Many things have been changing within one of the world’s largest pharmaceutical companies, Eli Lilly and Company (NYSE:$LLY) lately, causing the company’s shares to be a bit unstable. Besides beginning 2017 with a new CEO, after 27 years the company’s current chief financial officer (CFO) Derica Rice has just announced that he will be retiring at the end of the year.

However, changes within Lilly’s executives shouldn’t come as a surprise to many as the company has been suffering from a dwindle in sales growth. Despite this, the Indianapolis, Indiana-based company is still full of surprises.

Eli Lilly and Co has Been Around for More Than a Century

Lilly’s recent slow sales growth is typical for any company that has been around for a while. In the pharmaceutical company’s case, 141 years is quite a long time. Founded in 1879 by Colonel Eli Lilly, the company was an attempt to address the widespread of inconsistent drugs that went rampant due to lack of government regulation.

Since then, the company has expanded from the Midwest United States to a major distributor on a global scale. Eli Lilly’s drugs products are currently being sold in around 125 countries globally. The company also has manufacturing and distribution facilities in 15 countries.

Drugs for Animals

Unlike most pharmaceutical companies, Lilly is a huge contributor to animal health medicine. Last year, medicine sales to veterinarians accounted for around 15% of the company’s total revenue.

While Lilly has been around a while, its contribution to animal health is a pretty recent endeavor that was sparked from several recent acquisitions — including Novartis’ (VTX:$NOVN) animal health operations for $5.4 billion. As such, Lilly’s subsidiary company, Elanco Animal Health, has become the world’s second-largest veterinary pharmaceutical company. Elanco’s sales totaled $3.16 billion in the last year alone.

However, Lilly is now seeing pressure to spin-off Elanco after Pfizer (NYSE:$PFE) was recently spun-off by parent-company and the world’s leading player in the animal health sector, Zoetis (NYSE:$ZTS). As a result of the spin-off, Zoetis’ stock doubled. When asked to consider doing the same, Lilly had rejected the idea of a spin-off quite firmly. But this was under the leadership of former CEO John Lechleiter — with new people joining the executive team, investors should watch the company closely as to whether or not it will reconsider a spin-off for Elanco.

An Exception in the Industry

Besides expanding its animal health endeavors, Eli Lilly has also remained on the sidelines in the wake of big pharmaceutical companies merging with one another. Company management has argued against any big mergers, stating that the internal disruption would be damaging to the company and wouldn’t be worth it for any cost-saving benefits.

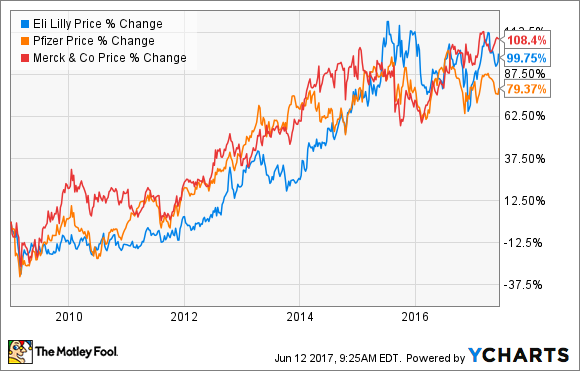

As such, management seems to have made the correct decision — particularly in a shareholder’s perspective. After Pfizer acquired Wyeth (NYSE:$AHP) in 2009 for almost $68 billion, Lilly’s share prices have consistently outperformed Pfizer’s even presently. Similarly, after Merck (NYSE:$MRK) spent around $41 billion to merge with Schering-Plough in 2009, Lilly’s shares have been performing to almost the same degree as Merck’s.

Dependent on Price Hikes

For the past several years, failing clinical trials and lack of new drugs in the market has slowed down Lilly’s growth. As a result, the company had to up its prices on existing products before patent expirations make price hikes impossible. Eli Lilly is one of seven pharmaceutical companies that have relied on price hikes for all of its earnings growth in the previous year.

Investors in the company be a little considered, as Humalog, a drug developed by Lilly and had gotten marketing approval by the FDA more than 20 years ago, had recently lost its patent protection. Humalog accounted for about 13.5% of sales in the first quarter of this year and has been one of Lilly’s biggest contributors in revenue. Besides the loss of patent protection — which means Lilly can’t up the price of the drug anymore — European drug regulators are also currently considering another drug similar to Humalog that was developed by Sanofi (EPA:$SAN). As such, if the drug by Sanofi makes it to the market, it could be hurtful to the sales of Lilly’s Humalog.

A Comeback Could Be on the Horizon

Clinical trial failures wasn’t the only thing that weakened the company’s pipelines. During Lechleiter’s time as CEO, Lilly was not very active in acquiring or licensing new promising drug candidates from smaller companies — a move that have accounted for the recent successes of big pharmaceuticals such as Bristol-Myers Squibb (NYSE:$BMY) and Johnson & Johnson (NYSE:$JNJ).

However, it looks like Eli Lilly is about to start acquiring new drug candidates from smaller companies under David Rick’s direction as CEO. The company has already made two acquisitions, CoLucid’s lasmiditan being one of them. CoLucid’s drug was developed to treat migraine and headaches, and has been proven to reduce pain within two hours of administering the drug. Lilly’s acquisition of the drug costed $832 million.

Besides lasmiditan, Lilly also have another migraine-treating drug that is in late-stage development called galcanezumab. The drug is being developed to reduce the frequency of headaches after long-term use.

It may be surprising, but the total annual expenses spent on treating migraines is $36 billion in the U.S. alone. Still, the majority of people who suffer from headaches and migraines remain untreated. If Lilly’s lasmiditan and galcanezumab is successful in their trials and earn FDA marketing approval, the company could make a major comeback from its recent slump in sales.

As well, Lilly has further expanded its work in the animal health sector with the purchase of $822 million worth of assets from Boehringer Ingelheim (traded privately) in January.

Featured Image: twitter