The Fed’s tightening cycle has punished technology stocks in 2022. For example, the Zacks Computer and Technology sector is down more than 30% year-to-date, widely underperforming compared to the S&P 500.

Still, while many of these stocks have faced adverse price action, a few of them carry solid growth profiles, including Adobe

ADBE

, Broadcom

AVGO

, and Jabil

JBL

.

Below is a chart illustrating the performance of all three stocks in 2022, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Adobe

Adobe is one of the biggest software companies in the world, generating the bulk of its revenue via licensing fees from its customers.

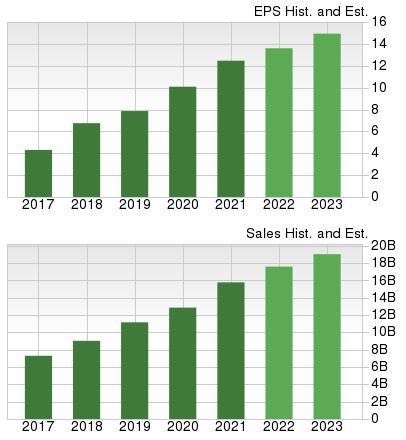

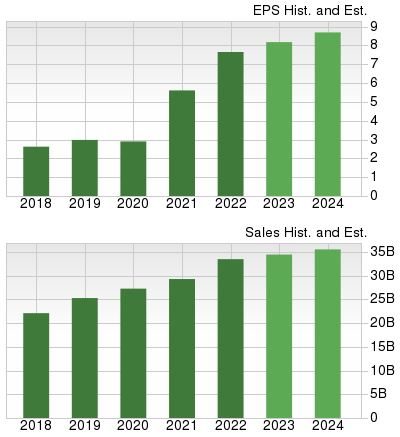

It’s hard to ignore ADBE’s growth trajectory; the company’s bottom line is forecasted to climb 11% in its current fiscal year (FY23) and a further 15% in FY24.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 9% in FY23 and 11.4% in FY24.

Image Source: Zacks Investment Research

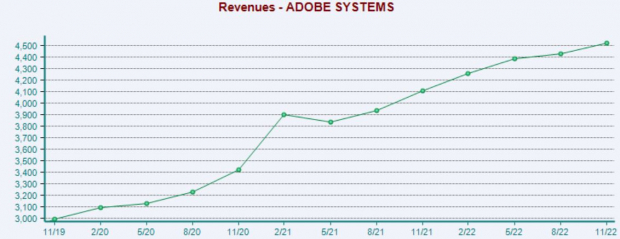

ADBE has a stellar earnings track record, exceeding earnings and revenue expectations in ten consecutive quarters. Just in its latest release, the company registered a 3% bottom line beat and reported sales marginally above expectations.

Image Source: Zacks Investment Research

Broadcom

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices.

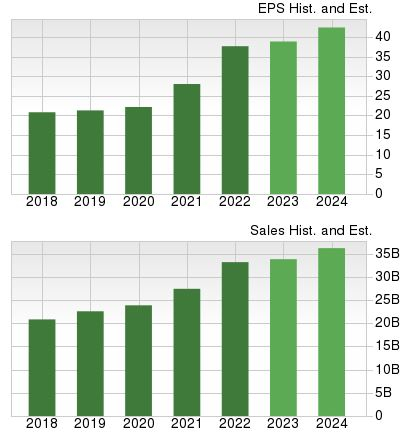

Like ADBE, Broadcom carries a solid growth profile, with earnings forecasted to climb 7.4% in its current fiscal year (FY23) on the back of Y/Y revenue growth of 5%. And in FY24, earnings and revenue are estimated to climb 7.5% and 4.9%, respectively.

Image Source: Zacks Investment Research

Additionally, Broadcom’s dividend metrics would excite any income-focused investor looking for tech exposure – AVGO’s annual dividend currently yields a solid 2.9% paired with a sizable 26.3% five-year annualized growth rate.

Image Source: Zacks Investment Research

Jabil Inc.

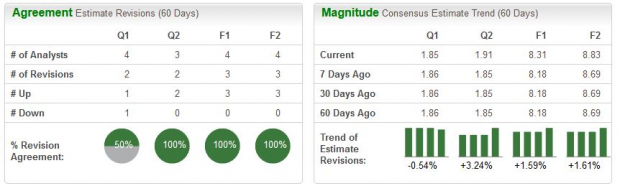

Jabil provides electronic manufacturing services and solutions to its customers. JBL has seen its near-term earnings outlook tick higher over the last several months, pushing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Jabil is estimated to deliver Y/Y earnings growth of nearly 9% in its current fiscal year (FY23), with revenue forecasted to climb by 3%. Looking ahead to FY24, estimates suggest Y/Y improvements of 6.3% in earnings and 2.9% in revenue.

Image Source: Zacks Investment Research

Bottom Line

Tech stocks have gotten a haircut in 2022, with a hawkish Fed spoiling all the fun.

Still, several tech stocks carry favorable growth profiles, owing to their ability to navigate through rough waters.

All three stocks above – Adobe

ADBE

, Broadcom

AVGO

, and Jabil

JBL

– carry favorable growth outlooks, expected to grow both the top and bottom lines in their current fiscal years and next.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report