The market was strong yesterday, providing investors with a much-needed day in the green. Today, that fun has seemingly come to a halt, with red sweeping across the board. It’s been an exhausting 2022, to say the least, with sellers remaining in control and pushing bulls out of the arena at seemingly every turn.

With the Fed pivoting to a hawkish position, the stock market has priced in the impact of higher borrowing rates. This, in turn, with soaring energy costs and supply-chain bottlenecks, have all spoiled the fun year-to-date.

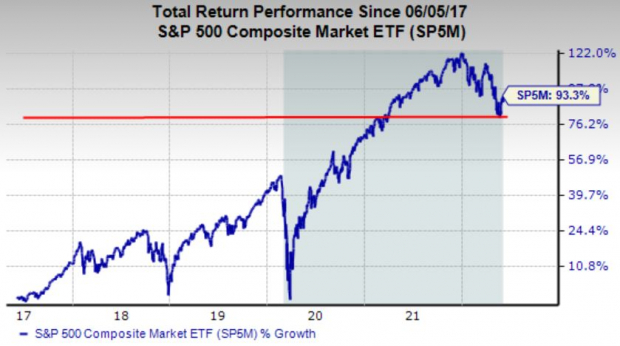

On a brighter note, the indices are still well above their 2022 lows, which any investor can celebrate. The five-year chart below illustrates that the S&P 500 has bounced off of March 2021 levels so far, another positive note.

Image Source: Zacks Investment Research

A staple found within many portfolios is large-cap stocks. Large-cap stocks are typically classified by companies with market valuations of $10 billion or more.

Large-cap companies are generally more mature, well-known companies within established industries. These stocks are less volatile, have greater coverage, and typically pay dividends. Additionally, they provide stability and pose less risk – these companies are less likely to face an economic or business circumstance that will cause insolvency.

Let’s look at three large-cap stocks – Dollar Tree

DLTR

, Hess Corporation

HES

, and Analog Devices

ADI

– that all sport the highly coveted Zacks Rank #1 (Strong Buy) and why these stocks would be solid bets for investors looking for large-cap exposure.

Hess Corporation

Hess Corp.

HES

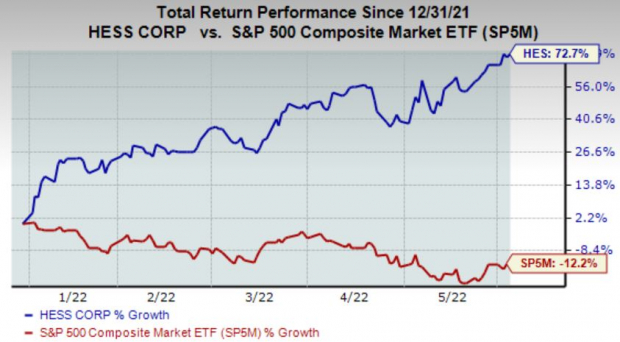

is a globally integrated energy company engaging in the exploration, production, development, transportation, purchase and sale of crude oil, natural gas liquids, and natural gas. Year-to-date, shares have been blistering hot, increasing nearly 73% in value and easily outperforming the S&P 500.

Image Source: Zacks Investment Research

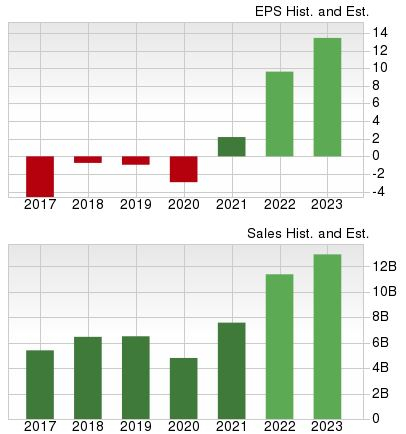

The company has reported strong quarterly results. Over its last four quarters, the average EPS surprise has been a double-digit 13%, and in its latest quarter, HES beat bottom-line estimates by a solid 16%.

In addition to solid quarterly results, analysts have been upping their bottom-line outlook rapidly over the last 60 days. For the upcoming quarterly release, the $2.24 EPS estimate reflects a jaw-dropping 830% expansion in the bottom line from the year-ago quarter.

Additionally, for FY22, earnings are expected to expand by a triple-digit 310%, and for FY23, the bottom line is expected to grow by an additional 40%.

Image Source: Zacks Investment Research

The company’s forward price-to-sales ratio of 3.5X is well below 2021 highs of 4.5X and represents a steep 31% discount relative to the S&P 500’s value of 4.1X.

Image Source: Zacks Investment Research

For investors who seek a stream of income, HES has that covered with its 1.19% annual dividend yield with a payout ratio sitting at 56% of earnings. Additionally, the company has increased its dividend once over the last five years, with a five-year annualized dividend growth rate of 2.3%.

The dividend yield is just marginally below the S&P 500’s 1.43% yield.

