Radius Health

RDUS

recently announced that it has entered into a definitive agreement to be acquired by Gurnet Point Capital and Patient Square Capital for a total consideration of $890 million. Its shares soared 21.7% in response to the news.

The price of $890 million includes the assumption of debt and assuming full payment of the CVR (Contingent Value Right).

Per the terms of the agreement, an entity jointly owned by Gurnet Point and Patient Square will initiate a tender offer to acquire all of the outstanding shares of Radius Health for $10.00 per share. The offer includes cash plus a CVR of $1.00 per share payable once Radius Health’s lead drug Tymlos (abaloparatide) net sales reach $300 million (inclusive of U.S. sales and Japan royalties or supply payments based on the supply of Tymlos for sale in Japan) during any consecutive 12-month period prior to Dec 31, 2025.

Shareholders of the company will receive up to an aggregate of $547 million in cash, including the CVR payment.

The transaction has been unanimously approved by the members of the board and is expected to close in the third quarter of 2022.

The decision to go private by Radius Health follows a nine-month strategic review process by the board to maximize shareholder value. The company has been facing rough waters of late.

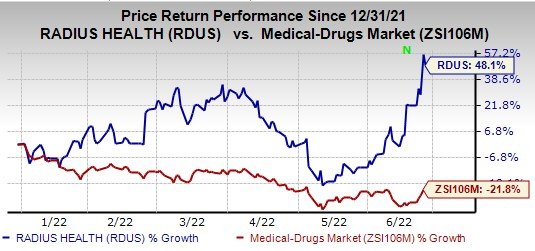

Shares of RDUS have gained 48.1% in the year so far against the

industry

’s decline of 21.8%.

Image Source: Zacks Investment Research

Earlier in the week, Radius Health announced that it will cease all work on abaloparatide transdermal system (abalo-TDS) development program. The company had earlier outlined three requirements needed to move the abalo-TDS program forward. These were regulatory clarity, a re-constructed supply chain and CMC agreement/economics and external funding.

However, a response from the FDA had indicated that an additional pivotal trial will be required to move forward with any regulatory filing.

Hence, given the clarity on the regulatory pathway, delayed commercial timelines and more than $100 million of additional capital required over the next three years, Radius Health will cease all work on abalo-TDS.

Last month, Radius Health reported a wider loss for the first quarter of 2022 on lower revenues. Tymlos is most likely facing challenges.

Competition is stiff for Tymlos from

Eli Lilly & Co’s

LLY

Forteo and

Amgen

‘s

AMGN

Prolia.

Eli Lilly’s Forteo generated sales of $137 million in the first quarter.

Amgen’s Prolia sales increased 12% year over year in the March quarter, driven by 10% volume growth and a higher net selling price. AMGN’s Evenity is also approved for treating osteoporosis in women post menopause, who are at high risk of fracture or cannot use another osteoporosis medicine or other osteoporosis medicines did not work well.

Radius Health currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the healthcare sector is

Geron

GERN

, which at present carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

GERN’s loss estimates for 2022 have narrowed 6 cents in the past 60 days. Geron surpassed on earnings in three of the trailing four quarters and missed the mark in the remaining one, the average surprise being 1.07%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report