Over the last several years, a strategy that has gained popularity within the market is stock splits. Generally, a company performs a stock split for two reasons – the stock price has become too expensive, causing a barrier to entry for potential investors, and the company is looking to boost liquidity within its shares.

Of course, a stock split doesn’t affect a company’s market capitalization. However, it lowers the value of each individual share, providing ease for the stock price to multiply once again and provide investors with sizable gains. Additionally, volume increases with a lower share price, boosting overall share movement.

Several companies have upcoming stock splits – Alphabet

GOOGL

, Amazon

AMZN

, and Nintendo

NTDOY

. Both Amazon and Alphabet will perform a 20-for-1 stock split, while Nintendo plans to conduct a 10-for-1 stock split.

All three companies aim to boost liquidity and lower the price tags of their shares, a positive move that investors of all three companies can look forward to in all the gloom and doom that has been 2022. Let’s take a magnified view of all three companies to see where they currently stand.

Nintendo

Nintendo

NTDOY

is responsible for many legendary franchises in interactive entertainment, including

The Legend of Zelda

,

Super Mario Brothers

,

Donkey Kong

, and

Pokémon

.

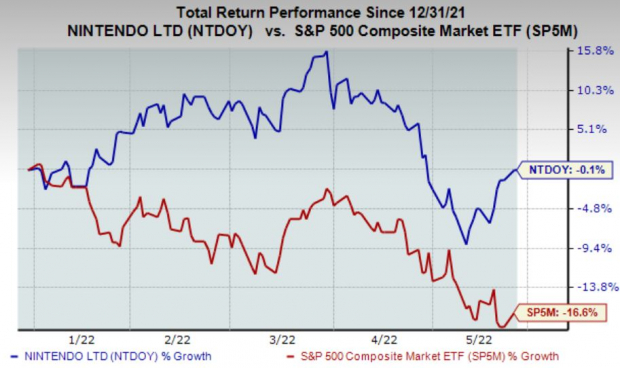

Year-to-date, Nintendo shares have been much stronger than the S&P 500, declining a marginal 0.1% and providing investors with a much-needed level of valuable defense.

Image Source: Zacks Investment Research

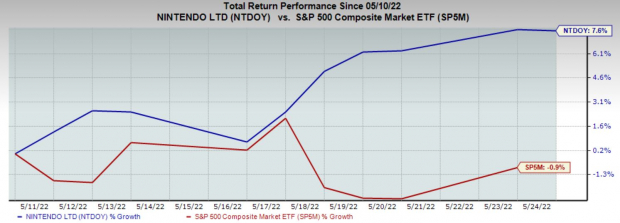

Additionally, since the split announcement on May 10

th

, shares have gained nearly 8% in value, displaying that the market has reacted well to the stock split announcement. In fact, almost all stock split announcements are generally seen as a bullish catalyst that sends shares upwards.

Image Source: Zacks Investment Research

Valuation metrics have come down to reasonable levels as well. NTDOY currently has a 15.8X forward earnings multiple, a fraction of its high of 45.3X in 2018 and well below the median of 20.5X over the last five years.

Affected by a slowdown in the pandemic-induced boom in gaming, NTDOY’s full current year earnings are forecasted to decline by a concerning 14%. However, the company smoked EPS estimates by a triple-digit 110% in its latest quarterly release. Additionally, the company sports a Style Score of A for Growth.

The 10-for-1 split will take effect later this year, on October 1st.

Alphabet

Alphabet

GOOGL

has evolved from primarily being a search engine into a company with operations in cloud computing, ad-based video and music streaming, autonomous vehicles, and more.

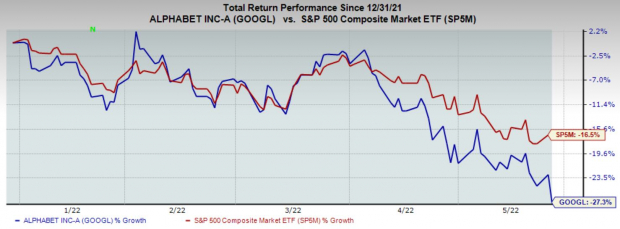

GOOGL shares have been hit hard throughout the tech-rout in 2022, down nearly 28% and vastly underperforming the general market.

