its subscriber strategy, which delivered strong growth and contributed to solid performance in the third quarter. This raises our optimism about the stock.

Downsides

Stiff Competition:

The long-term oxygen therapy (LTOT) market is a highly competitive industry. Inogen competes with a number of manufacturers and distributors of POC, as well as providers of other LTOT solutions such as home delivery of oxygen tanks or cylinders, stationary concentrators, transfilling concentrators and liquid oxygen. Given the relatively straightforward regulatory path in the oxygen therapy device manufacturing market, Inogen expects that the industry will become increasingly competitive in the future.

Forex Woes:

Inogen generates a significant portion of its revenues from the international market. Management expects international revenues to remain lumpy owing to the timing and size of the distributor. It also expects adverse foreign currency exchange rates to impede revenue growth in the near term owing to the strengthening of the U.S. dollar against the Euro and other foreign currencies.

Estimate Trend

Inogen has been witnessing a negative estimate revision trend for 2022. Over the past 90 days, the Zacks Consensus Estimate for its loss per share has widened from $1.77 to $1.85.

The Zacks Consensus Estimate for fourth-quarter 2022 revenues is pegged at $89.1 million, suggesting a 16.7% improvement from the year-ago reported number.

This compares to our fourth-quarter 2022 revenue estimate of $87.2 million, suggesting a 14.1% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are

Exact Sciences Corporation

EXAS

,

ShockWave Medical, Inc.

SWAV

and

Merit Medical Systems, Inc.

MMSI

.

Exact Sciences, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 27.5%. EXAS’ earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in one, the average beat being 0.6%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Exact Sciences has lost 31.3% compared with the

industry

’s 22.5% decline in the past year.

ShockWave Medical, carrying a Zacks Rank #2 at present, has an estimated growth rate of 22.2% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 146.1%.

ShockWave Medical has gained 18.2% against the industry’s 29.7% decline over the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 10.3% against the

industry

’s 11.9% decline over the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report