InterDigital, Inc.

IDCC

recently updated its guidance for second-quarter 2022. The improved outlook offers better clarity regarding its business operations as it aims to navigate through the post-pandemic market revival and is likely to instill investors’ confidence in the stock.

Management currently expects second-quarter revenues to lie between $120 million and $124 million, up from the previously guided range of $114 million-$120 million, reflecting the operating leverage of the company’s business model. This includes recurring revenues of $98-$100 million. The Zacks Consensus Estimate for revenues is pegged at $115 million.

The improved top-line expectation is primarily driven by a license agreement inked during the quarter with an unnamed consumer electronics and other product manufacturer. InterDigital has also connected automobile license agreements with General Motors Company and Ford Motor Company through a licensing platform. These contracts are likely to generate incremental revenues for the company in the upcoming quarter.

InterDigital’s commitment to licensing its broad portfolio of technologies to wireless terminal equipment makers, which allows it to expand its core market capability, is laudable. It has leading companies, such as Huawei, Samsung, LG, and Apple, under its licensing agreements. Consequently, the company expects to generate healthy revenues from patent licensing in the forthcoming quarters as well.

InterDigital’s global footprint, diversified product portfolio and ability to penetrate different markets are impressive. Apart from the company’s strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive significant value, considering the massive size of the market it licenses. Furthermore, the company remains committed to pursuing acquisitions to drive its product portfolio and boost organic growth.

The company is focused on pursuing agreements with unlicensed customers in the handset and consumer electronics markets. InterDigital aims to become a leading designer and developer of technology solutions and innovation for the mobile industry, IoT and allied technology areas by leveraging its research and development capabilities, technological know-how and rich industry experience. At the same time, it intends to enhance its licensing revenue base by adding licensees and expanding into adjacent technology areas that align with its intellectual property position.

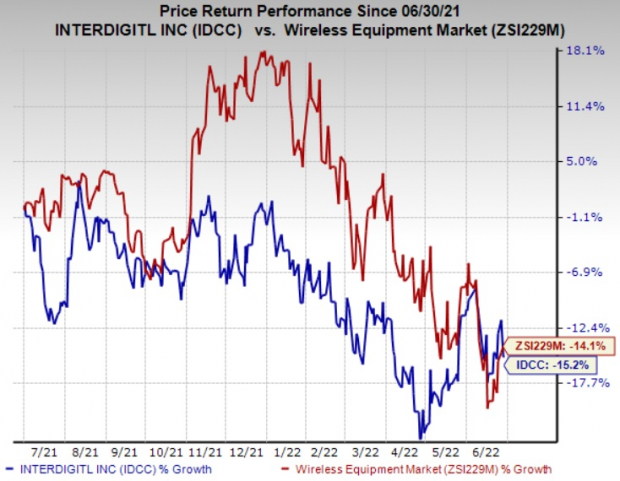

The stock has lost 15.2% over the past year compared with the

industry

’s decline of 14.1%.

Image Source: Zacks Investment Research

We remain impressed with the inherent growth potential of this Zacks Rank #1 (Strong Buy) stock. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Sierra Wireless, Inc.

SWIR

carries a Zacks Rank #2 (Buy). It has a long-term earnings growth expectation of 15% and delivered an earnings surprise of 223.7%, on average, in the trailing four quarters.

Over the past year, Sierra Wireless has gained 25.1%. Earnings estimates for the current year for the stock have moved up 616.7% since June 2021. The company continues to launch innovative products for business-critical operations that require high security and optimum 5G performance.

Qualcomm Incorporated

QCOM

, carrying a Zacks Rank #2, is another key pick for investors. It has a long-term earnings growth expectation of 16.3% and delivered an earnings surprise of 11.4%, on average, in the trailing four quarters.

Earnings estimates for the current year for the stock have moved up 47.5% over the past year, while that for the next fiscal is up 47%. Qualcomm is likely to benefit in the long run from solid 5G traction and a surge in demand for essential products that are the building blocks of digital transformation in the cloud economy.

TESSCO Technologies Incorporated

TESS

, carrying a Zacks Rank #2, delivered an earnings surprise of 61.9%, on average, in the trailing four quarters. Earnings estimates for TESSCO for the current year have moved up 40.7% since Jun 2021.

TESSCO offers products to the industry’s top manufacturers in mobile communications, Wi-Fi, wireless backhaul and related products. With more than three decades of experience, it delivers complete end-to-end solutions to the wireless industry.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report