Gilead Sciences, Inc.

GILD

has announced results from the phase III study evaluating the first-in-class entry inhibitor Hepcludex (bulevirtide) for the treatment of chronic hepatitis delta virus (HDV) infection at 48 weeks.

At week 48, study participants treated with bulevirtide monotherapy at 2 mg or 10 mg once daily achieved a significantly greater combined virological and biochemical response (45% and 48%, respectively) when compared to participants who had not received antiviral treatment at this stage of the study (2%). Treatment with Hepcludex met the primary endpoint.

Data at week 48, when considered alongside the integrated week 24 analyses of the ongoing phase II studies (MYR202 and MYR203) and the interim week 24 phase III MYR301 data, combined response rates of bulevirtide increased from week 24 to week 48, highlighting an improved response of bulevirtide with prolonged treatment.

These data reinforce the clinical utility of bulevirtide as monotherapy for the treatment of chronic HDV.

The data were presented at the International Liver Congress 2022 Official Press Program.

The candidate is not approved in the United States yet but has obtained Conditional Marketing Authorization from the European Commission. A biologics license application (BLA) was submitted in the fourth quarter to the FDA for bulevirtide for injection (2 mg) to treat adults with HDV and compensated liver disease. The above-mentioned phase III data is included in the filing of bulevirtide to the FDA. Bulevirtide has been granted Breakthrough Therapy and Orphan Drug designations by the FDA.

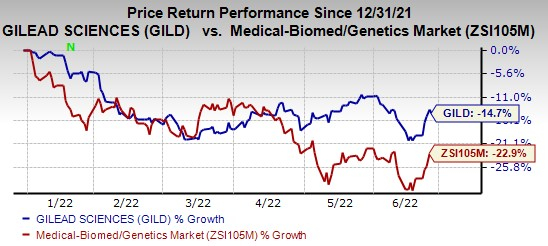

Gilead’s stock has lost 14.7% so far in the year compared with the

industry

‘s decline of 22.9%.

Image Source: Zacks Investment Research

We note that the HIV franchise is the lead growth driver for Gilead propelled by the solid uptake of Biktravy.

Concurrently, Gilead is making efforts to develop its oncology business to diversify its revenue base as competition is stiff in the HIV business from the likes of

GlaxoSmithKline

GSK

. Also, the loss of exclusivity for Truvada has hurt the company’s business.

Glaxo’s HIV franchise recorded 14% growth in the quarter. Growth was driven by new HIV products Dovato, Cabenuva, Rukobia, Juluca and Apretude and phasing.

Gilead currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks are

Alkermes

ALKS

and

Geron Corporation

GERN

. While Alkermes sports a Zacks Rank #1 (Strong Buy), Geron has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Loss estimates for ALKS for 2022 have narrowed to 3 cents from a loss of 14 cents in the past 60 days. Alkermes surpassed estimates in all of the trailing four quarters, the average surprise being 350.48%.

Loss estimates for GERN for 2022 have narrowed by 6 cents in the past 60 days. Geron surpassed estimates in three of the trailing four quarters, the average surprise being 1.07%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report