AstraZeneca

AZN

announced detailed positive data from the pivotal phase III DESTINY-Breast04 study, which evaluated its antibody drug conjugate (ADC) drug Enhertu, in previously treated patients with HER2-low unresectable and/or metastatic breast cancer with hormone receptor (HR) positive or HR-negative disease.

The DESTINY-Breast04 study achieved its primary endpoint of progression free survival (PFS) in patients with HER2-low metastatic breast cancer with HR-positive disease. Enhertu demonstrated a 49% reduction in the risk of disease progression or death over the physician’s choice of chemotherapy. A median PFS of 10.1 months was observed in patients administered Enhertu compared to 5.4 months concerning those who were administered chemotherapy.

The study also showed a clinically meaningful overall survival (OS), a key secondary endpoint, in the above patient group. Data from the study showed a 36% in the risk of death in HR-positive disease patients who were administered Enhertu, based on OS. A median OS of 23.9 months was observed in patients administered Enhertu compared to 17.5 months in those administered chemotherapy.

Overall, the study showed a consistent efficacy of Enhertu in all study participants pertaining to both HR-positive and HR-negative diseases. The study met the key secondary endpoint of PFS in all study participants (both HR-positive and HR-negative disease patients), wherein there was 50% reduction in the risk of disease progression or death observed between Enhertu and chemotherapy. Based on the OS endpoint, there was 36% reduction in risk of death in the patients administered Enhertu over those administered chemotherapy.

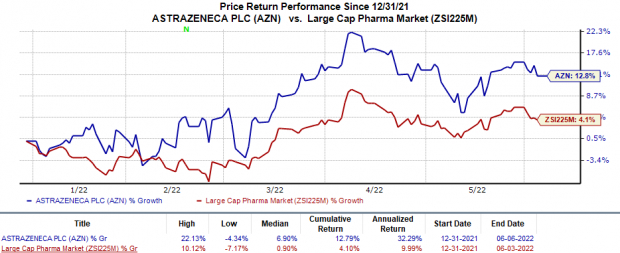

In the year so far, shares of AstraZeneca have risen 12.8% compared with the

industry

’s 4.1% increase.

Image Source: Zacks Investment Research

Based on these results, AstraZeneca believes that a HER2-directed therapy like Enhertu has the potential to redefine treatment for approximately half the patients with breast cancer, thereby providing a survival benefit to those with low HER2 expression.

We remind investors that Enhertu is already approved by the FDA to treat certain patients with HER2-positive breast cancer as well as specific patients with HER2-positive stomach cancer (called gastric or gastroesophageal junction adenocarcinoma). The drug is developed by AstraZeneca in collaboration with Daiichi Sankyo.

Both AstraZeneca and Daiichi Sankyo are also exploring the potential of Enhertu in earlier lines of treatment as well as in new breast cancer settings.

AstraZeneca is highly focused on strengthening its oncology business. In first-quarter 2022, AZN generated $3.6 billion worth of total revenues from its Oncology business, reflecting a 25% year-over-year rise in the constant exchange rate, driven by a solid performance of newer medicines, such as Tagrisso, Lynparza, Imfinzi and Calquence. AZN is working to further strengthen this portfolio through label expansions and advancing oncology pipeline candidates.

Zacks Rank & Stocks to Consider

AstraZeneca currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Abeona Therapeutics

ABEO

,

Alkermes

ALKS

and

Sesen Bio

SESN

. While Alkermes sports a Zacks Rank #1 (Strong Buy) at present, both Abeona Therapeutics and Sesen Bio carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 60 days. Shares of ALKS have risen 26% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, ALKS delivered an earnings surprise of 1,100%.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 34 cents to 31 cents in the past 30 days. The same for 2023 has narrowed from 15 cents to 13 cents in the same time frame. Shares of ABEO have plunged 52.7% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and met the same on the remaining two occasions, the average negative surprise being 8.2%. In the last reported quarter, ABEO missed on earnings by 25%.

Sesen Bio’s loss per share estimates for 2022 have declined from 33 cents to 32 cents in the past 60 days. Shares of SESN have dropped 30.4% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, SESN delivered an earnings surprise of 100%.

Free: Top Stocks for the $30 Trillion Metaverse Boom

The metaverse is a quantum leap for the internet as we currently know it – and it will make some investors rich. Just like the internet, the metaverse is expected to transform how we live, work and play. Zacks has put together a new special report to help readers like you target big profits.

The Metaverse – What is it? And How to Profit with These 5 Pioneering Stocks

reveals specific stocks set to skyrocket as this emerging technology develops and expands.

Download Zacks’ Metaverse Report now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report