It’s been a stellar week in the market. The S&P 500 is on track to record its third weekly close in the green out of the last six, undoubtedly a development that investors can celebrate amid a brutal first half.

Coming out of a once-in-a-lifetime pandemic has landed us in a highly unique economic spot. Soaring inflation paired with ongoing tensions in Ukraine have weighed heavily on stocks year-to-date.

Now that we’re finally seeing some green in beaten-down areas, a few companies that stand to lead the market’s rebound include some heavy-hitters, such as Apple

AAPL

, Adobe

ADBE

, and Advanced Micro Devices

AMD

.

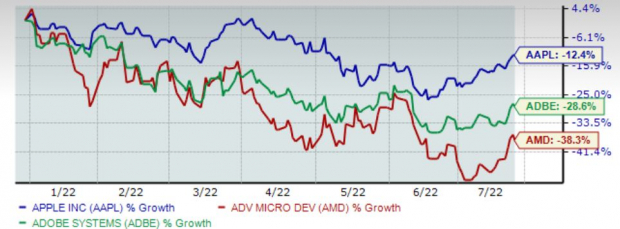

The chart below illustrates the share performance of all three companies year-to-date.

Image Source: Zacks Investment Research

As we can see, it’s been a brutal stretch for all three in 2022. However, things aren’t as bad as they look.

Over the last month, shares of all three companies have rallied hard, signaling that buyers have finally arrived and have started to push bears back into hibernation.

Image Source: Zacks Investment Research

Let’s get into why these three stocks would be excellent adds amid a rebounding market.

Advanced Micro Devices

Advanced Micro Devices’

AMD

share performance over the last decade is far more than stellar, up more than 2050% with an average annualized return of a mind-boggling 36%. Shares lagged the S&P 500 from 2013 to late 2016 but have since exploded.

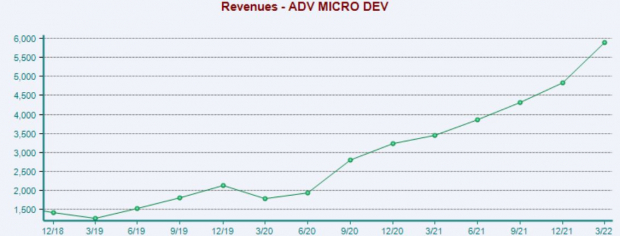

Image Source: Zacks Investment Research

AMD has been on a blazing hot earnings streak, impressively chaining together eight consecutive EPS beats. The company recorded a solid 25% double-digit bottom-line beat in its latest quarterly release.

Top-line results have been just as remarkable – the company has recorded ten consecutive quarterly revenue beats.

Image Source: Zacks Investment Research

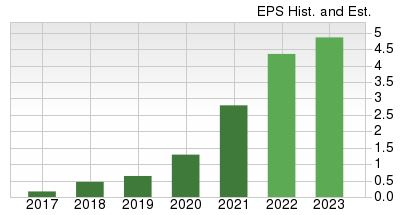

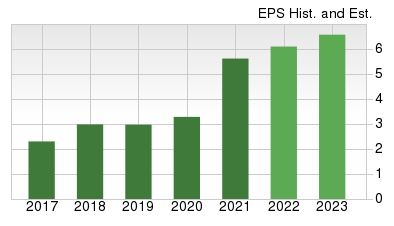

As displayed by top and bottom-line estimates, AMD is forecasted to grow at a breakneck pace.

The Zacks Consensus EPS Estimate for the current fiscal year (FY22) resides at $4.35, good enough for a sizable 56% double-digit expansion in the bottom-line year-over-year. The earnings growth doesn’t stop there – AMD’s bottom-line is projected to tack on an additional 12% in FY23.

