Deciphera Pharmaceuticals, Inc.

DCPH

currently looks like a good stock from the biotech sector to invest in. Though smaller biotech companies are riskier as their product pipelines are several years away from commercialization, an investor looking to invest in a relatively safe yet prospective stock can consider Deciphera at the moment.

Deciphera’s sole marketed drug, Qinlock (ripretinib), is approved for the treatment of adult patients with advanced gastrointestinal stromal tumor (“GIST”) who have received prior treatment with three or more kinase inhibitors, including Novartis’ Gleevec (imatinib).

Let’s delve deeper:

Good Rank and Rising Estimates:

Deciphera currently has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

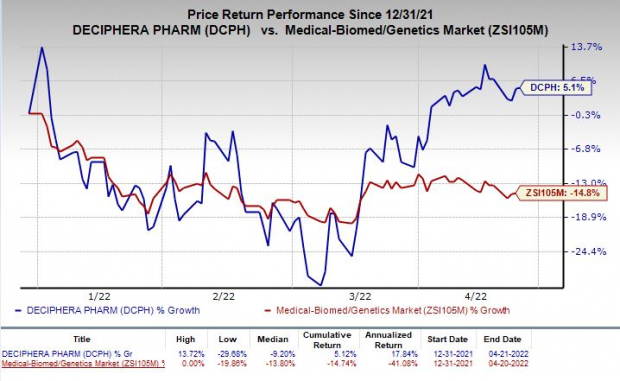

Deciphera’s loss estimates have narrowed from $2.94 per share to $2.84 per share for 2022 over the past 60 days. The Deciphera stock have gained 5.1% so far this year against the

industry

’s decline of 14.8%.

Image Source: Zacks Investment Research

Qinlock Approval a Big Boost:

Qinlock’s sales are being driven by high demand in the advanced GIST market. The initial uptake of the drug has been strong. Apart from Qinlock, there is no other marketable drug in the company’s portfolio. The drug contributes the majority of Deciphera’s revenues.

In November 2021, the European Commission approved Qinlock for the treatment of fourth-line GIST. The nod in Europe should fuel sales further.

Deciphera is also working to expand the label of Qinlock in second-line GIST. A potential label expansion for other indications will make the drug eligible to treat a broader patient population and drive sales further in 2022 and beyond.

Restructuring Initiatives Saving Costs:

Deciphera, in November 2021, entered into a corporate restructuring operation, whereby the company decided to streamline its commercial operations and reduce its current workforce by approximately 35% or almost 140 positions.

The changes in clinical development programs, along with restructuring efforts, are expected to significantly reduce the company’s operating expenses and extend the cash runway into 2024, which is a positive.

Promising Pipeline:

Deciphera is rapidly advancing its portfolio of innovative pipeline candidates that are in various stages of clinical development.

The company initiated the phase III MOTION study, which is evaluating vimseltinib for the treatment of tenosynovial giant cell tumor (“TGCT”). The company plans to present updated data from a phase I/II study in TGCT patients in the second half of 2022.

A phase I study is evaluating DCC-3116 as a single agent and in combination with FDA-approved MEK inhibitor, trametinib, for the treatment of patients with various advanced/metastatic tumors resulting from mutations in RAS/RAF genes.

A successful development and potential approval of these candidates will be a big boost for the company.

Other Stocks to Consider

Other stocks worth considering in the biotech sector include

Aligos Therapeutics, Inc.

ALGS

,

Vertex Pharmaceuticals Incorporated

VRTX

and

Voyager Therapeutics, Inc.

VYGR

, all carrying the same Zacks Rank #2 at present.

The Zacks Consensus Estimate for Aligos Therapeutics’ loss per share has narrowed 14.3% for 2022 and 43.7% for 2023 over the past 60 days.

Earnings of ALGS surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Vertex’s earnings estimates have been revised 1.7% upward for 2022 and 0.4% upward for 2023 over the past 60 days. The VRTX stock has rallied 28.2% year to date.

Earnings of Vertex surpassed estimates in each of the trailing four quarters.

Voyager Therapeutics’ loss per share estimates have narrowed 38.6% for 2022 and 29% for 2023 over the past 60 days. The VYGR stock has skyrocketed 167.5% year to date.

Earnings of Voyager Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report