Wall Street has been witnessing a welcome rally in July after reeling under severe volatility in the first half of 2022. Of the various sectors of the economy, the technology sector suffered the most in this period. Interestingly of the three major indexes, the tech-heavy Nasdaq Composite has rallied the most in July.

We believe the market rally will continue in the near future as most of the negatives, such as mounting inflation, higher interest rate and tighter monetary control are already factored in the market’s valuation. Moreover, better-than-expected second-quarter earnings results so far are likely to provide the necessary impetus for the rally to sustain.

At this stage, it should be prudent to invest in the Nasdaq Composite listed technology stocks with a favorable Zacks Rank to gain in the near-term. Here are five such stocks —

Broadcom Inc.

AVGO

,

CrowdStrike Holdings Inc.

CRWD

,

Synopsys Inc.

SNPS

,

MongoDB Inc.

MDB

and

Palo Alto Networks Inc.

PANW

.

Nasdaq Composite Tumbles in 1H 2022

In the last two coronavirus-ridden years, the Nasdaq Composite recorded an astonishing rally of more than 140%. The meteoric rise of the technology stocks was the sole reason for this impressive rally. Therefore, Wall Street started 2022 with a highly overvalued technology sector. Consequently, investors started profit booking in this sector.

Moreover, mounting inflation compelled the Fed to significantly raise the benchmark interest rate from March this year. The central bank also imposed tougher monetary control sucking liquidity from the economy raising the market’s risk-free returns.

Higher interest rate is detrimental to growth sectors like technology. Consequently, the tech-laden Nasdaq Composite plunged 29.5% in the first half of 2022, marking the worst first half in the index’s history. Year to date, the index is down 24% and currently in the bear market.

Nasdaq Composite Rallies in July

Defying the trend of the first half of this year, Wall Street is rallying in July as most of the negative concerns are already factored in market’s valuation. Of the three major indexes, the Nasdaq Composite has rallied the most.

Month to date, Nasdaq Composite has rallied 7.9%. From its 52-week low recorded on Jun 16 the index has advanced 12.6%. By any means, this is a substantial recovery. Market participants are currently divided on whether the recent recovery is a bear market rally or if the markets have already bottomed out. Whatever the reason, investor sentiment has improved to a large extent in July.

Our Top Picks

We have narrowed our search to five Nasdaq Composite listed technology bigwigs. These stocks have strong growth potential for the rest of 2022 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

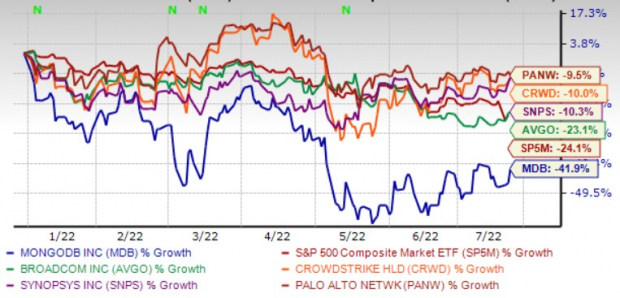

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Broadcom

is riding on continued strength in networking and server storage segments. Networking is well-poised on the strong adoption of AVGO’s next-gen merchant switching and routing solutions by hyperscalers, enterprises and service providers. Broadcom is benefiting from the world’s first complete end-to-end chipset solutions for the Wi-Fi 7 ecosystem.

In the server storage connectivity domain, much of the growth is anticipated from the continued recovery of enterprise IT spending deployed toward upgrading computer services. An upbeat third-quarter fiscal 2022 guidance is encouraging. The recently announced VMware acquisition will aid prospects in the long term.

Zacks Rank #1 Broadcom has an expected earnings growth rate of 32.3% for the current fiscal-year (ending October 2022). The Zacks Consensus Estimate for current fiscal-year earnings has improved 0.3% over the last 30 days.

CrowdStrike Holdings

is benefiting from the rising demand for cyber-security solutions owing to the slew of data breaches and the increasing necessity for security and networking products amid the COVID-19 pandemic-led remote working trend.

Continued digital transformation and cloud-migration strategies adopted by organizations are key growth drivers. CRWD’s portfolio strength, mainly the Falcon platform’s 10 cloud modules, boosts its competitive edge and helps add users. Strategic acquisitions, like that of Humio and Preempt, are expected to drive growth for CrowdStrike Holdings.

Zacks Rank #1 CRWD has an expected earnings growth rate of 85.1% for the current fiscal-year (ending January 2023). The Zacks Consensus Estimate for current fiscal-year earnings has improved 0.8% over the last 30 days.

Palo Alto Networks

has been benefiting from continuous deal wins and the increasing adoption of its next-generation security platforms, attributable to the rise in the remote work environment and the need for stronger security.

Growing traction in Prisma and Cortex offerings are acting as a tailwind. PANW continues to acquire new customers and increase wallet share with existing customers. Palo Alto Networks’ higher sales incentives related to next-generation Security products are likely to continue negatively impacting its bottom line.

Zacks Rank #2 PANW has an expected earnings growth rate of 24.3% for the current fiscal-year (ending July 2023). The Zacks Consensus Estimate for current fiscal-year earnings has improved 0.1% over the last 60 days.

Synopsys

is benefiting from strong design wins owing to a robust product portfolio. Growth in the work-and-learn-from-home trend is driving demand for bandwidth. Moreover, strong traction for SNPS’ Fusion Compiler product boosted the top line.

Growing demand for advanced technology, design, IP and security solutions is also creating solid prospects for Synopsys. Moreover, the rising impact of artificial intelligence, 5G, internet of things and big data are driving investments in new compute and machine learning architectures.

Zacks Rank #2 Synopsys has an expected earnings growth rate of 26.8% for the current year (October 2022). The Zacks Consensus Estimate for its current-year earnings has improved 9.7% over the last 60 days.

MongoDB

provides general purpose database platform worldwide. MDB offers MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment, MongoDB Atlas, a hosted multi-cloud database-as-a-service solution, and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

MongoDB also provides professional services comprising consulting and training. MDB serves financial services, government, healthcare, media and entertainment, retail, technology and telecommunications industries.

Zacks Rank #2 MongoDB has an expected earnings growth rate of 54.2% for the current year (January 2023). The Zacks Consensus Estimate for its current-year earnings has improved 30.8% over the last 60 days.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report