Image Source: Zacks Investment Research

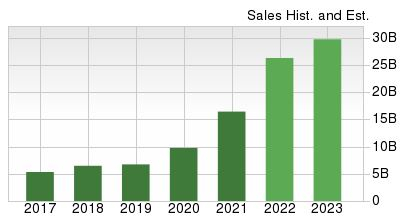

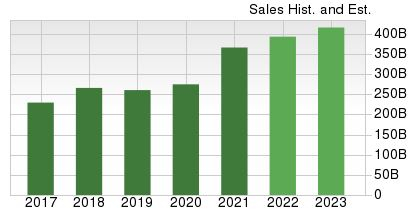

In addition, AMD is projected to rake in $26.3 billion in revenue for FY22, representing a stellar 60% uptick in annual sales year-over-year. Undoubtedly impressive, annual revenue is projected to grow by an additional 13% in FY23.

Image Source: Zacks Investment Research

Apple

Apple

AAPL

shares have been one of the best places for investors to park their cash over the last decade, up more than 750%. The company has absolutely revolutionized the mobile phone landscape.

Image Source: Zacks Investment Research

In addition, the tech titan has repeatedly reported bottom-line results above expectations, exceeding the Zacks Consensus EPS Estimate in 18 of its previous 20 quarters. In the company’s latest quarter, it posted a solid 6.3% bottom-line beat in the face of harsh business conditions.

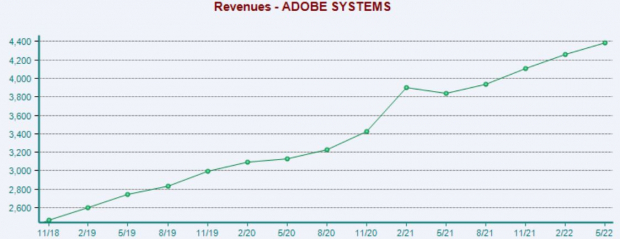

Top-line results have also been stellar; over Apple’s previous 20 quarters, the company has recorded 19 bottom-line beats. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Apple’s still growing at a rock-solid pace. For the current fiscal year (FY22), the Zacks Consensus EPS Estimate of $6.09 pencils in a notable 8.5% uptick in earnings year-over-year. Impressively, earnings are expected to tack on an additional 8% in FY23.

Image Source: Zacks Investment Research

Apple is projected to generate a mighty $393 billion revenue in FY22, notching a solid 7.4% expansion of the top-line year-over-year. In addition, annual revenue is projected to grow a further 6% in FY23.

Image Source: Zacks Investment Research

Adobe

Adobe

ADBE

shares are up a quad-digit 1160% over the last decade, with an average annualized return of an impressive 30%. The company is one of the largest software companies in the world.

Image Source: Zacks Investment Research

The company has been the definition of consistency in its bottom-line results, exceeding the Zacks Consensus EPS Estimate in 19 of its 20 previous quarters. In Adobe’s latest quarter, it recorded a 1.5% EPS beat.

Quarterly sales results have been just as robust, with Adobe recording 19 top-line beats over its previous 20 quarters.

Image Source: Zacks Investment Research

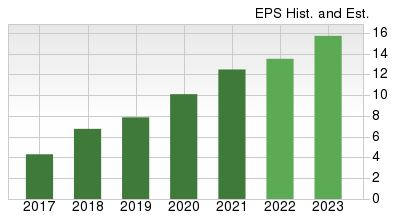

Top and bottom-line projections allude to rock-solid growth. For the current fiscal year (FY22), the Zacks Consensus EPS Estimate resides at $13.51, notching an 8% growth in the bottom-line year-over-year. In addition, the bottom-line is expected to expand a further double-digit 16% in FY23.

Image Source: Zacks Investment Research

Pivoting to the top line, the annual revenue estimate of $17.7 billion reflects a substantial 12% uptick in revenue year-over-year. In FY23, the top-line is projected to tack on an additional 14%.

Image Source: Zacks Investment Research

Bottom Line

While 2022 has undoubtedly been a rough time in the market, it’s given us an opportunity to buy high-quality companies at a discount. In addition, it seems that the bears are tiring out – all three companies’ shares above have rallied hard over the last month.

All three companies have had stellar long-term returns in the market, have serious growth potential, and are the definition of consistency within their quarterly results.

All three stocks would be excellent choices for investors looking to reap the rewards of a rebounding market.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report