The New Year has finally arrived, with investors remaining optimistic that 2023 can bring more prosperity.

Undoubtedly a positive, the beginning of 2023 looks much different than that of 2022; inflation is easing, the bulk of the Fed’s rate hikes are in the rearview mirror, and valuations have been slashed.

And perhaps to the surprise of some, several technology stocks have a bright outlook for the beginning of the New Year.

Three technology stocks – Jabil Inc.

JBL

, MongoDB

MDB

, and Arista Networks Inc.

ANET

– have all seen their near-term earnings outlooks improve over the last several months.

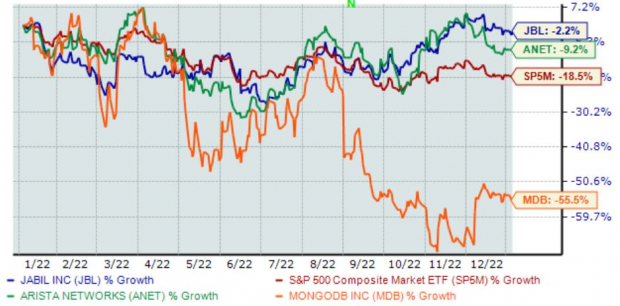

Below is a chart illustrating the performance of all three stocks over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

For those interested in technology stocks, let’s take a closer look at each one.

MongoDB

MongoDB provides a developer data platform that offers services and tools necessary to build distributed applications at a performance level and scale that users demand. MDB sports a Zacks Rank #2 (Buy).

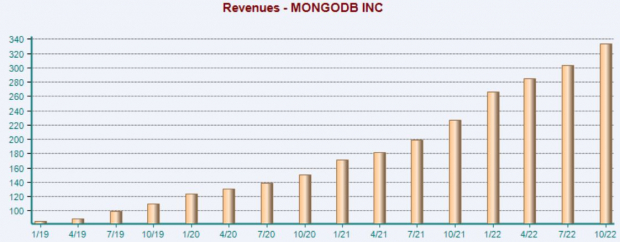

Image Source: Zacks Investment Research

MDB’s quarterly performance has been outstanding, exceeding earnings and revenue estimates in ten consecutive quarters. Just in its latest release, the company penciled in a sizable 235% EPS beat and reported revenue 10% above expectations.

Image Source: Zacks Investment Research

In addition, MDB carries a strong growth profile, with earnings forecasted to soar more than 150% in its current fiscal year (FY23) on top of 44% revenue growth.

And in FY24, earnings and revenue are forecasted to climb 100% and 24%, respectively.

Jabil Inc.

Jabil provides electronic manufacturing services and solutions to its customers. The company has witnessed positive earnings estimate revisions over the last several months, pushing the stock into a Zacks Rank #1 (Strong Buy).

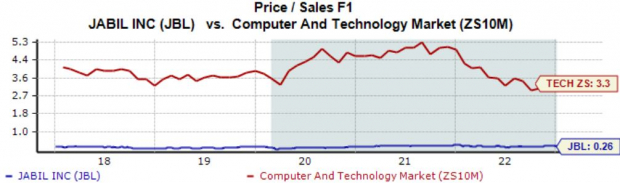

Image Source: Zacks Investment Research

Valuation multiples don’t appear stretched, further reinforced by its Style Score of “A” for Value.

JBL’s forward price-to-sales ratio currently stands at 0.3X, just a tick above its five-year median value and nowhere near its Zacks Computer and Technology sector average.

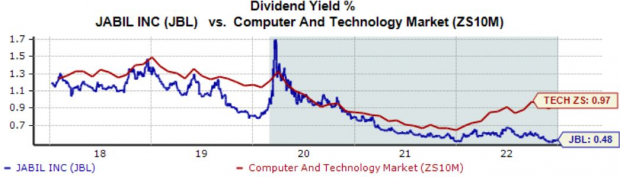

Image Source: Zacks Investment Research

And for the cherry on top, the stock pays a dividend, currently yielding a modest 0.5%. JBL carries a sustainable payout ratio sitting at 5% of its earnings.

Image Source: Zacks Investment Research

Arista Networks Inc.

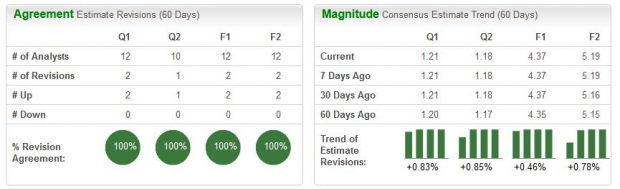

Arista Networks provides cloud networking solutions for data centers and cloud computing environments. Like the stocks above, ANET’s earnings outlook has recently improved, helping push it into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

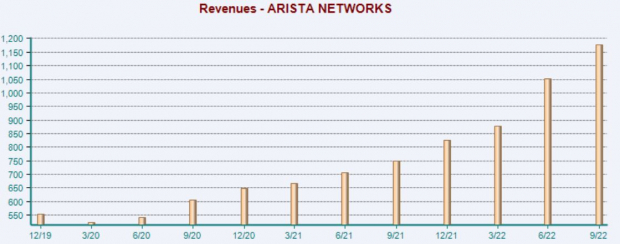

Exceeding quarterly estimates is the norm for the company; ANET has posted better-than-expected earnings and revenue results in 12 consecutive quarters. In its latest print, Arista Networks registered a nearly 20% EPS beat paired with an 11% sales surprise.

Image Source: Zacks Investment Research

Bottom Line

With investors flipping their calendars, hopes of a more prosperous year are undoubtedly widespread. A hawkish Federal Reserve, geopolitical issues, and lingering COVID-19 uncertainties shook the market to its core in 2022.

Of course, nobody has a magic crystal ball that tells us where we head from here.

But we do know that all three technology stocks above – Jabil Inc.

JBL

, MongoDB

MDB

, and Arista Networks Inc.

ANET

– have seen their near-term earnings outlook improve as of late.

For those interested in technology exposure paired with favorable business outlooks, all three deserve consideration.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report