Wall Street maintained its northbound journey in the first five months of this year after finishing an impressive 2020 despite facing the global outbreak of the deadly coronavirus. However, the pattern of investing has changed in 2021.

While the growth-oriented technology sector was the predominant driver of the last two years’ rally, cyclical sectors like consumer discretionary, industrials, materials, financials and oil-energy are the main sources of Wall Street’s northbound journey year to date. Of late, the major threat to the technology sector is market participants’ growing expectations of inflation.

Near-Term Threats to the Technology Sector

Since the beginning of 2021, a section of economists and financial experts has raised eyebrows about the high valuation of this sector. Notably, the Technology select sector SPDR

XLK

, one of the 11 broad sectors of the market’s benchmark S&P 500 Index, had soared 43.6% in 2020 and helped Wall Street to exit the coronavirus-led short bear market and form a new bull market.

In contrast, with the nationwide deployment of the COVID-19 vaccines and the great reopening of the U.S. economy, relatively cheaper cyclical stocks, which suffered the most from the pandemic-led lockdown last year, have become lucrative to investors.

Moreover, growing indications of inflationary pressure dented investors’ confidence in growth stocks like technology. If inflationary pressures continue to mount, the Fed may be compelled to gradually terminate its quantitative easing program of buying $120 billion of bonds per month.

This will reduce bond price and consequently yields will increase. A higher risk-free interest rate will be detrimental to growth stocks as they generally depend on easy access to cheap credit for expanding their businesses. Consequently, the XLK dropped 1.4% in the past month.

Not All Tech Stocks Will Succumb to Inflation

The Fed is yet to trigger the inflation button. So far, the central bank has reiterated that any inflation in 2021 will be transitory and that it will pursue easy-money policies. Even if the Fed changes its dovish monetary stance in near future pushing up the market’s interest rate, technology giants are not likely to bear the brunt of inflation.

Technology is the best bet in the long term with vast potential. Technology behemoths have a robust business model across the world and command globally acclaimed brand values. Their strong financial position will help them to cope with higher a interest rate.

In fact, a transitory inflation may be good as technology bigwigs can generate higher profits despite raising the wage rate. The spread between higher product prices and higher wages will increase their profits.

Moreover, several globally recognized financial agencies and research firms have raised their forecast for 2021 global GDP. Aside from the United States, the economies of the Eurozone, China, Canada and Mexico, the major trading partners of the United States, are recovering faster than expected.

This will open up the export markets. In macroeconomic theory, higher inflation generally results in the depreciation of a country’s currency value in international markets, making high-tech U.S. products more attractive internationally.

Vast Potential

We must not forget that the growing demand for hi-tech superior products has been a catalyst for the sector in an otherwise tough environment. A series of breakthroughs in 5G wireless network, cloud computing, predictive analysis, AI, self-driving vehicles, digital personal assistants and IoT, has given a boost to the overall space.

The thrust for digitization is likely to come from two sides. Individuals, who enjoyed the immense benefits of digital platforms during the coronavirus-induced lockdowns last year, are less likely to go back to their old habits. The new way of connecting has opened up a new world for them. Also, business entities will be more interested in cloud computing, automation and AI to establish smooth supply chain systems.

The leading emerging markets of Asia, Latin America, Africa and some European countries are still way behind in using digital technology compared with the developed world.

The countries that are more digitally advanced have been able to minimize their losses during the pandemic. These are major lessons to the other countries. Even those who are less inclined toward digital technology and online platforms, are now feeling the massive advantage of online transactions.

Our Top Picks

We have narrowed down our search to seven U.S. technology bigwigs (market capital > $100 billion) with strong growth potential for 2021 and beyond. These stocks witnessed solid earnings estimate revisions in the last 7 to 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

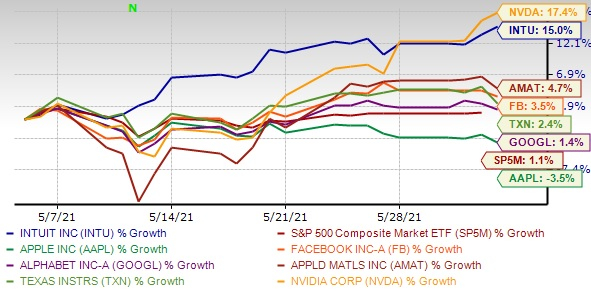

The chart below shows the price performance of our seven picks in the past month.

Image Source: Zacks Investment Research

Alphabet Inc.

GOOGL

has an expected earnings growth rate of 55% for the current year. This Zacks Rank #1 company has a long-term growth rate of 18.1%. The Zacks Consensus Estimate for the current year has improved 26.9% over the last 60 days.

Apple Inc.

AAPL

has an expected earnings growth rate of 57.6% for the current year (ending September 2021). This Zacks Rank #2 company has a long-term growth rate of 12.5%. The Zacks Consensus Estimate for the current year has improved 1.4% over the last 7 days. It has a current dividend yield of 0.70%.

Facebook Inc.

FB

has an expected earnings growth rate of 30.6% for the current year. This Zacks Rank #1 company has a long-term growth rate of 20.1%. The Zacks Consensus Estimate for the current year improved 1% over the last 7 days.

NVIDIA Corp.

NVDA

has an expected earnings growth rate of 58.4% for the current year (ending January 2021). This Zacks Rank #1 company has a long-term growth rate of 17.6%. The Zacks Consensus Estimate for the current year improved 9.8% over the last 7 days. It has a current dividend yield of 0.10%.

Texas Instruments Inc.

TXN

has an expected earnings growth rate of 23.8% for the current year. This Zacks Rank #2 company has a long-term growth rate of 19.9%. The Zacks Consensus Estimate for the current year improved 0.4% over the last 7 days. It has a current dividend yield of 2.14%.

Applied Materials Inc.

AMAT

has an expected earnings growth rate of 31.7% for the current year (ending October 2021). The company has a long-term growth rate of 18%. The Zacks Consensus Estimate for the current year has improved 9.2% over the last 30 days. This Zacks Rank #2 company has a current dividend yield of 0.69%.

Intuit Inc.

INTU

has an expected earnings growth rate of 19% for the current year (ending July 2021). The company has a long-term growth rate of 14.8%. The Zacks Consensus Estimate for the current year has improved 12% over the last 30 days. This Zacks Rank #2 company has a current dividend yield of 0.53%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report