Technology stocks have delivered an uncharacteristically sluggish performance in 2022. A tech-focused exchange-traded fund, Technology Select Sector SPDR ETF (XLK) declined 28.4% and lagged the S&P 500 by 7.8% this year through Dec 22.

Wall Street analysts expect the plunge in technology stocks this year to give way to a sharp rebound in 2023 as companies work to protect profitability and the Federal Reserve winds down its rate-hike campaign.

The sector’s expected rebound can be attributed to the impressive long-term growth prospects of tech companies, including

DecisionPoint Systems

DPSI

,

Airgain

AIRG

and

Kaleyra

KLR

, owing to continuous digital transformations. The rapid adoption of cloud computing and the ongoing integration of AI and machine learning have been major growth drivers.

Moreover, growing demand for e-commerce, contactless delivery through drones and digital payment highlights the urgency for accelerated 5G network development.

Meanwhile, blockchain, IoT, smartphones, autonomous vehicles, storage solutions, AR/VR and wearables, networking and connectivity solutions — including Wi-Fi as well as Wi-Fi/Bluetooth integrated SOCs — and the need for high-speed data in both communications networks and data centers offer significant growth opportunities.

Despite the challenges presented by the current economic downturn, there are still plenty of reasons to be optimistic about the tech sector’s future.

Meta Platform

META

,

Amazon

AMZN

, Microsoft and Alphabet have started work to keep margins intact by cutting costs and curbing non-strategic areas of spending to withstand what major banks and economists see as an oncoming recession. Among the cost cuts, thousands of tech workers have been laid off in recent weeks, with reductions at Meta and Amazon among them.

Though a workforce-trimming strategy might hurt employer brand and employee morale, it is often a necessary evil that companies consider adopting to stay afloat during turbulent times.

Our Picks

Given the abovementioned positives, we pick three technology stocks that have strong fundamentals and are well-poised for growth in 2023. These stocks carry a

VGM Score

of A or B and a Zacks Rank 1 (Strong Buy) or 2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Per the Zacks proprietary methodology, stocks with such a perfect mix of elements offer solid investment opportunities.

While these stocks trade under $10 and can be more volatile than their costlier peers, strong bottom-line projections and positive estimate revisions in recent times point toward momentum in the near term.

Moreover, these stocks carry an average brokerage recommendation (ABR) in the range of <=2. ABR is the calculated average of actual recommendations made by brokerage firms on a scale of 1 to 5 (Strong Buy to Strong Sell) and indicates the future potential of the stock.

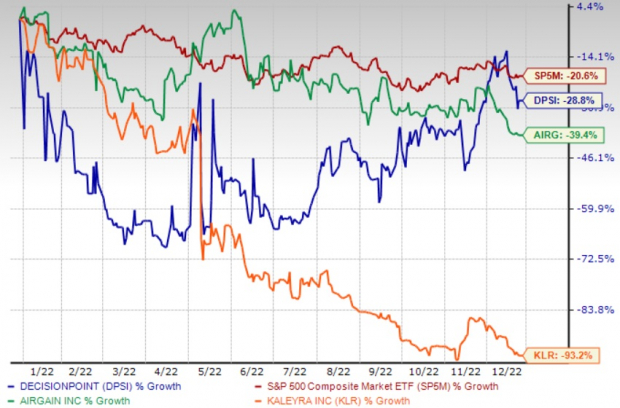

The chart below shows the price performance of our three picks year to date.

Year-to-Date Performance

Image Source: Zacks Investment Research

DecisionPoint

provides enterprise mobility and radio frequency identification technologies. The top-line performance is being driven by broad-based strength across several verticals amid global supply chain disruptions. Also, the company’s strong relationships with its OEMs and distribution partners are a tailwind.

Synergies from acquisitions are likely to drive DecisionPoint’s performance. The company concluded two buyouts — Advanced Mobile Group and Boston Technologies — earlier in 2022. These acquisitions boost the company’s position in the lucrative transportation and direct store delivery verticals.

Also, the company completed the re-branding of ExtenData Solutions into DecisionPoint Systems in October 2022. The company was acquired by DecisionPoint Systems in December 2020. The acquisition has helped DecisionPoint to improve its regional presence across the Rocky Mountain and Southwest regions of the United States and expand its professional services team. ExtenData’s MobileConductor delivery management platform has also opened up a new SaaS-based subscription revenue stream for DecisionPoint.

DecisionPoint sports a Zacks Rank #1 and has a VGM Score of A. It is currently trading at $8.08 and has an ABR of 2. The Zacks Consensus Estimate for the company’s 2023 earnings has remained steady at 43 cents per share in the past 30 days, indicating growth of 19.4% year over year.

Kaleyra

offers mobile communication services to financial institutions, e-commerce players, OTTs, software firms, logistic enablers, healthcare providers, retailers and other large organizations worldwide. Through its proprietary platform and robust APIs, it manages multi-channel integrated communication services, consisting of messaging, rich messaging and instant messaging, video, push notifications, e-mail, voice services and chatbots across more than 190 countries, including all tier-1 U.S. carriers.

Kaleyra carries a Zacks Rank #2 and has a VGM Score of A. It is currently trading at 68 cents and has an ABR of 2. The Zacks Consensus Estimate for Kaleyra’s 2023 earnings has remained steady at a loss of 62 cents per share in the past 30 days, indicating growth of 39.8% year over year.

Airgain

offers integrated wireless solutions in the form of antenna products. These products are equipped to solve critical connectivity needs in the design process and the operating environment across the enterprise, automotive and consumer markets.

Ideal for original equipment and design manufacturers, vertical markets, chipset vendors, service providers, value-added resellers and software developers worldwide, the customizable antennas serve both indoor and outdoor connectivity issues.

Airgain carries a Zacks Rank #2 and has a VGM Score of B. It is currently trading at $6.45 and has an ABR of 2. The Zacks Consensus Estimate for Airgain’s 2023 earnings has remained steady at 33 cents per share in the past 30 days, indicating growth of 14.1% year over year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report