Veeva Systems Inc.

VEEV

is well poised for growth in the coming quarters, backed by a slew of strategic deals inked over the past few months. A robust first-quarter fiscal 2023 performance, along with increasing adoption of the company’s products, is expected to contribute further. Stiff competition and forex woes persist.

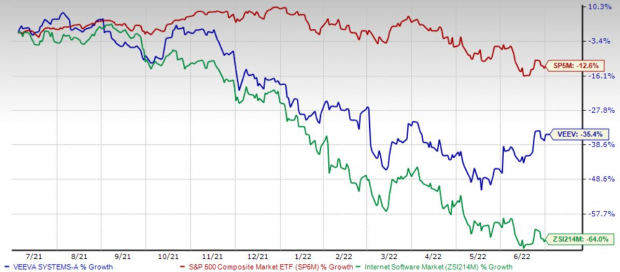

Over the past year, this Zacks Rank #3 (Hold) stock has lost 35.4% compared with 64.1% fall of the

industry

and 12.6% decline of the S&P 500 composite.

The renowned provider of cloud-based software applications and data solutions for the life sciences industry has a market capitalization of $31.61 billion. The company projects 17.2% growth for the next five years and expects to maintain its strong performance. It has delivered an earnings surprise of 7.4% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strategic Deals to Drive Growth:

Veeva Systems has entered into a slew of partnerships over the past few months, raising our optimism. In June, the company announced a collaboration with ANI Pharmaceuticals, Inc. to define and operationalize data-driven commercial strategies for the latter’s new Rare Disease business unit.

In April, Veeva Systems announced that it has expanded its partnership with LEO Pharma to drive relevant discussions within the scientific community using Veeva Link for Key People — a real-time intelligence application from the Veeva Link family of data products.

Increasing Product Adoption:

Veeva Systems has been registering robust adoption of its products over the past few months. The company, in May, announced that Lucid Diagnostics Inc. had selected Veeva Vault Clinical Data Management Suite to provide electronic data capture, coding and data cleaning in their upcoming study for EsoGuard.

The same month, Veeva Systems announced that AmplifyBio will be building a foundation for advanced quality, study execution and reporting with Veeva Vault Quality Suite.

Strong Q1 Results:

Veeva Systems’ solid first-quarter fiscal 2023 results buoy optimism. Both of its segments performed impressively during the quarter. The company continues to benefit from its flagship Vault platform, which is encouraging. Veeva Commercial Cloud’s continued strength looks impressive. Expansion of gross margin also bodes well.

Downsides

Forex Woes:

Veeva Systems derives a major share of its revenues from international operations. Some of its international agreements provide for payment denominated in local currencies and the majority of its local costs are also denominated in local currencies. Fluctuations in the value of the U.S. dollar versus foreign currencies may impact its operating results when converted into U.S. dollars.

Stiff Competition:

Veeva Systems operate in a highly competitive market. In new sales cycles within the company’s largest product categories, it competes with other cloud-based solutions from providers that make applications inclined toward the life sciences industry. The company’s Commercial Cloud and Veeva Vault application suites also compete to replace client-server-based legacy solutions offered by large companies and other smaller application providers.

Estimate Trend

Veeva Systems is witnessing a positive estimate revision trend for 2022. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 2.9% north to $4.14.

The Zacks Consensus Estimate for the company’s second-quarter fiscal 2023 revenues is pegged at $530.8 million, suggesting a 16.5% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are

AMN Healthcare Services, Inc.

AMN

,

Patterson Companies, Inc.

PDCO

and

Masimo Corporation

MASI

.

AMN Healthcare, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 1.1%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 15.6%.

You can see

the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has gained 18.2% against the

industry

’s 47.8% fall in the past year.

Patterson Companies, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 9.6%. PDCO’s earnings surpassed estimates in all the trailing four quarters, the average beat being 16.5%.

Patterson Companies has gained 0.7% against the

industry

’s 10.1% fall over the past year.

Masimo, carrying a Zacks Rank #2 at present, has an earnings yield of 3.4% against the industry’s negative yield. MASI’s earnings surpassed estimates in the trailing four quarters, the average beat being 4.4%.

Masimo has lost 46.1% compared with the

industry

’s 24.9% fall over the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report