Image Source: Zacks Investment Research

However, when the company announced the upcoming split in February, shares skyrocketed 7.5% the following day. Once again, it seems that market participants wholly welcomed the stock split – it’s no secret that GOOGL shares became pricey, limiting overall trading volume and steering away potential investors.

The adverse price action throughout 2022 has caused GOOGL’s forward earnings multiple to retrace down to 19.8X, well below 2020 highs of 39.1X and much lower than the median of 27.3X over the last five years.

In its latest quarter, to the surprise of many, GOOGL missed on EPS by nearly 5%. However, the company sports a Style Score of B for Value and a Style Score of A for Growth.

The 20-for-1 split goes into effect on July 15th.

Amazon

Amazon

AMZN

has evolved into an e-commerce giant with global operations. The company also enjoys a dominant position within the cloud computing space with its Amazon Web Services (AWS) operations.

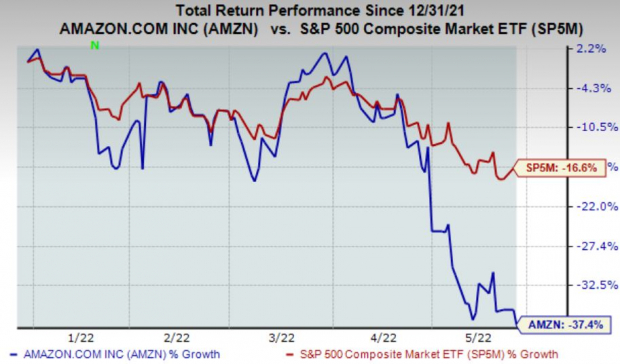

AMZN shares have had quite a fall from glory in 2022, declining nearly 40% and vastly underperforming the general market.

Image Source: Zacks Investment Research

Like NTDOY and GOOGL, the market reacted very well to the upcoming split, sending shares upwards by 6% the day following the announcement. The split came at a bit of a surprise – AMZN hasn’t split since 1999. Furthermore, like GOOGL, Amazon shares had become quite expensive, grinding down overall trading volume and steering away potential investors.

A less-than-ideal start to 2022 for Amazon shares has caused its forward price-to-sales ratio to decline down to 2.1X, nowhere near 2020 highs of 4.8X and well below the median of 3.3X over the last five years. Additionally, the current value represents a 41% discount relative to the S&P 500’s 4.1X forward price-to-sales ratio.

However, the outlook for AMZN has drastically shifted, and it will be worthwhile for investors to heed caution in this stock.

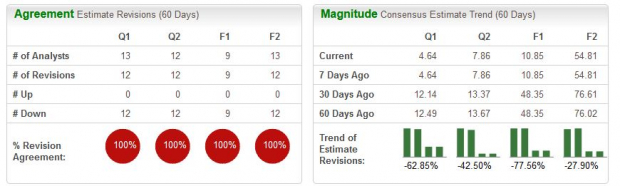

The company missed EPS expectations by a massive 52% in its latest quarter, sending shares on a steep downward trajectory following the report. Additionally, analysts have rapidly lowered their EPS estimates across the board, with current full-year earnings expected to decline a nasty 83% year-over-year.

Image Source: Zacks Investment Research

AMZN ranks as a Zacks Rank #5 (Strong Sell), which paints a depressing picture for AMZN shares moving forward in the near term. The one bullish catalyst I can find is the upcoming stock split, which occurs on June 3rd of this year.

Bottom Line

Stock splits are a positive announcement that should excite current and potential investors. With some of these once high-flying stocks, such as AMZN and GOOGL, share prices had gotten too expensive, causing potential investors to steer away and restricting overall volume.

With splits, liquidity within shares is increased. Additionally, it allows investors to reap considerable gains as the stock climbs back up.

Due to current market conditions and the updated outlook, I believe it is vital for investors to wait to buy AMZN shares – the company is a Zacks Rank #5 (Strong Sell). The time will come again for Amazon, but right now, the safer play is to stay on the sidelines.

For GOOGL and NTDOY, the outlook for shares is much more promising when paired with the upcoming splits.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report