Consumer spending activity, which is one of the pivotal factors driving the economy, held up last month, as Americans spent more on goods amid heightened inflation. This was clearly evident from retail sales data for the month of June that bounced back after a decline in May. The Commerce Department stated that U.S. retail and food services sales in June rose 1% sequentially to $680.6 billion, following an upwardly revised reading of 0.1% decline registered in May.

A robust job market and decent household finances, thanks to the stimulus checks received in the peak pandemic period, have allowed consumers to shield themselves from inflationary pressure to an extent. But the question industry experts are asking is how long will this last as soaring commodity and gasoline prices as well as rising interest rates have already started pinching consumers’ pockets. These also raise concerns about the health of the U.S. economy.

We note that the consumer price index rose 1.3% month on month in June, following an increase of 1% in May. On a year-over-year basis, the metric rose 9.1% — the fastest pace since November 1981. This jump was led by higher gasoline and food grain prices, primarily due to the conflict between Russia and Ukraine. This is enough for the Federal Reserve to take a more aggressive stance.

Category-Wise Sales

The Commerce Department’s report suggests that sales at motor vehicle & parts dealers and furniture & home furnishings stores increased 0.8% and 1.4%, respectively, on a sequential basis. Sales at electronics & appliance stores rose 0.4%, while the same at miscellaneous store retailers increased 1.4%. Again, sales at non-store retailers were up 2.2%.

Sales at food & beverage stores increased 0.4%, while at food services & drinking places it grew 1%. At sporting goods, hobby, musical instrument, & book stores, sales advanced 0.8%. Meanwhile, receipts at gasoline stations were up 3.6%, driven by high gasoline prices.

The report also indicates that sales at building material & supplies dealers declined 0.9%, while the same at clothing & clothing accessories outlets fell 0.4%. Sales at health & personal care stores declined 0.1%, while the same at general merchandise stores fell 0.2%.

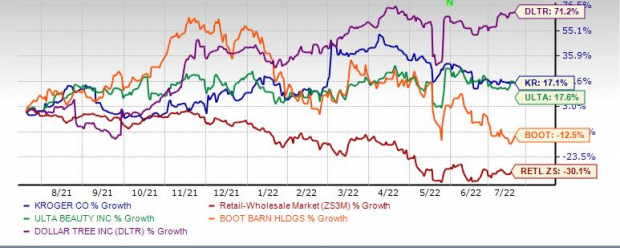

Past Year Price Performance

Image Source: Zacks Investment Research

4 Prominent Picks

Investors can count on

Dollar Tree, Inc.

DLTR

. This Chesapeake, VA-based company’s strategic initiatives, including the expansion of $3 and $5 Plus assortment in Dollar Tree stores, as well as Combo Stores and H2 Renovations at Family Dollar, provide tremendous opportunities to drive sales and traffic.

Impressively, Dollar Tree has a trailing four-quarter earnings surprise of 13.1%, on average. This operator of discount variety stores has an estimated long-term earnings growth rate of 15.5%. The Zacks Consensus Estimate for Dollar Tree’s current financial year sales and EPS suggests growth of 6.7% and 40.5%, respectively, from the year-ago period. The stock sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Another stock worth considering is

Ulta Beauty, Inc.

ULTA

. The company has been strengthening its omni-channel business and exploring the potential of both physical and digital facets. It has been implementing various tools to enhance guests’ experience, like offering a virtual try-on tool and in-store education, and reimagining fixtures, among others. Ulta Beauty focuses on offering customers a curated and exclusive range of beauty products through innovation.

Impressively, this beauty retailer and the premier beauty destination for cosmetics, fragrance, skincare products, hair care products and salon services has a trailing four-quarter earnings surprise of 49.8%, on average. We note that this Zacks Rank #1 company has an estimated long-term earnings growth rate of 10.7%. The Zacks Consensus Estimate for Ulta Beauty’s current financial year sales suggests growth of 10.3% from the year-ago period.

You may invest in

Boot Barn Holdings, Inc.

BOOT

. This lifestyle retailer of western and work-related footwear, apparel and accessories has been successfully navigating through the challenging environment, courtesy of merchandising strategies, omni-channel capabilities and better expense management as well as marketing. This, combined with the expansion of the store base, has helped Boot Barn Holdings gain market share and strengthen its position in the industry.

This Zacks Rank #2 (Buy) company has an estimated long-term earnings growth rate of 20%. The Zacks Consensus Estimate for Boot Barn Holdings’ current financial year sales and EPS suggests growth of 17% and 4.4%, respectively, from the year-ago period.

The Kroger Co.

KR

is another potential pick. The company, which operates in the thin-margin grocery industry, has been undergoing a complete makeover not only with respect to products but also in terms of the way consumers prefer shopping grocery. The company has been adding new products as well as eyeing technological expansion to enhance its omnichannel reach. Kroger has been making significant investments to enhance product freshness and quality, and expand digital capabilities. Impressively, the company has been introducing new items under its “Our Brands” portfolio.

Kroger has a trailing four-quarter earnings surprise of 20.3%, on average. The company has an estimated long-term earnings growth rate of 11.3%. The Zacks Consensus Estimate for Kroger’s current financial year sales and EPS suggests growth of 6.7% and 6.3%, respectively, from the year-ago period. The stock carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report