Canadian Solar Inc.

CSIQ

recently signed an agreement with SPIC Brasil to divest 70% stake in its Marangatu and Panati-Sitia solar projects. With a total generation capacity of 738 megawatt-peak (MWp), these two projects are currently at an advanced stage of development and are projected to start commercial operation in late 2023.

Post completion, these two projects are estimated to be two of the largest solar power plants in Brazil.

Prospects in Brazil

The Brazilian solar market is expected to increase manifold, buoyed by favorable weather conditions and increased penetration of the solar market in the region. Per the report from Mordor Intelligence, the Brazilian Solar market is anticipated to witness a CAGR of 5.5% during the 2022-2027 period. Such solid growth expectation thus offers ample expansion opportunities for solar companies like Canadian Solar. The latest sale agreement is a bright example of that.

Meanwhile, in a bid to capture more market share in Brazil, Canadian Solar raised the $100 million financing facility with Brazilian banks to support the development and construction of solar projects in July 2021. In March 2022, the company announced that its Global Energy business group clinched a power purchase agreement (PPA) with Usinas Siderurgicas de Minas Gerais S.A, involving the building and development of a solar project in Brazil. Such strategic moves, including the latest divestiture, by the company entails its ability to reap the benefits of the growth opportunity that Brazil’s solar market offers.

Peer Moves

Apart from Canadian Solar, other solar players who are also expanding their territory in the growing Brazilian solar market are:

JinkoSolar

JKS

: In December 2021, JinkoSolar’s subsidiary, Jinko Solar Co. Ltd, signed a distribution generation agreement with Aldo Solar to provide nearly 4 million photovoltaic modules in 2022 in Brazil.

The Zacks Consensus Estimate for JinkoSolar’s 2022 earnings implies growth of a solid 64.1% from the prior-year figure. The Zacks Consensus Estimate for JKS’ 2022 sales suggests growth of 52.9% from the prior-year figure.

Enphase Energy

ENPH

: In September 2021, Enphase announced its expansion in Brazil with the introduction of its IQ 7+ microinverters in the region.

The Zacks Consensus Estimate for Enphase’s 2022 earnings implies growth of a solid 44.4% from the prior-year figure. The Zacks Consensus Estimate for ENPH’s 2022 sales suggests growth of 50% from the prior-year figure.

SolarEdge Technologies

SEDG

: In 2019, the company announced its expansion in the Brazilian PV market, introducing three-phase inverters with synergy technology up to 100 kilowatt-peak that fit the 127/220, 220/380 and 277/480 grid types.

SolarEdge boasts a long-term earnings growth rate of 28.5%. The Zacks Consensus Estimate for SEDG’s 2022 sales suggests growth of 51.7% from the prior-year figure.

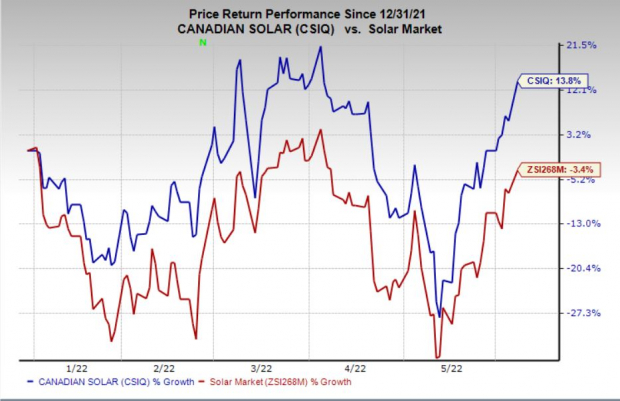

Price Movement

In the year-to-date period, shares of Canadian Solar have gained 13.8% against the

industry

’s 3.4% decline.

Image Source: Zacks Investment Research

Zacks Rank

Canadian Solar currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report