Enphase Energy, Inc.

ENPH

recently announced that the deployment of its Enphase Energy system, powered by IQ 8 microinverters, has increased manifold in Southern California amid the impending higher grid outages in the region as it approaches the summer season.

Such enhanced installation of products indicates significantly pent-up demand for Enphase’s IQ 8 microinverter, considering the fact that this smartest microinverter among its predecessors was only launched last October in North America. No doubt, this upbeat demand underlines the underlying strength of ENPH’s product portfolio, which enables it to expand rapidly in a market that portrays significant demand.

What’s Driving Demand?

Enphase IQ8 microinverter is the industry’s first microgrid-forming microinverter. Moreover, it boasts features capable of forming a microgrid during a power outage using only sunlight, thus providing backup power even without a battery.

Further, the Enphase Energy System with IQ8 comes in four different configurations: the Solar Only, the Sunlight Backup with no battery, the Home Essentials Backup with a small battery and the Full Energy Independence with a large battery. Additionally, the IQ8 microinverter is Enphase’s most powerful microinverter in its IQ8 family and boasts a California Energy Commission efficiency of 97%.

Such product proclamation must have boosted demand in an area prone to prolonged power cuts. Going forward, Enphase may witness demand further escalating in the region as it endeavors to adopt solar energy to curtail climate-crisis conditions.

US Solar Market Boom

Energy from renewable sources is likely to witness a maximum increase in the United States in the next two years, per the latest short-term energy outlook report from the U.S. Energy Information Administration. The report further suggests that solar capacity additions to the electric power sector will be 20 gigawatts (GW) for 2022 and 22 GW for 2023 while small-scale solar capacity is expected to grow to 39 GW by the end of 2022 and to 46 GW in 2023.

Such expansion estimates in the U.S. solar market stand to benefit the industry participants, significantly. The solar companies other than Enphase with the potential to reap benefits of the prospective U.S. solar market are

SunPower

SPWR

,

First Solar

FSLR

and

SolarEdge

SEDG

.

SunPower Corporation is a leading solar technology and energy services provider that offers fully integrated solar, storage and home energy solutions. SPWR added 16,500 customers in the first quarter, reflecting 40% growth year over year and expecting the residential customer volume to grow by more than 35% in 2022 from the 2021 levels.

The Zacks Consensus Estimate for 2022 sales suggests a growth rate of 20.8% from the prior-year actuals. Shares of SPWR have rallied 37.4% in the past month.

First Solar is a leading global provider of comprehensive photovoltaic solar energy solutions. It is investing heftily in the production ramp-up of this module to expand its manufacturing capacity. In 2021, FSLR announced plans to expand its manufacturing capacity by 6.6 GW via constructing its third manufacturing facility in the United States and the first plant in India.

First Solar’s long-term earnings growth rate is pegged at 13.2%. FSLR’s shares have rallied 13.2% in the past month.

SolarEdge is a leading provider of an optimized inverter solution. As of Mar 31, 2022, SEDG shipped 89.6 million power optimizers, 3.7 million inverters and 16.3 thousand residential batteries. Also, more than 2.6 million installations are currently connected to and monitored through a cloud-based monitoring platform.

SolarEdge boasts a long-term earnings growth rate of 28.5%. The SEDG stock has rallied 20% in the past year.

Price Performance

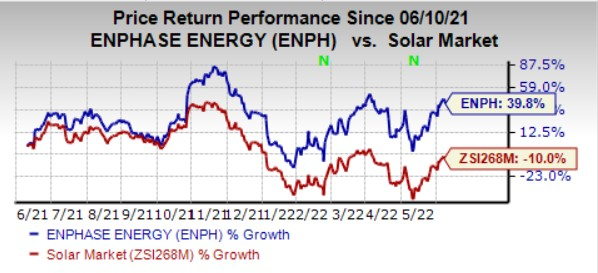

In the past year, shares of Enphase have surged 39.8% against the

industry

’s decline of 10%.

Image Source: Zacks Investment Research

Zacks Rank

Enphase currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report