Image Source: Zacks Investment Research

Dollar Tree

Dollar Tree

DLTR

is an operator of discount variety stores offering merchandise and other assortments, operating in all types of sized cities. Year-to-date, DLTR shares have been a hot item, increasing nearly 15% in value and easily outpacing the general market.

Image Source: Zacks Investment Research

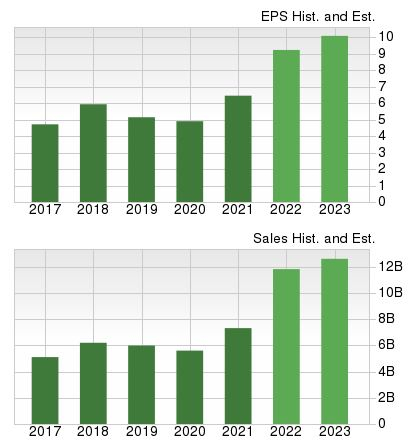

The company has chained together an impressive streak of ten consecutive bottom-line beats dating back to 2020, and over its last four quarterly reports, Dollar Tree has exceeded earnings estimates by 13%, on average. Furthermore, the company smoked EPS estimates by a sizable 20% in its latest quarterly release.

The Consensus Estimate Trend for the upcoming quarter has retraced by a concerning 8%, but the $1.56 EPS estimate still displays a notable 26% growth in earnings from the year-ago quarter. Additionally, earnings are forecasted to grow 40% in FY22 and an additional 14% in FY23.

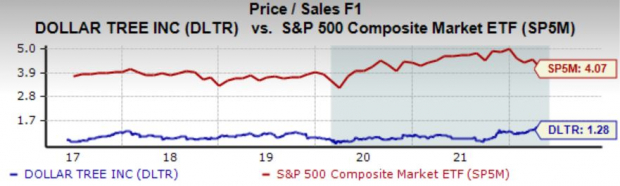

Image Source: Zacks Investment Research

Looking at valuation levels, Dollar Tree’s forward price-to-sales ratio of 1.3X is nicely below highs of 1.4X earlier this year and just above its median of 1.0X over the last five years. Additionally, the value represents a steep 67% discount relative to the S&P 500’s value.

Image Source: Zacks Investment Research

Analog Devices

Analog Devices

ADI

is an original equipment manufacturer of semiconductor devices, specifically analog, mixed-signal, and digital signal processing integrated circuits. Year-to-date, shares have displayed a valuable level of defense relative to the S&P 500, decreasing 5% in value.

Image Source: Zacks Investment Research

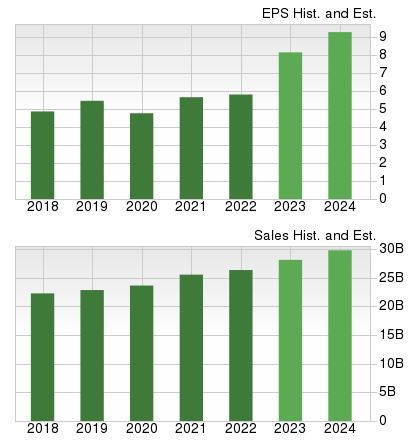

The company has been on a blazing-hot earnings streak, exceeding EPS expectations in ten consecutive quarters. Over its last four quarterly reports, the company has an average EPS surprise of a notable 7.7%, and in its latest quarter, ADI beat bottom-line estimates by a substantial 13%.

Analysts have been upping their earnings outlook across the board over the last 60 days, undoubtedly a bullish signal. For the upcoming quarter, the $2.42 EPS estimate reflects a sizable 43% growth in earnings from the year-ago quarter.

Additionally, earnings are expected to climb 43% in FY22 and an additional 9.3% in FY23.

Image Source: Zacks Investment Research

ADI’s forward earnings multiple sits at 18.3X, well below the median of 21.1X over the last five years and nowhere near 2020 highs of 29.2X. Furthermore, the value represents a slight 2% discount relative to the S&P 500’s forward P/E ratio of 18.6X.

Image Source: Zacks Investment Research

ADI enjoys rewarding its shareholders via its 1.8% annual dividend yield with a payout ratio sitting at 39% of earnings. Over the last five years, ADI has increased its dividend five times, with a five-year annualized dividend growth rate of a sizable 11.3%. Additionally, the yield is higher than that of the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

Large-cap stocks provide a higher level of defense compared to others. Additionally, these companies have proven themselves over their lifetime and operate within established industries.

All three companies carry the highly coveted Zacks Rank #1 (Strong Buy), which further instills confidence as to why they would be solid additions for any large-cap investor.

Zacks’ Top Picks to Cash in on Electric Vehicles

Big money has already been made in the Electric Vehicle (EV) industry. But, the EV revolution has not hit full throttle yet. There is a lot of money to be made as the next push for future technologies ramps up. Zacks’ Special Report reveals 5 picks investors

See 5 EV Stocks With Extreme Upside Potential >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report