Are These The Best Beverage Stocks To Buy Now?

An increasing number of analysts in the

stock market

have been predicting that a recession would happen sometime this year or next. For this reason, it is no surprise that many investors are cautious about their investments. Hence, it’s natural that we would look for companies with resilient earnings and revenue streams. And that’s exactly what you get with

beverage stocks

.

For instance,

PepsiCo

(

NASDAQ: PEP

) started the earnings season on a strong note after publishing its latest set of quarterly results. The beverage giant reported an adjusted quarterly profit of $1.86 per share, 12 cents above estimates. What’s more, the company also raised its full-year forecast as consumer demand holds up as prices rise. PepsiCo CFO Hugh Johnston told Reuters that consumers have so far been undeterred by previous price increases implemented last year, and can expect more to come from the beverage giant. “

In a world where we’re seeing things like vegetable oil, grains and packaging prices increasing dramatically, I would be surprised if there wasn’t more (price increase) over the course of the next year,

” Johnston said.

Not to mention, beverage companies fall into the larger category of consumer staples, making them recession-proof. This would be due to their ability to withstand some of the broader challenges that their discretionary counterparts face. While some of these beverage companies may come off as boring, it is these stocks that may be able to help you fend off the volatility in the stock market. Considering all of this, which beverage stocks are on your watchlist right now?

Beverage Stocks To Watch Right Now

-

Coca Cola Co.

(

NYSE: KO

) -

Monster Beverage Corp.

(

NASDAQ: MNST

) -

Boston Beer Company Inc.

(

NYSE: SAM

) -

Constellation Brands, Inc.

(

NYSE: STZ

)

Coca Cola

Similar to PepsiCo,

Coca-Cola

’s brand loyalty would enable the beverage giant to raise prices to offset its costs without taking much of a hit to its sales. The company sells its products in more than 200 countries and territories. Its multiple billion-dollar brands can be found across various beverage categories worldwide. These notable brands include the likes of Coca-Cola, Sprite, and Fanta to name a few. Next to soft drinks, the company also offers sports, coffee, and tea brands. For a sense of scale, Coca-Cola hires more than 700,000 employees across the globe.

Late last month, the company announced that it will be releasing a limited-edition flavor. The flavor, created in collaboration with Grammy-nominated artist Marshmello, will be available in July. In detail, the new flavor will introduce strawberry and watermelon to Coke. This release is the latest in a string of new flavors to come out of the Coca-Cola Creations platform. For those unfamiliar, in addition to creating new flavors, the platform seeks to position the company as a lifestyle brand through merchandise and virtual experiences. Its previous flavors, Starlight and Byte, similarly attempted to capitalize on pop culture. As such, would KO stock make your list of best beverage stocks to buy right now?

[Read More]

Best Dividend Stocks To Buy In 2022? 5 To Watch Right Now

Monster Beverage

Next up, energy drink maker

Monster Beverage

is another top beverage stock to watch. Even though the company had a rough start for the year, the stock quickly rebounded. It has surged more than 30% since its low of around $72 since March. While best known for its energy drinks, Monster Beverage also makes and sells a host of other drinks, including tea, fruit juices, soda and more.

From its latest fiscal report, the energy company reported mostly good news for the selling period that ended in late March. In addition to that,

Morgan Stanley

’s (

NYSE: MS

) Dara Mohsenian also called it a “top pick” in the beverage sector. The analyst cited topline growth factors to back up the view. Favorable demographic trends, plus international expansion, could generate strong revenue for the company. Given all this, would you consider investing in MNST stock right now?

Boston Beer

Shares of

Boston Beer

have been declining through most of 2022. That is due to the waning demand for hard seltzer. In light of that, the company also recently received a downgrade from

Goldman Sachs

(

NYSE: GS

). The investment bank is predicting further negative returns ahead due to worsening demand trends for Truly drinks. However, with SAM stock declining by over 60% over the past year, some may argue that the deep pessimism is already priced in. Could that lead to a stronger rebound when things turn around?

Notably, the management said back in late April that its inventory situation had improved. Of course, the sales are falling overall as consumers continue moving away from the hard seltzer niche and the Truly brand. Boston Beer’s next earnings report on July 21 will determine whether the company is capable of returning to modest sales growth in 2022. With that in mind, would you say that the recent dip in SAM stock provides a good opportunity for investors to buy in?

[Read More]

4 Top Fintech Stocks To Watch Today

Constellation Brands

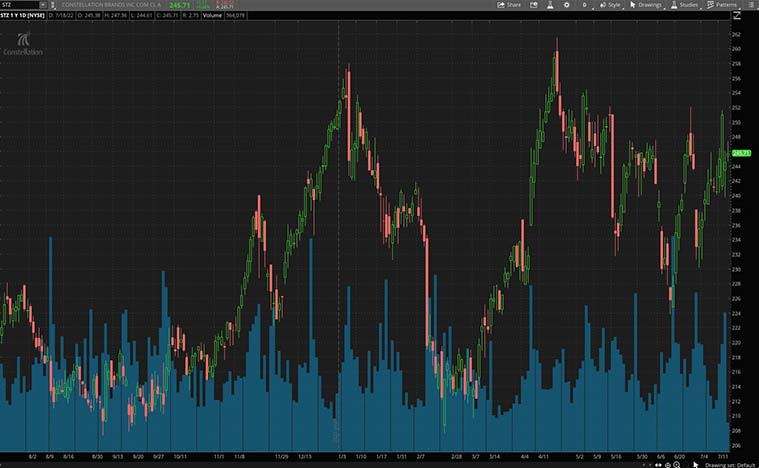

Constellation Brands

is a leading international alcoholic beverage company. The company’s product portfolio includes Corona, Modelo Especial, Modelo Negra, and Pacifico. These products, along with a craft beer lineup, have enabled Constellation Brands to become the third largest beer company in the U.S. and the largest seller of imported beers in the country. From its latest quarterly report, it shows that sales trends held up well, especially considering all the volatility around consumer demand right now.

Better yet, Constellation Brands is just as optimistic about the upcoming fiscal year as it was back in early April. The beer business is still on track to grow sales by between 7% and 9% and boost profits at a slightly slower rate. What’s more, it has a heavy presence in more than just beer. The company holds many leading wine and spirits brands as well. Management also affirmed their forecast for a return to profitability for the wine and spirits segment. Cash flow targets were all affirmed as well. Considering all this, would you include STZ stock on your watchlist right now?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel.

CLICK HERE RIGHT NOW!!