Tandem Diabetes Care, Inc.

TNDM

presented positive real-world data, showing immediate and continued benefits across a diverse group of people using the t:slim X2 insulin pump with the Control-IQ technology. The study data was presented at the American Diabetes Association (ADA) 82nd Scientific Sessions in New Orleans.

The data presented at the ADA comes from the ongoing real-world longitudinal study of Control-IQ Observational, an ongoing study of people using the t:slim X2 insulin pump with the Control-IQ technology.

The latest encouraging study results are likely to help Tandem Diabetes strengthen its global insulin pump business.

A Glance at Tandem Diabetes’ Presentations

The analysis of patient outcomes from an ethnically diverse group of 1,306 adults demonstrated considerable improvements in diabetes-specific quality of life, satisfaction with insulin delivery device, and reduction in diabetes-related burden over 12 months with Control-IQ technology. The data also showed that it significantly enhanced sleep quality for all participants using the system.

Moreover, the evaluation of long-term glycemic outcomes by ethnicity in adults with type 1 diabetes utilizing Control-IQ technology assessed relationships between ethnicity, baseline HbA1c, Glucose Management Indicator (GMI), and sensor Time in Range for 1,045 adults. The study reflected glycemic improvements for all participants, with Black/African American participants demonstrating a clinically relevant 0.7% overall reduction.

Image Source: Zacks Investment Research

Further, the study, evaluating baseline HbA1c and glucose management indicators derived from sensor data from 1,107 adults using the Control-IQ technology for 12 consecutive months, displayed considerable glycemic improvements, regardless of prior therapy modality.

Significance of the Study Outcome

Per Tandem Diabetes management, the Control-IQ technology continues to be an excellent equalizer for people with insulin-intensive diabetes, with sustained positive clinical and quality-of-life improvement evidence with its use, irrespective of age, ethnicity, or prior therapy. The evidence enhances the company’s motivation to bring progress in technology to benefit people living with diabetes across the world.

Industry Prospects

Per a report

published in PR Newswire, the global automated insulin delivery systems market is expected to see a CAGR of 6.0% by 2027. Factors like the rising diabetic population worldwide, technological developments, several research investments in diabetes management, favorable reimbursement policies and rising awareness programs are expected to drive market growth.

Given the huge market potential, favorable data supporting Tandem’s automated insulin delivery system bears strategic prospects.

Recent Developments

In April 2022, Tandem Diabetes presented real-world data at the 15th International Conference on Advanced Technologies and Treatments for Diabetes in Barcelona, Spain. The study data demonstrated that the use of the t:slim X2 insulin pump with Control-IQ advanced hybrid closed-loop technology resulted in immediate and ongoing improvements in glycemic control, quality of life outcomes, and user-reported reduced burden of diabetes management.

In February 2022, Tandem Diabetes announced that bolus insulin dosing on the t:slim X2 insulin pump, utilizing the t:connect mobile app, has been cleared by the FDA. With the approval, the t:connect mobile app becomes the first-ever FDA-cleared smartphone application capable of initiating insulin delivery on iOS and Android operating systems.

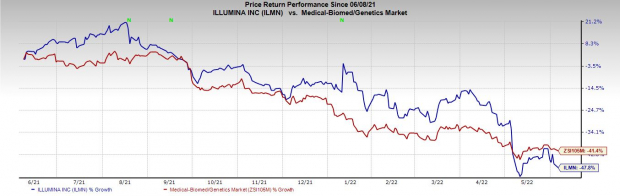

Price Performance

Shares of the company have lost 47.8% in a year compared with the

industry

‘s rise of 41.4%.

Zacks Rank and Key Picks

Tandem Diabetes currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space are

UnitedHealth Group Incorporated

UNH

,

Medpace Holdings, Inc.

MEDP

and

Alkermes plc

ALKS

.

UnitedHealth, having a Zacks Rank #2 (Buy), reported first-quarter 2022 earnings per share (EPS) of $5.49, which beat the Zacks Consensus Estimate by 1.7%. Revenues of $80.1 billion outpaced the consensus mark by 14.2%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UnitedHealth has an estimated long-term growth rate of 14.8%. UNH’s earnings surpassed estimates in the trailing four quarters, the average surprise being 3.7%.

Medpace reported first-quarter 2022 adjusted EPS of $1.69, which surpassed the Zacks Consensus Estimate by 34.1%. Revenues of $330.9 million outpaced the Zacks Consensus Estimate by 1.1%. It currently has a Zacks Rank #2.

Medpace has a historical growth rate of 27.3%. MEDP’s earnings surpassed estimates in the trailing four quarters, the average surprise being 17.1%.

Alkermes reported first-quarter 2022 adjusted EPS of 12 cents, which surpassed the Zacks Consensus Estimate of a penny. Revenues of $278.6 million outpaced the Zacks Consensus Estimate by 6.2%. It currently sports a Zacks Rank #1.

Alkermes has an estimated long-term growth rate of 25.1%. ALKS’ earnings surpassed estimates in the trailing four quarters, the average surprise being 350.5%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report